GSTR 9 help – One page guide

One page guide for GSTR 9 help: FIle it in minutes

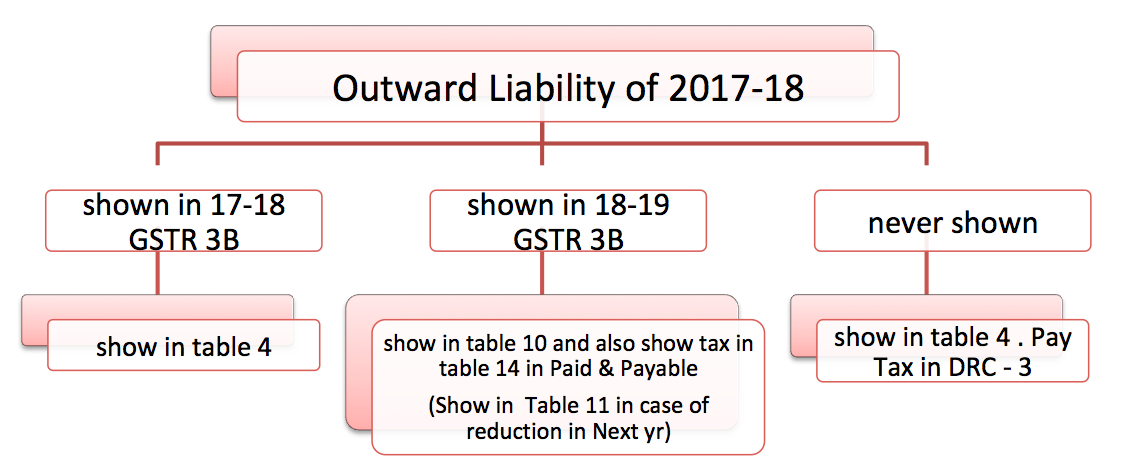

GSTR 9 help for taxpayers need to file it. After reading this article you will be able to resolve all your issues. The last date for filing of Annual return in FORM GSTR-9 for the FY 2017-18 is 31st August 2019. And many professionals facing lot of Confusion regarding Presentation purpose in different tables of GSTR 9 especially in case of transactions shown in 18-19 GSTR 3B which are pertaining to FY 17-18. SO What will be Treatment of transactions shown in 2017-18 GSTR 3B or you might have shown 18-19 or what if You have never shown?? .Here it Goes. This chart will guide you for the presentation of such transaction in GSTR 9 in different tables. Hope you find it useful. Also, at last, I have given you some check-points which will help you decide which data should ideally match internally in GSTR 9.

What will be Treatment of transactions shown in 2017-18 or you might have shown 18-19 or You have never shown??. This chart will guide you for the presentation of such transaction in GSTR9.

![GSTR 9 - ONE PAGE GUIDE - BY CA HARSHIL SHETH (2).docx [Compatibility Mode] 2019-08-07 14-52-27](https://www.consultease.com/wp-content/uploads/2019/08/GSTR-9-ONE-PAGE-GUIDE-BY-CA-HARSHIL-SHETH-2.docx-Compatibility-Mode-2019-08-07-14-52-27.png)

![GSTR 9 - ONE PAGE GUIDE - BY CA HARSHIL SHETH (2).docx [Compatibility Mode] 2019-08-07 14-52-44](https://www.consultease.com/wp-content/uploads/2019/08/GSTR-9-ONE-PAGE-GUIDE-BY-CA-HARSHIL-SHETH-2.docx-Compatibility-Mode-2019-08-07-14-52-44.png)

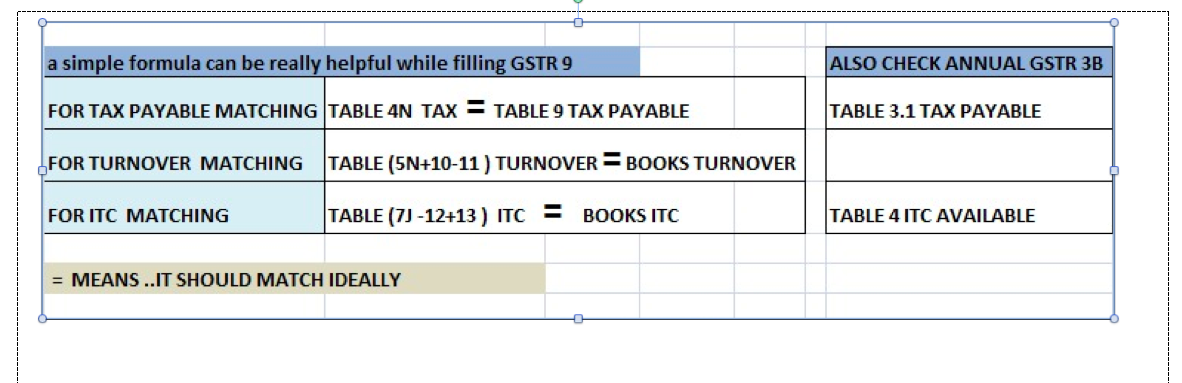

3 simple Formulas which Serves as CHECK-POINT for TAX PAYABLE AMOUNT, TURNOVER FIGURE, & ITC MATCHING

I hope it is useful for you. In spite of so many issues, you can file an annual return using this summary in minutes.