Revised GST invoice rules released

GST invoice rules released

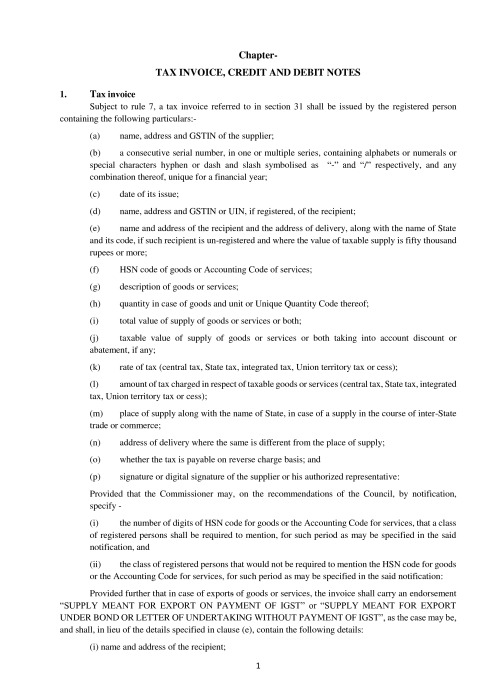

GST invoice rules are released. These rules contains the major provisions related to the invoice, debit notes and credit notes. Major provisions covered are given below. PDF of these rules is also given above.

- Tax invoice: Containing the major items to be given in an GST tax invoice.

- Time limit for issuing tax invoice

- Manner of issuing invoice

- Bill of supply: In some cases bill of supply is required to be issued. Here the items to be covered in a bill of supply are contained.

- Receipt voucher

- Supplementary tax invoice and Credit or debit notes

- Tax Invoice in special cases

- Transportation of goods without issue of invoice

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.