Best PPT on Annual Return

RELEVANT SECTION, RULE, NOTIFICATIONS, AND ROD

- Relevant Section: Section 44 read with Rule 80

- Relevant Notification: Notification No. 74/2018-Central Tax Dated 31st December 2018

- Order No. 1/2018 – Central Tax- Removal of difficulty order regarding extension of due date for filing of Annual return (in FORMs GSTR-9, GSTR-9A, and GSTR-9C) for FY 2017-18 till 31st March 2019

- Order No. 2/2018 – Central Tax- Seeks to extend the due date for availing ITC on the invoices or debit notes relating to such invoices issued during the FY 2017-18

- Order No. 3/2018 – Central Tax- Seeks to amend Removal of Difficulty Order No. 1/2018 dated 11.12.2018 so as to extend the due date for furnishing of annual returns in FORM GSTR-9, FORM GSTR-9A and reconciliation statement in FORM GSTR-9C for the FY 2017-2018 till 30.06.2019.

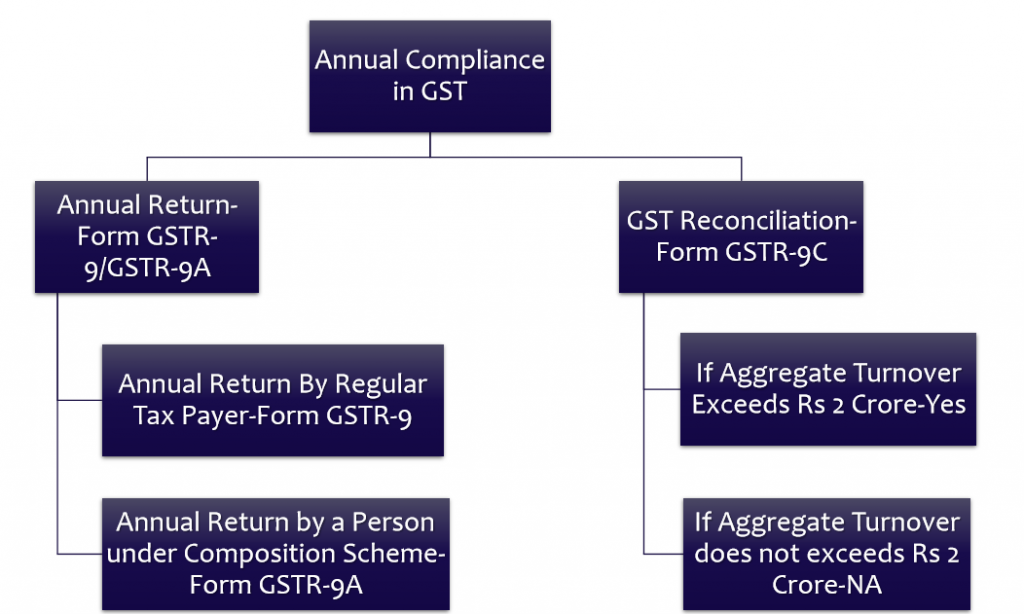

RELEVANT FORMS FOR THE PURPOSE OF ANNUAL RETURN AND RECONCILIATION FORMAT

- GSTR-9 – Annual Return

- GSTR-9A – Annual Return for (Composition Tax Payers)

- GSTR-9C – Reconciliation Statement

WHO IS NOT REQUIRED TO FILE ANNUAL RETURN

- Input Service Distributor,

- A person paying tax under section 51 or section 52,

- A casual taxable person and

- A non-resident taxable person

- Department of Central Government or State Government or local authority, whose books of account are subject to audit by the Comptroller and Auditor-General of India or an auditor appointed for auditing the accounts of local authorities under any law for the time being in force.

RELEVANT SECTION AND RULE

|

SECTION – 44(1) ANNUAL RETURN |

RULE – 80(1) ANNUAL RETURN |

|---|---|

|

|

ANNUAL RETURN

| Q.No. | Question | Answer |

|---|---|---|

| 1 | Is this return to be furnished by a person whose registration has been canceled during the year 2017-18? | Yes, Annual return would have to be furnished by a person whose registration has been canceled during the Year 2017-18. Further, if a person had applied for cancellation of registration and his application for cancellation of registration was pending as on 31st March 2018, he also would be required to file Annual Return. |

| 2 | Is Annual return to be filed by the person who had migrated to GST Regime provisionally but they had not canceled their registration by filing REG-29 under Rule 24(4) of the CGST Rules, 2017 with effect from 1st July 2017 | No, such persons would not be required to file Annual Return for the Year 2017-18. |

| 3 | Whether Annual Return can be filed without filing GSTR-1 and GSTR-3B for the Year 2017-18? | No, it is mandatory to file FORM GSTR-1 and FORM GSTR-3B for FY 2017-18 before filing Annual return in FORM GSTR-9 |

| 4 | Whether any additional liability can be declared through GSTR-9 | Yes, Additional liability for the FY 2017-18 not declared in FORM GSTR-1 and FORM GSTR-3B may be declared in this return (Instruction 3) |

| 5 | Whether any additional input tax credit can be claimed through GSTR-9 | No, taxpayers cannot claim input tax credit unclaimed during FY 2017-18 through this return (Instruction 4) |

| 6 | How would Annual Return be filed by a person who was under composition scheme for part of the year and under a regular scheme for remaining part of the Year | Such persons would have to file GSTR-9 for the period under which they were under Regular Scheme and GSTR-9A for the period under which they were composition scheme. |

Download this Best PPT on Annual Return by clicking the Image Below:-