42th Council Meeting SUM AND SUBSTANCE

42th Council Meeting

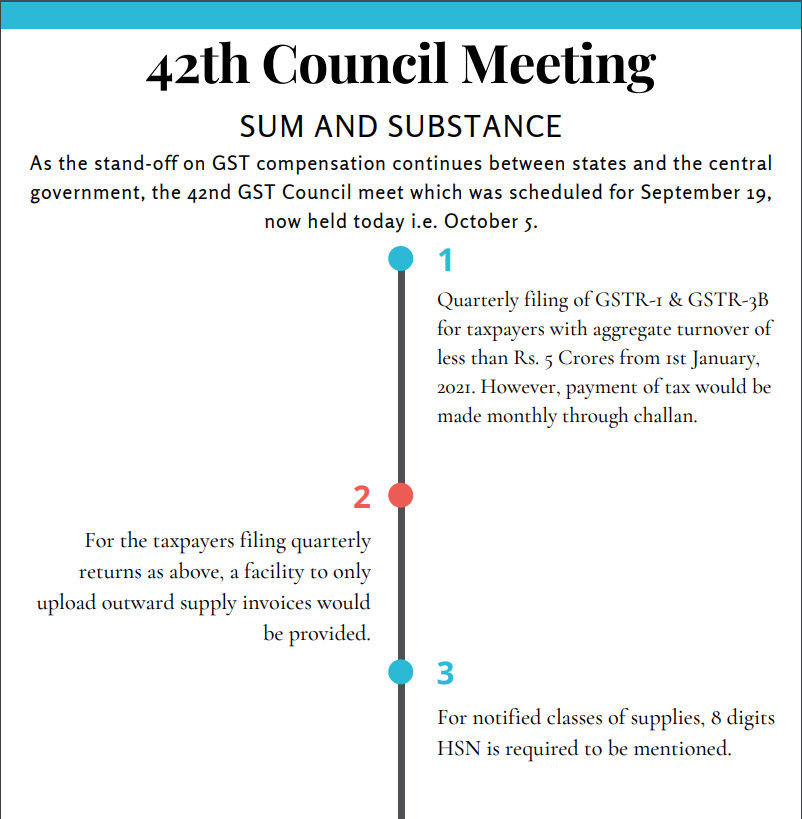

As the stand-off on GST compensation continues between states and the central government, the 42nd GST Council meeting which was scheduled for September 19, now held today i.e. October 5.

Quarterly filing of GSTR-1 & GSTR-3B for taxpayers with aggregate turnover of less than Rs. 5 Crores from 1st January 2021. However, payment of tax would be made monthly through challan.

For the taxpayers filing quarterly returns as above, a facility to only upload outward supply invoices would be provided.

For notified classes of supplies, 8 digits HSN is required to be mentioned.

For taxpayers with aggregate turnover of more than Rs. 5 Crores, HSN code to be mentioned at 6-digit level and for those with aggregate turnover of less than Rs. 5 Crores making B2B supplies, HSN code to be mentioned at 4-digit level.

Satellite launch services are to be exempted to promote start-ups making satellites.

Levy of Compensation Cess to be extended beyond the transition period of five years i.e. beyond June, 2022

From 1st January, 2021, refund would be disbursed to only those bank accounts which are validated with PAN and Aadhar. Further, refund applications can now be signed through Aadhar authentication via OTP.

With respect to compensation to States with revenue shortfall, another meeting would be held on 12th October 2020 to reach an ultimatum.

Various amendments in the CGST Rules and FORMS have been recommended which includes provision for furnishing of Nil FORM CMP-08 through SMS.

ENHANCEMENT IN FEATURES OF RETURN FILING In its 39 Meeting held in March 2020, the Council had recommended an incremental approach to incorporate features of the new return system in the present familiar GSTR-1/3B scheme. Various enhancements have since been made available on the GST Common Portal. With a view to further enhance Ease of Doing Business and improve the compliance experience, the Council has approved the future roadmap for return filing under GST. The approved framework aims to simplify return filing and further reduce the taxpayer’s compliance burden in this regard significantly, such that the timely furnishing of details of outward supplies (GSTR-1) by a taxpayer and his suppliers would – (i) allow him to view the ITC available in his electronic credit ledger from all sources i.e. domestic supplies, imports and payments on reverse charge etc. prior to the due date for payment of tax, and (ii) enable the system to auto-populate return (GSTR-3B)through the data filed by the taxpayer and all his suppliers. In other words, the timely filing of the GSTR-1 statement alone would be sufficient as the return in FORM GSTR-3B would get auto prepared on the common portal. To this end, the Council recommended/decided the following: Due date of furnishing quarterly GSTR-1 by quarterly taxpayers to be revised to 13 of the month succeeding the quarterw.e.f. 01.1.2021; Roadmap for auto-generation of GSTR-3B from GSTR-1s by: i. Auto-population of liability from own GSTR-1 w.e.f. 01.01.2021; and ii. Auto-population of the input tax credit from suppliers’ GSTR-1s through the newly developed facility in FORM GSTR-2B for monthly filers w.e.f. 01.01.2021 and for quarterly filers w.e.f. 01.04.2021; In order to ensure the auto-population of ITC and liability in GSTR 3B as detailed above, FORM GSTR 1would be mandatorily required to be filed before FORM GSTR3Bw.e.f. 01.04.2021. The present GSTR-1/3B return filing system to be extended till 31.03.2021 and the GST laws to be amended to make the GSTR-1/3B return filing system as the default return filing system.

Read and download a copy

42th GST Council Meeting