Impact analysis of GST on E-commerce operator

We all are aware that E-commerce operators would be treated differently in GST. In this article we will understand the meaning or an E-commerce operator and how it is different from an aggregator. There are following e- commerce models working at present.

We all are aware that E-commerce operators would be treated differently in GST. In this article we will understand the meaning or an E-commerce operator and how it is different from an aggregator. There are following e- commerce models working at present.

- Inventory Model: Where the supplier of goods/services develops their own platform to supply goods/ services.

- Aggregator Model: Where the e- commerce platform sells the services provided by others in their own brand name.

- Market place model: When the e –commerce portal sells the goods of others

- C to C model: When the customer sells the goods they own to the other customers

- Online information services: When we sell the database or information we have acquired.

GST categorisation: Under GST all these models are categorised in two parts. E- commerce model and aggregator model

Why it is important to determine the nature of e- commerce portal: This is important to correctly identify the nature of e- commerce portal because their tax treatment is different.

Aggregator: Clause 43B (a) of Model GST Law

“Aggregator means a person, who owns and manages an electronic platform, and by means of the application and a communication device, enables a potential customer to connect with the persons providing service of a particular kind under the brand name or trade name of the said aggregator”

Clause 43B(b) defines the term “Brand name or trade name”

“Brand name or trade name means, a brand name or a trade name, whether registered or not, that is to say, a name or a mark, such as an invented word or writing, or a symbol, monogram, logo, label, signature, which is used for the purpose of indicating, or so as to indicate a connection, in the course of trade, between a service and some other person using the name or mark with or without any indication of the identity of that person;”

Clause 43B(c) defines the term branded services:

“Branded services means services which are supplied by an electronic commerce operator under its own brand name or trade name, whether registered or not;”

Clause 43B (d) defines the term electronic commerce

“‘electronic commerce’ shall mean the supply or receipt of goods and / or services, or transmitting of funds or data, over an electronic network, primarily the internet, by using any of the applications that rely on the internet, like but not limited to e-mail, instant messaging, shopping carts, Web services, Universal Description, Discovery and Integration (UDDI), File Transfer Protocol (FTP), and Electronic Data Interchange (EDI), whether or not the payment is conducted online and whether or not the ultimate delivery of the goods and/or services is done by the operator;”

Clause 43B ( E) defines the term electronic commerce operator

“electronic commerce operator shall include every person who, directly or indirectly, owns, operates or manages an electronic platform that is engaged in facilitating the supply of any goods and/or services or in providing any information or any other services incidental to or in connection there with but shall not include persons engaged in supply of such goods and/or services on their own behalf.”

Example:1

|

Company |

Aggregator/E-commerce operator |

Reason |

|

Flipkart |

E- commerce operator |

Brand name is not of flipkart |

|

Snapdeal |

E- commerce operator |

Brand name is of snapdeal |

|

Consultease |

E- commerce operator |

Brand name is not of consultease |

|

Ola |

Aggregator |

Brand name is of Ola |

|

Uber |

Aggregator |

Brand name is of Uber |

|

Urban clap |

E- commerce operator |

Brand name is not of urban clap |

|

Policy bazaar |

E- commerce operator |

Brand name is of companies |

|

Urban pro |

E- commerce operator |

Brand name is not of urban pro |

|

Freelancer |

E- commerce operator |

Brand name is not of freelancer |

|

Practo |

E- commerce operator |

Brand name is not of practo |

Tax treatment of an e-commerce portal in GST:

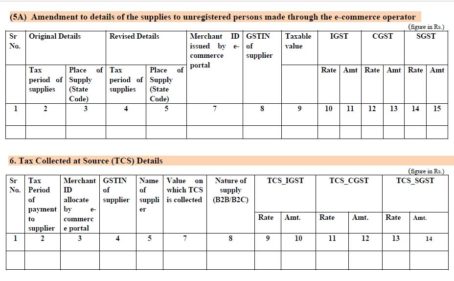

Under GST e- commerce portal will be liable for TCS under clause 43(c) of GST Model Law. Detail provisions are as under:

- every electronic commerce operator shall, at the time of credit of any amount to the account of the supplier of goods and/or services or at the time of payment of any amount in cash or by any other mode, whichever is earlier, collect an amount, out of the amount payable or paid to the supplier, representing consideration towards the supply of goods and /or services made through it, calculated at such rate as may be notified in this behalf by the Central/State Government on the recommendation of the Council.

- The power to collect the amount specified in sub-section (1) shall be without prejudice to any other mode of recovery from the operator.

- The amount so collected shall be paid to the credit of appropriate government within 10 days after the end of the month in which such collection is made.

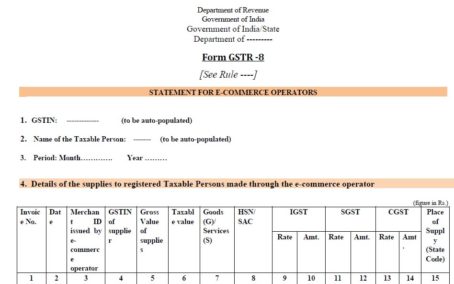

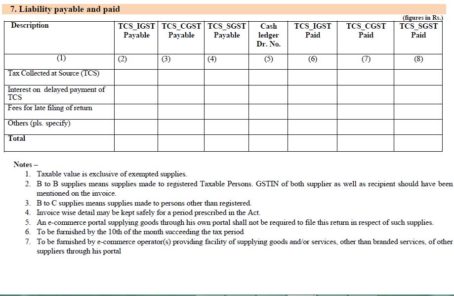

- Every E- commerce portal is required to furnish details of supplied made through it in GSTR-8 within 10 days of next month. Following details are required to e furnish under GSTR-8.

- Details of supplies to registered taxable person:

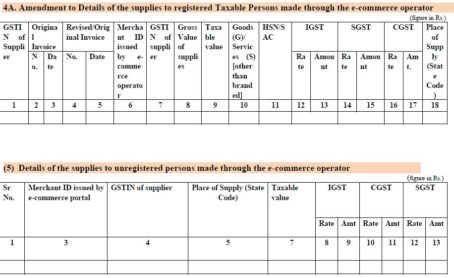

2. Amendment to details of supplies to taxable person and supplies to unregistered person

3. Amendment to the details of supplies to unregistered person and details of Tax collected at source.

4. Details of liability payable and actual payment

- Any payment collected and paid by the E- commerce operator shall be treated as a payment made by the supplier.

- The details of supplies and the amount collected during a calendar month, and furnished by every operator under sub-section (4), shall, in the manner and within the period prescribed, be matched with the corresponding details of outward supplies furnished by the concerned supplier in his valid return for the same calendar month or any preceding calendar month.

- Details furnished by the supplier and by the E- commerce will be matched and discrepancy will be communicated to supplier in prescribed manner. If any discrepancy is not sorted out by supplier it will be added to his output tax liability in the month succeeding the month in which it was communicate to the supplier.

- Any authority not below the rank of Joint Commissioner may, by notice, either before or during the course of any proceeding under this Act, require the operator to furnish such details relating to—

- supplies of goods and/or services effected through such operator during any period,

- or stock of goods held by the suppliers making supplies through such operator in the go downs or warehouses, by whatever name called, managed by such operators and declared as additional places of business by such suppliers as may be specified in the notice.

- Every operator on whom a notice has been served under sub-section (10) shall furnish the required information within five working days of the date of service of such notice.

- Any person who fails to furnish the information required by the notice served under sub-section (10) shall, without prejudice to any action that is or may be taken under section 66, be liable to a penalty which may extend to rupees twenty-five thousand.

Treatment of an Aggregator in GST:

Definition of supply has the specific provisions for an aggregator. Clause 3 of GST Model Act provide for supply which covers the supply made by an aggregator. It reads as follows

” (4) Notwithstanding anything contained in sub-section (1), the supply of any branded service by an aggregator, as defined in section 43B, under a brand name or trade name owned by him shall be deemed to be a supply of the said service by the said aggregator.”

- This supply made by an aggregator will be taxable in their hands under GST.

- There is no separate return form prescribed for an aggregator. An aggregator will file their GST return in GSTR 1, 2 and 3.

- Provisions of TCS are also not applicable to an aggregator.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.