Trial of new GST return is live on the portal

Table of Contents

- New GST return is live on the portal:

- How to set the profile and select type of return?

- Annex:1 of New GST return:

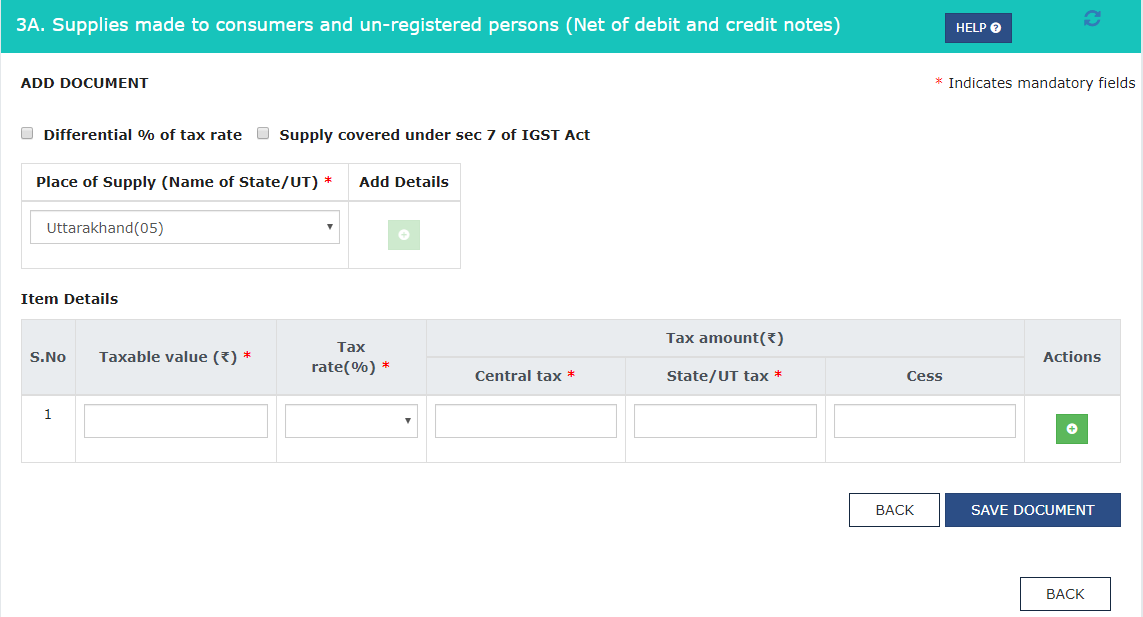

- Table-3A. Supplies made to consumers and un-registered persons (Net of debit and credit notes)

- Table-3B. Supplies made to registered persons (other than those attracting reverse charge)(including edit/amendment)

- Table-3C & 3D. Exports with/without payment of tax

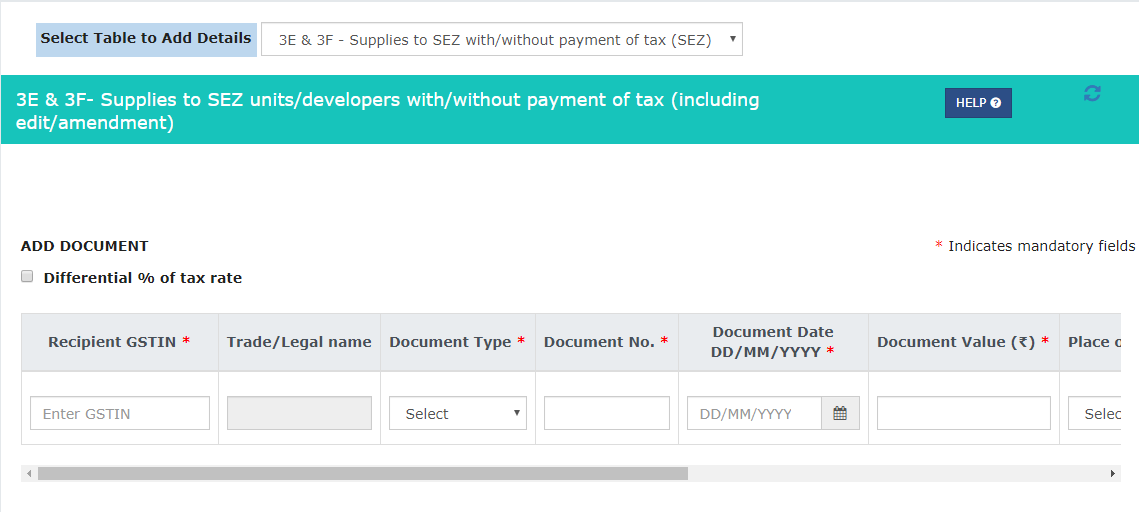

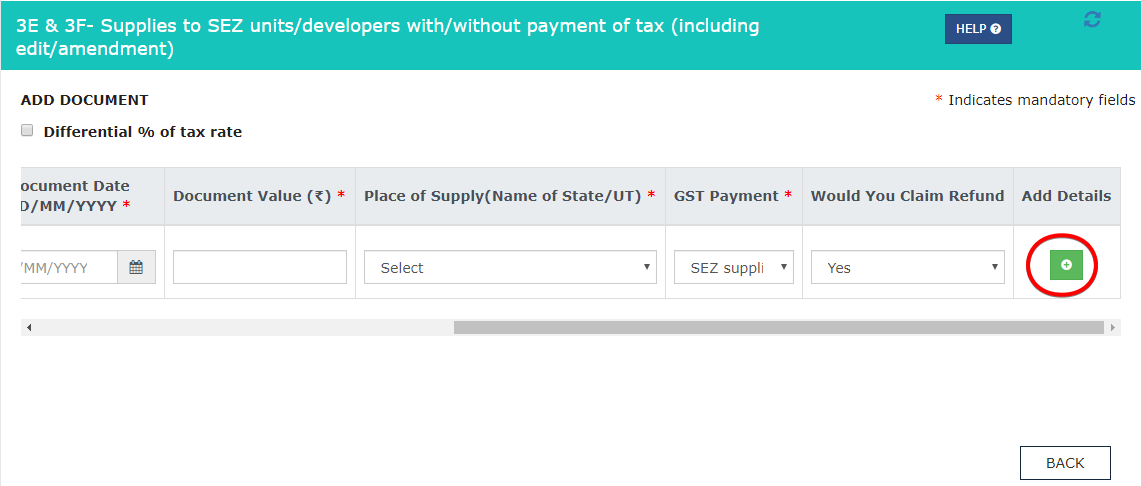

- Table-3E & 3F. Supplies to SEZ units/developers with/without payment of tax(including edit/amendment)

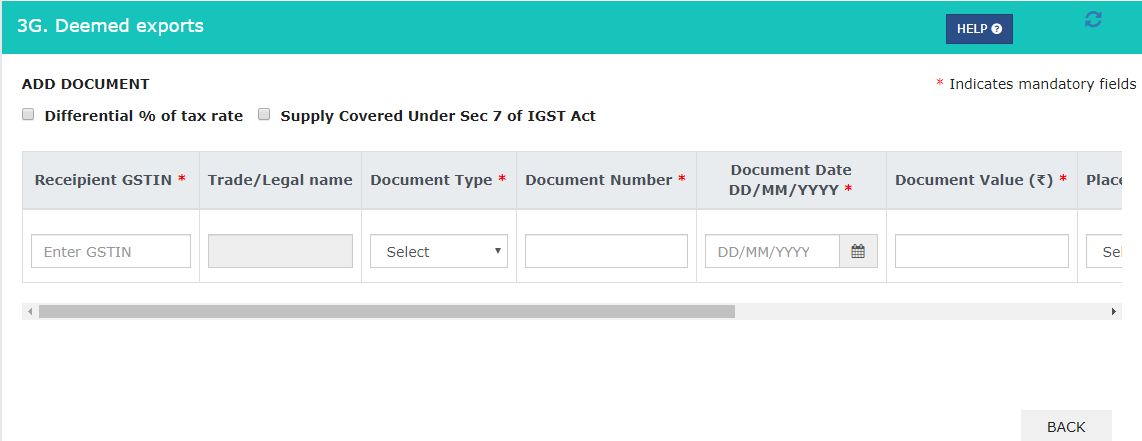

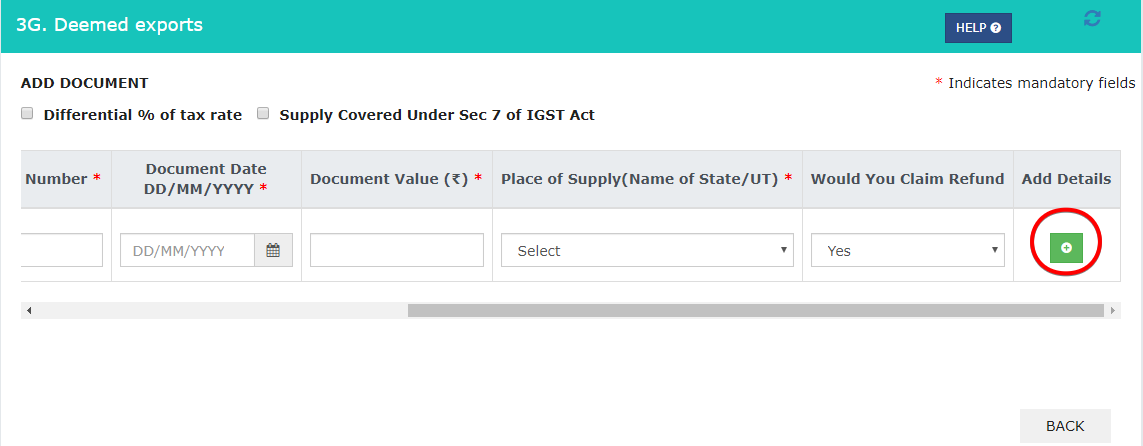

- Table-3G. Deemed Exports

- Table-3H. Inwards supplies attracting reverse charge (RCM)

- Table-3I. Import of services( net of debit/ credit notes and advances paid, if any)

- Table-3J. Imports of Goods(IMPG)

- Table-3K. Import of goods from SEZ units on a Bill of Entry.

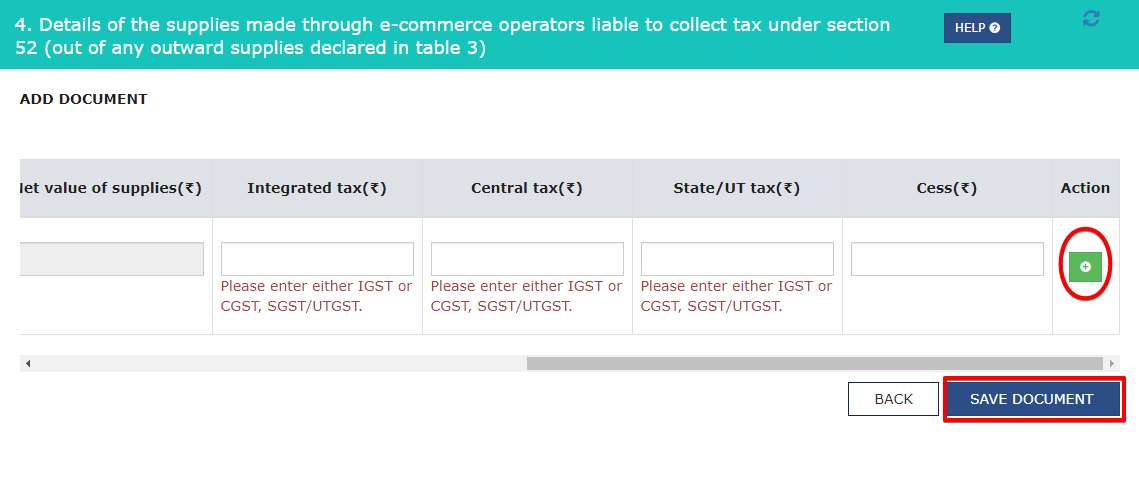

- Table-4. Details of the supplies made through e-commerce operators liable to collect tax under section 52 ( out of any outward supplies declared in table 3)

- Annex 2 of New GST return

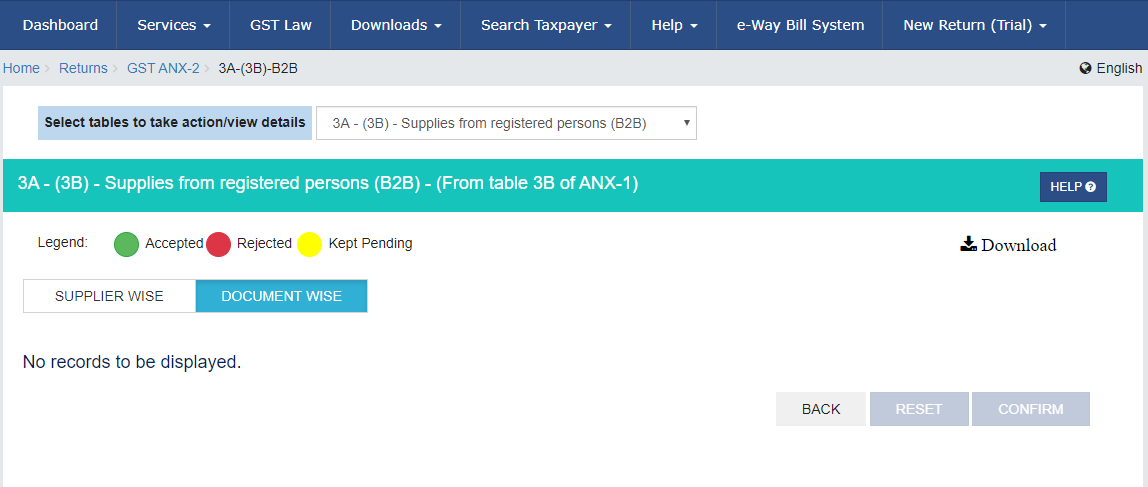

- Table-3A – (3B). Supplies from registered persons (B2B) – ( From table-3B of ANX-1)

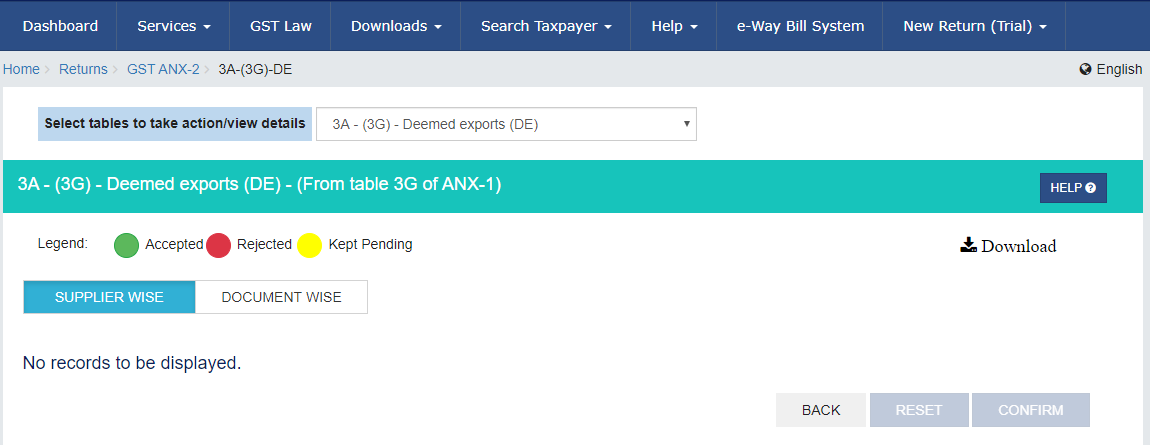

- Table-3A – (3G). Deemed Exports (DE) – (From table-3G of ANX-1)

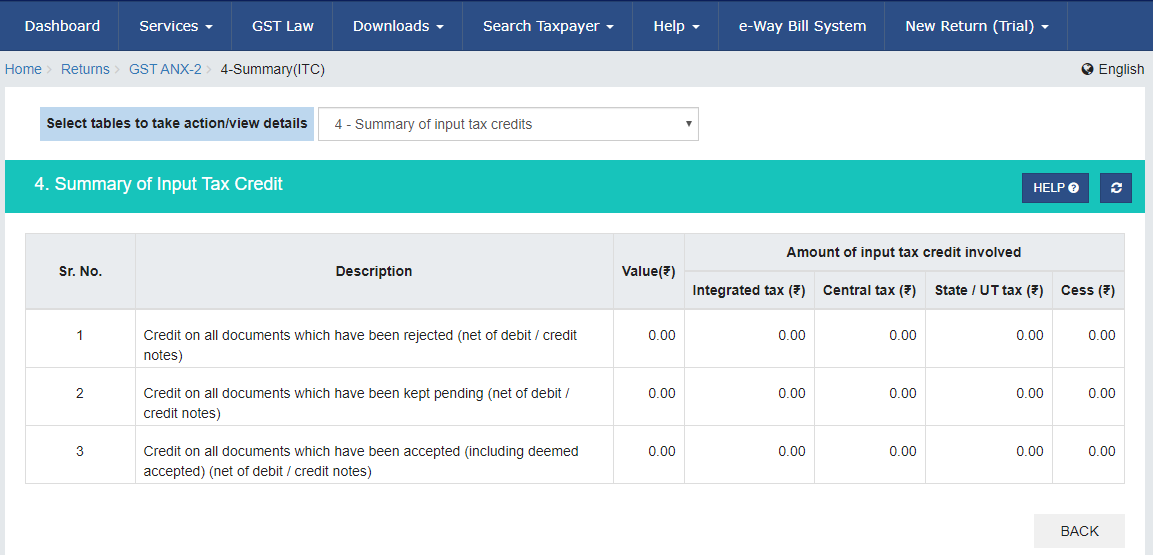

- Table-4. Summary of Input Tax Credit

- RET-01:

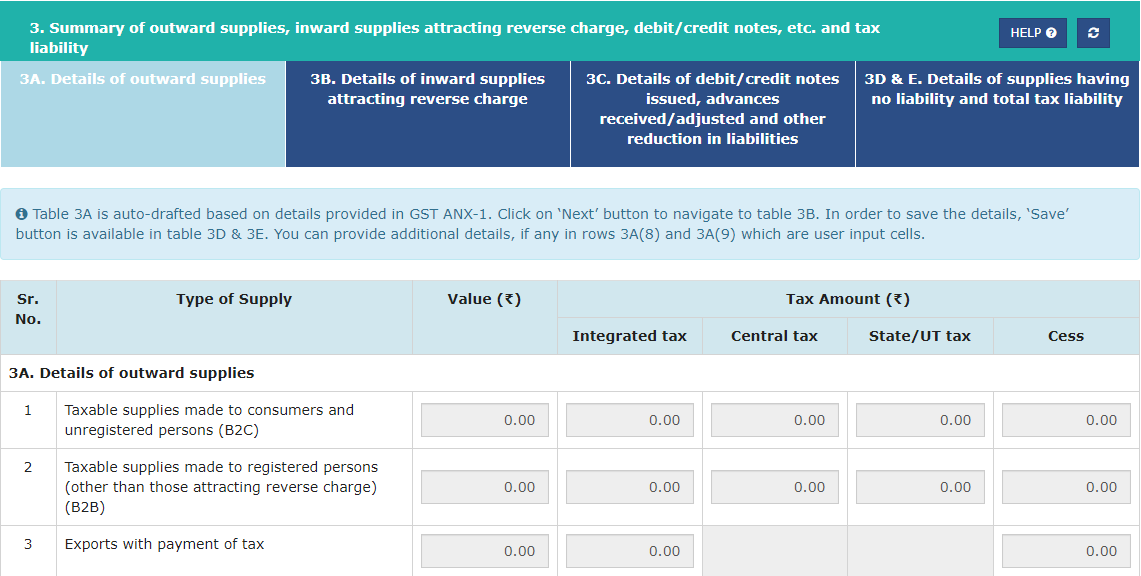

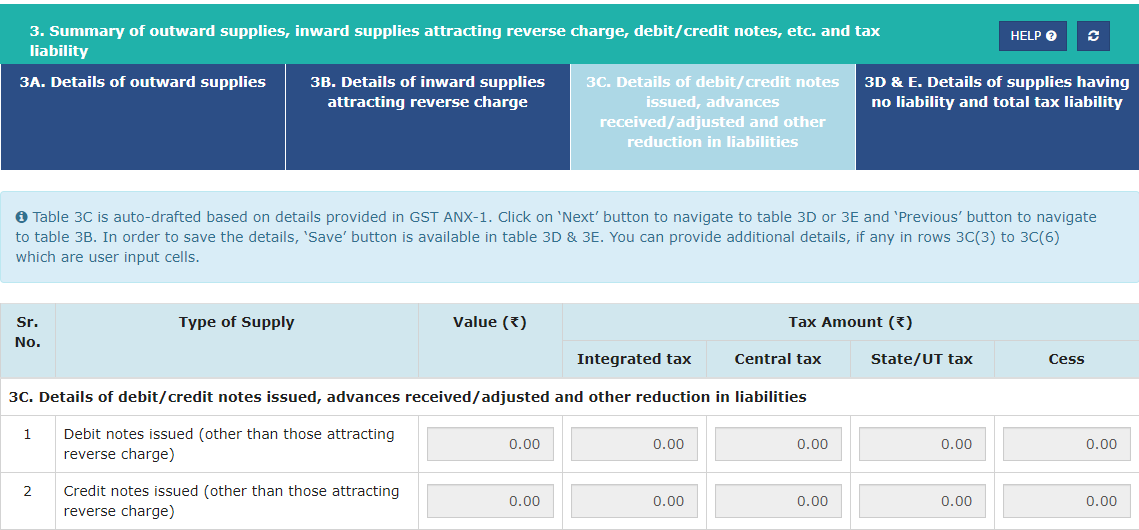

- Table-3. Summary of outward supplies, inward supplies attracting reverse charge, debit/credit notes, etc. and tax.

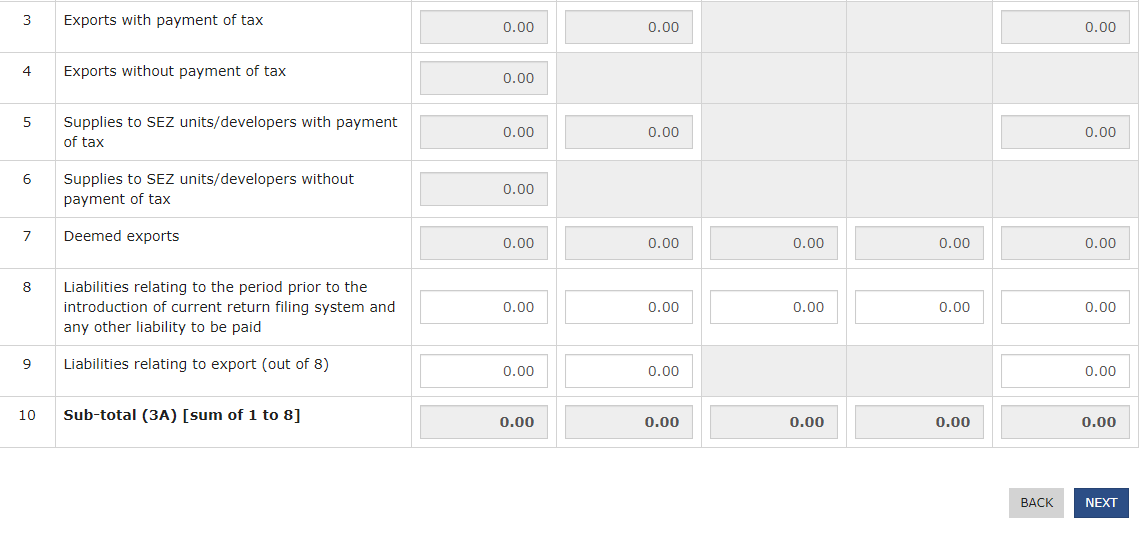

- Table-3A. Details of outward supplies.

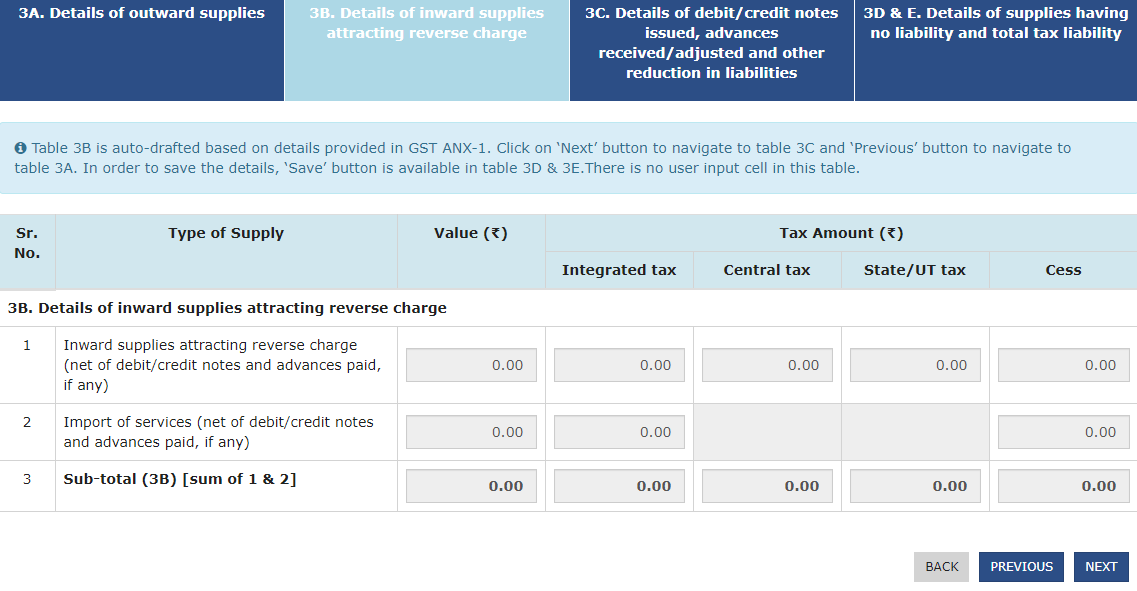

- Table-3B. Details of inward supplies attracting reverse charge.

- Table-3C. Details of debit/credit notes issued, advances received/ adjusted and other reduction in liabilities.

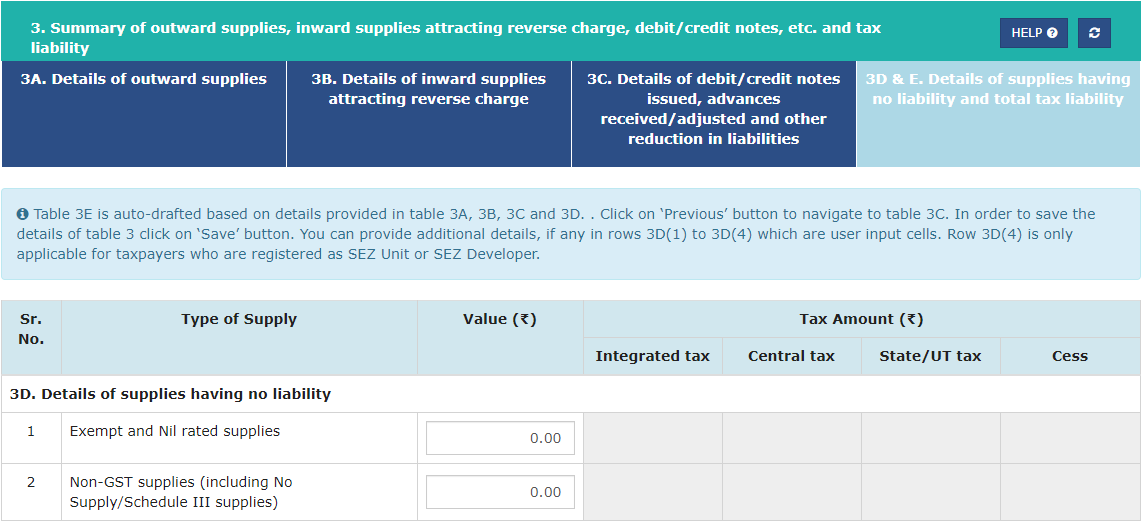

- Table-3D & E. Details of supplies having no liability and total tax liability.

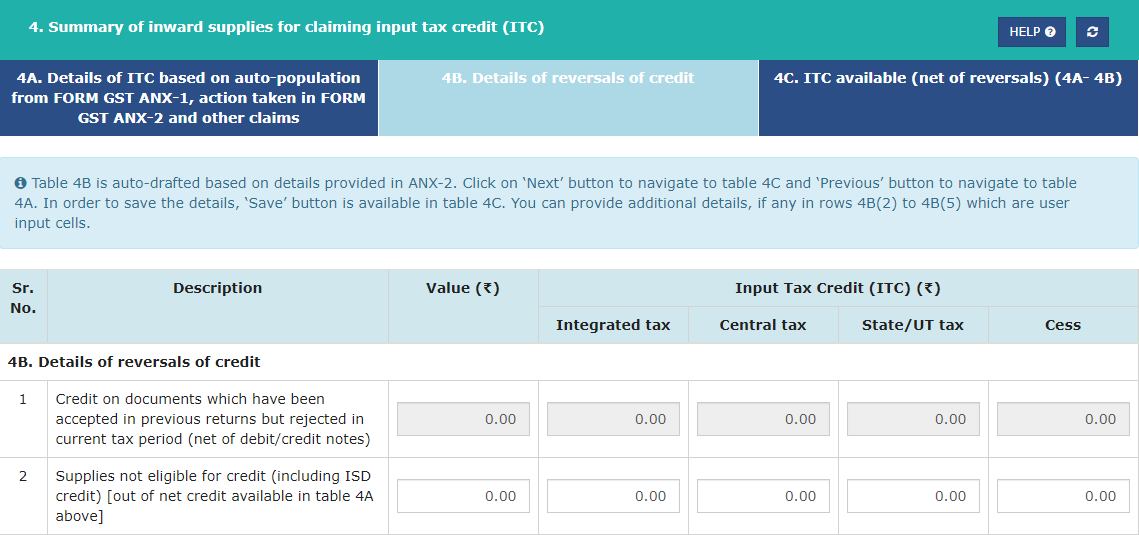

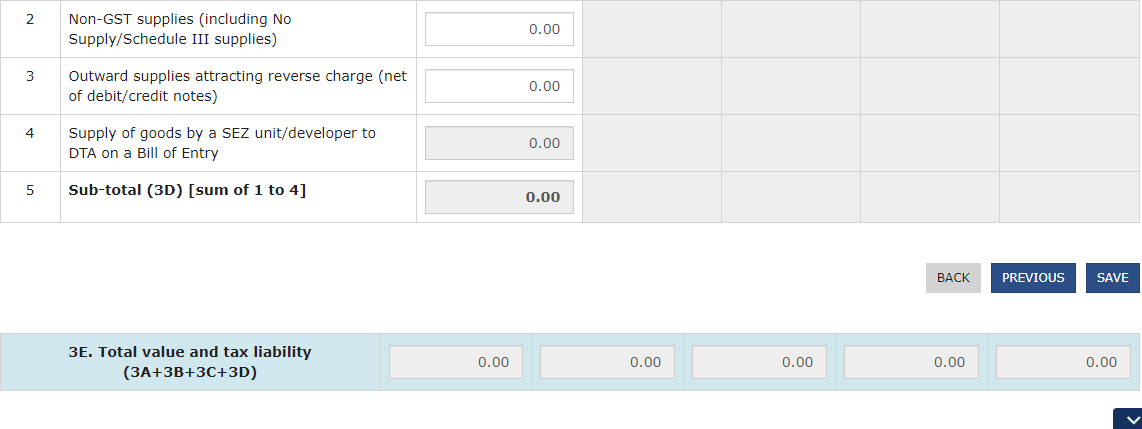

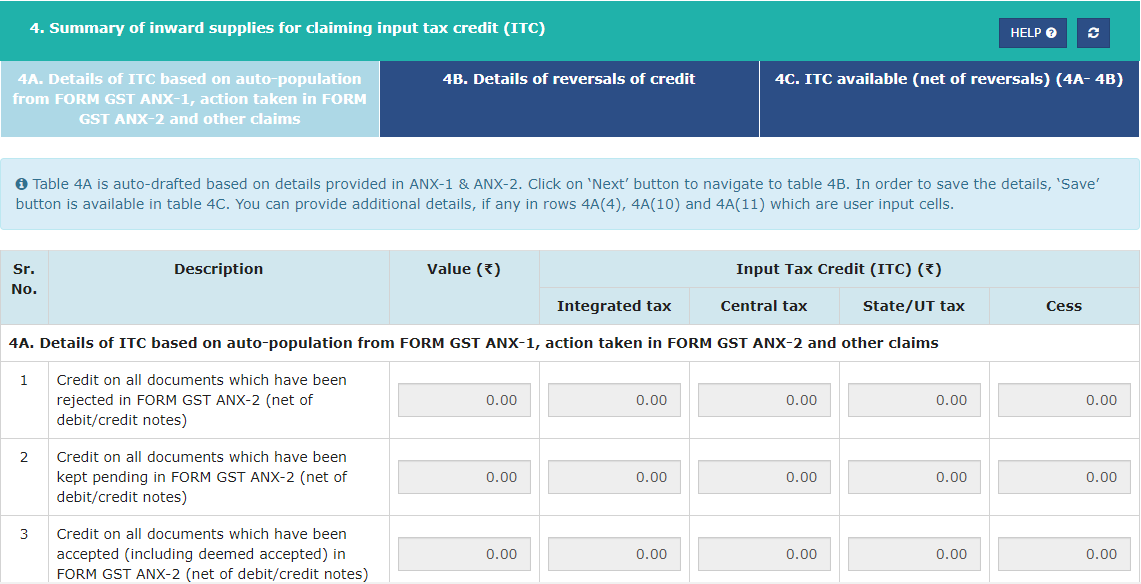

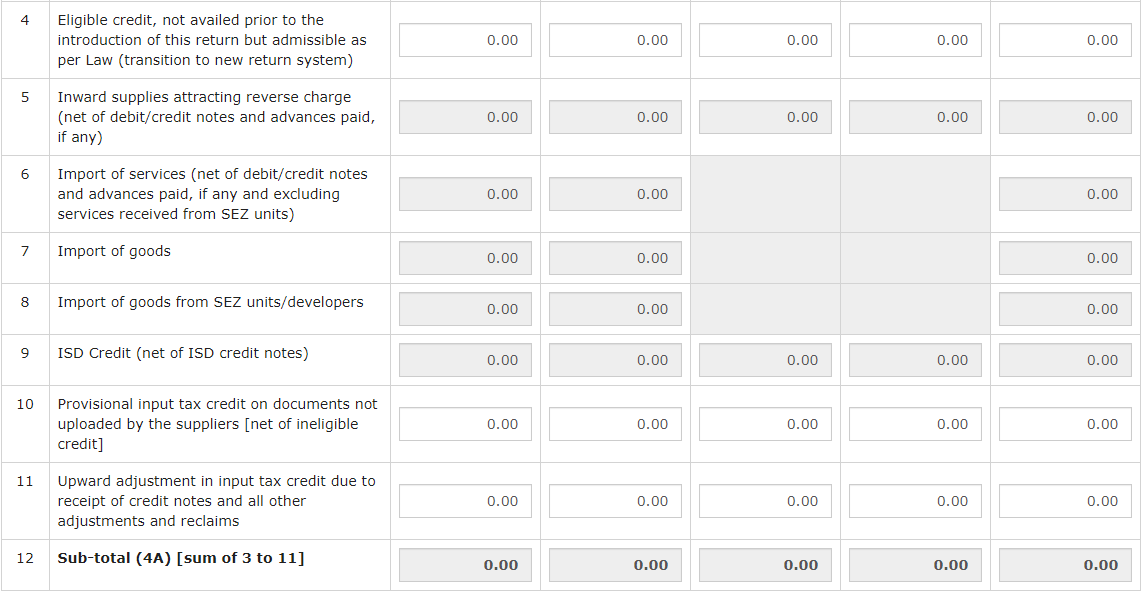

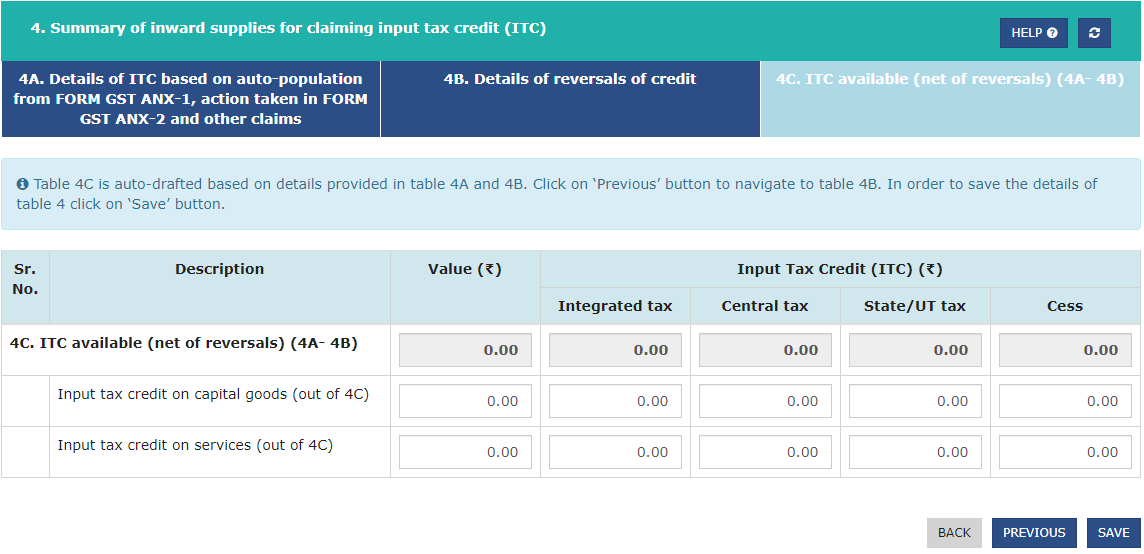

- Table-4. Summary of inward supplies for claiming input tax credit (ITC).

- Table-4A. Details of ITC based on auto-population from FORM GST ANX-1, action taken in FORM GST ANX-2 and other claims.

- Table-4B. Details of reversals of credit.

- Table-4C. ITC available (net of reversals) (4A-4B).

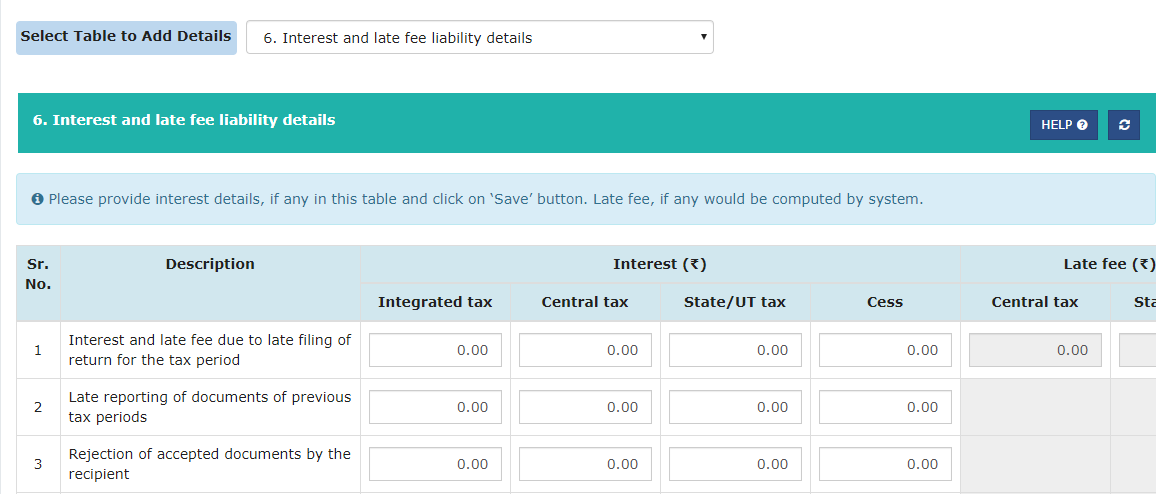

- Table-6. Interest and late fee liability details.

New GST return is live on the portal:

New GST return is live on the portal. It will be applicable from 1.04.2020. (Expected to be postponed to September, in GST council meeting on 14th March 2020). We filed many wrong returns in the past but this return is more automated. Chances of mistakes will be lesser. Let us have a screen to screen look of it. Basically it has three parts:

Annex-1: It is a statement of supply. It has the following main tables:

- B2C supply

- B2B supply

- Export supply

- Deemed export

- SEZ supply

- Imports

- Inward supply liable for RCM

Annex 2: Statement of inward supplies

RET 01,02,03: Final return containing the data from Annex 1 and 2

You can read these FAQs to understand it first.

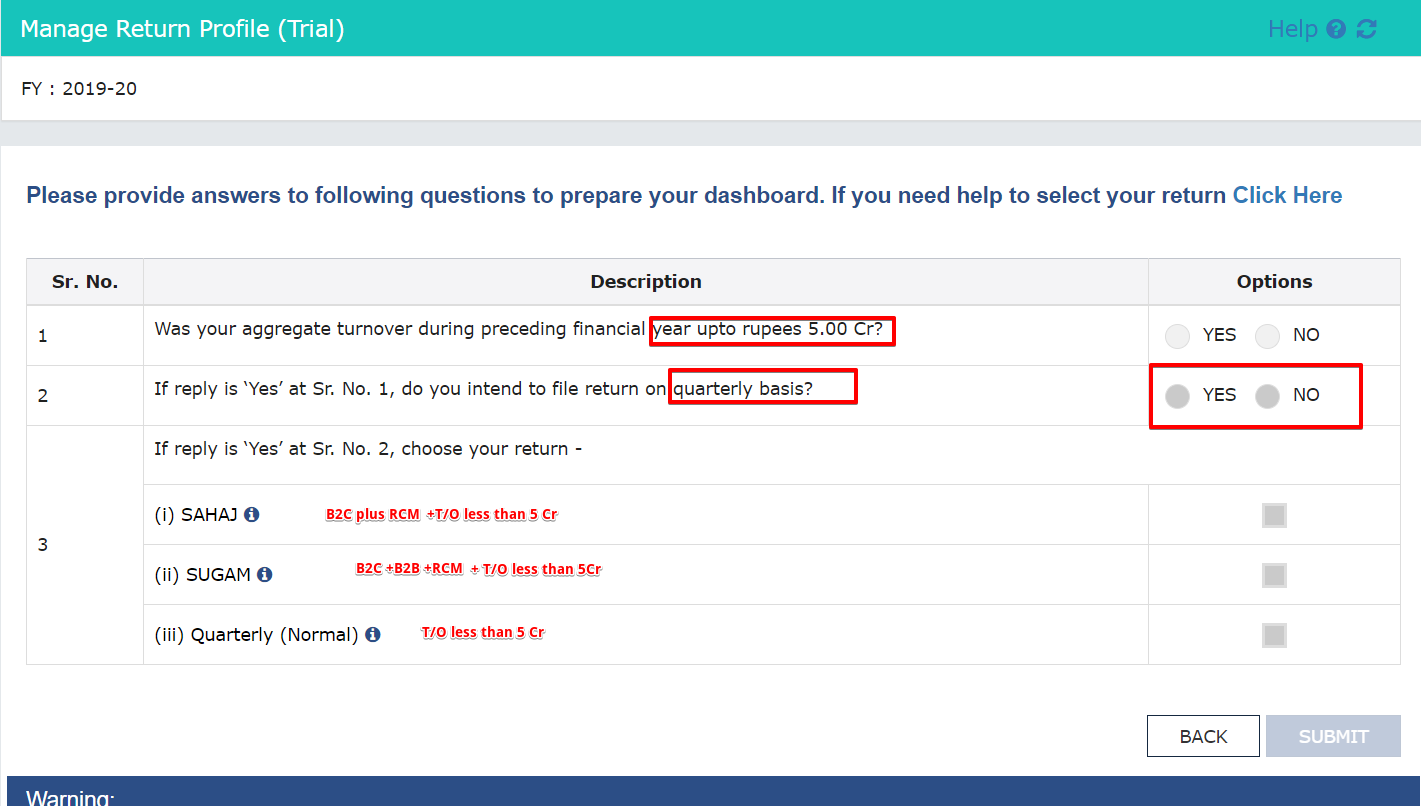

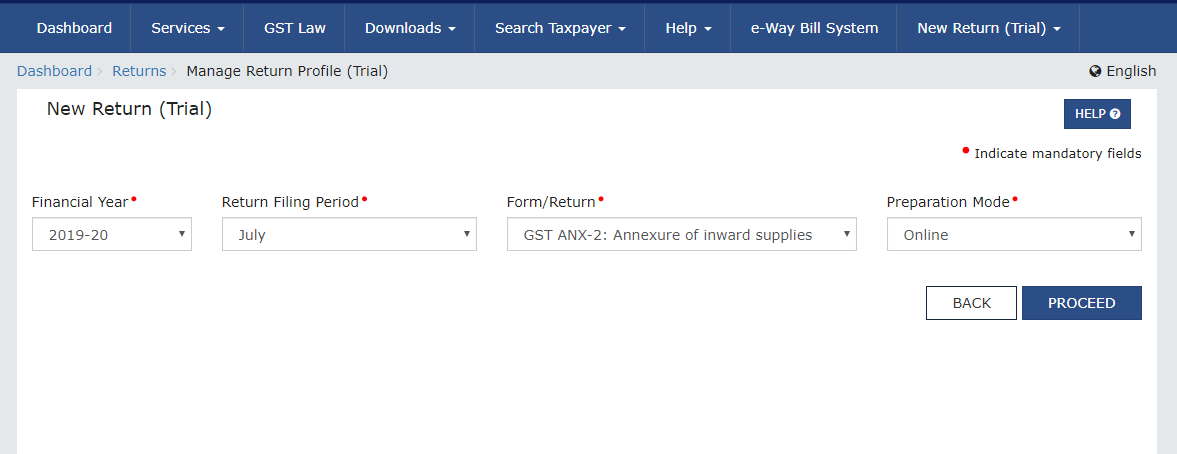

How to set the profile and select type of return?

First of all login into the GST portal and click on New return (Trial). Select the date and period and then click on “online”. GST new return has three parts:

If your turnover is less than Rs 5 Cr you can select RET 01 qtrly or GSTR Sahaj or GSTR Sugam.

GSTR Sahaj can be selected when there are only B2C supply and RCM.

GSTR Sugam can be selected when there only B2B and B2C supply and RCM.

In all other cases, RET 01 will be applicable.

This return has three parts.

- Annex 1: Supply, and RCM details.

- Annex 2: Purchase details auto populated.

- RET 01 (the main return)

Annex:1 of New GST return:

Let us understand what is annex 1. It is an annexure of outward supply and RCM.

Table-3A. Supplies made to consumers and un-registered persons (Net of debit and credit notes)

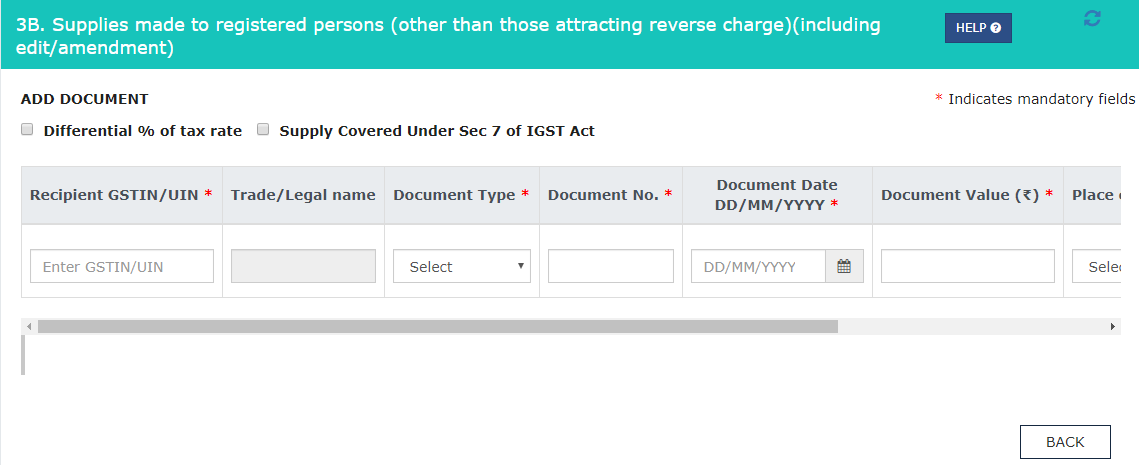

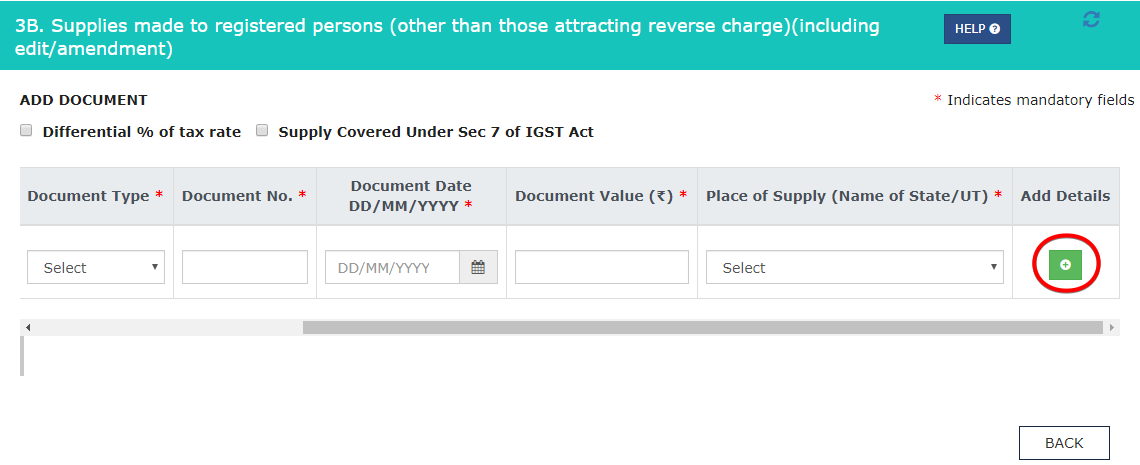

Table-3B. Supplies made to registered persons (other than those attracting reverse charge)(including edit/amendment)

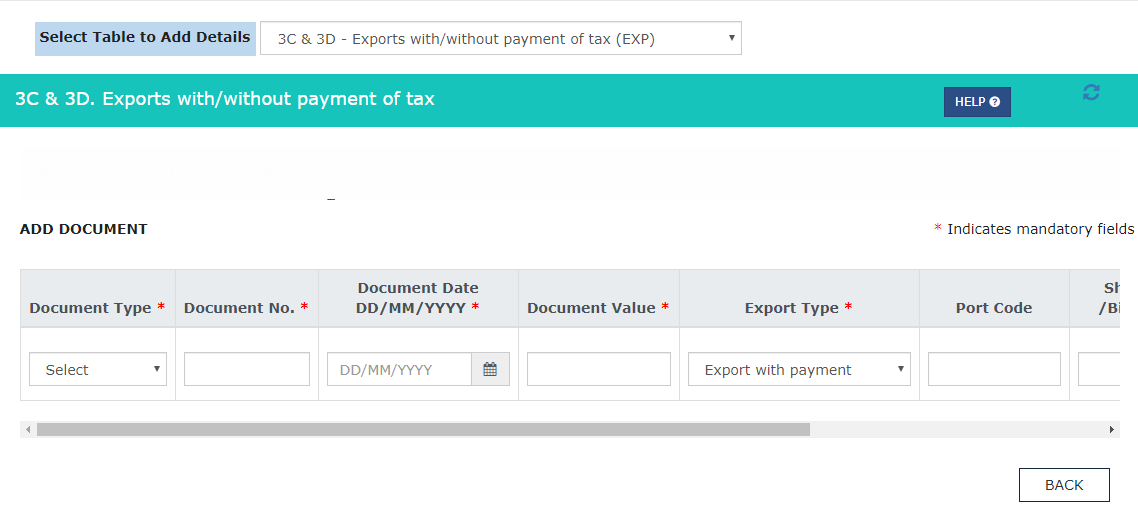

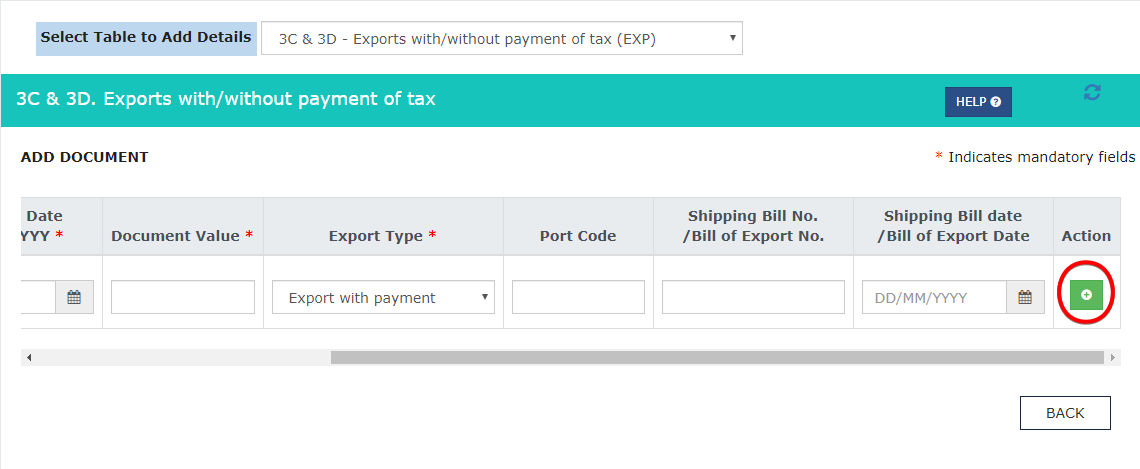

Table-3C & 3D. Exports with/without payment of tax

Table-3E & 3F. Supplies to SEZ units/developers with/without payment of tax(including edit/amendment)

Table-3G. Deemed Exports

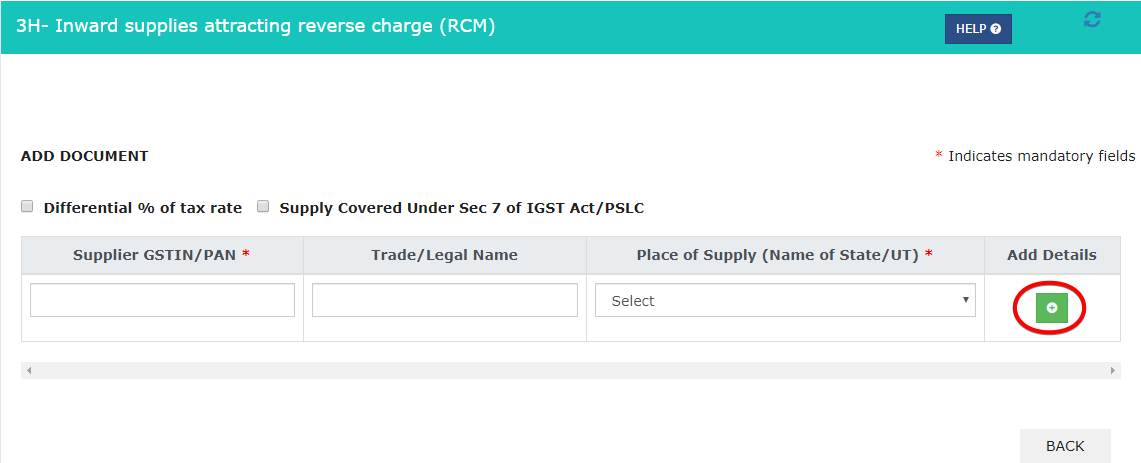

Table-3H. Inwards supplies attracting reverse charge (RCM)

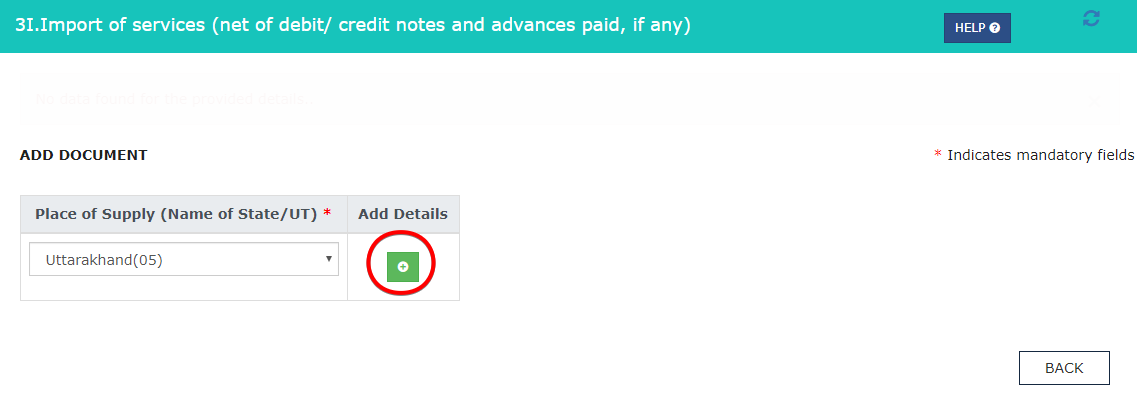

Table-3I. Import of services( net of debit/ credit notes and advances paid, if any)

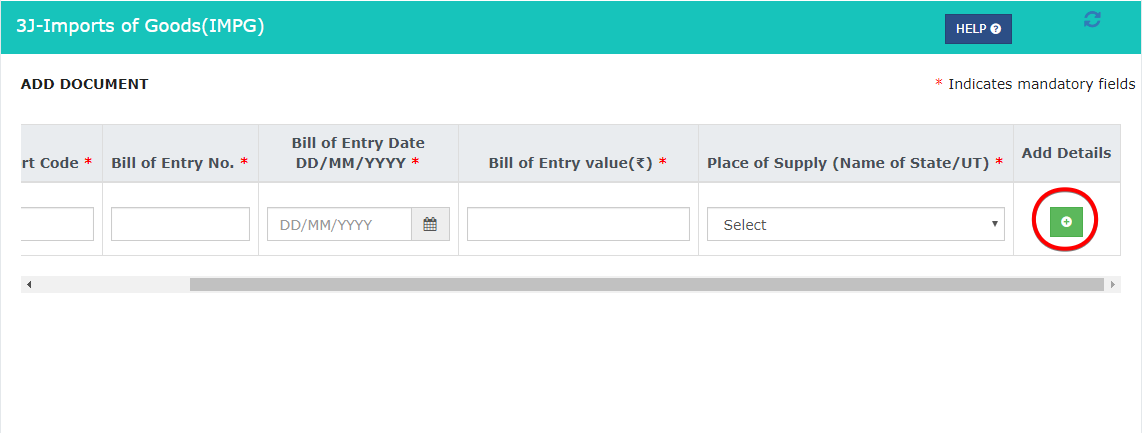

Table-3J. Imports of Goods(IMPG)

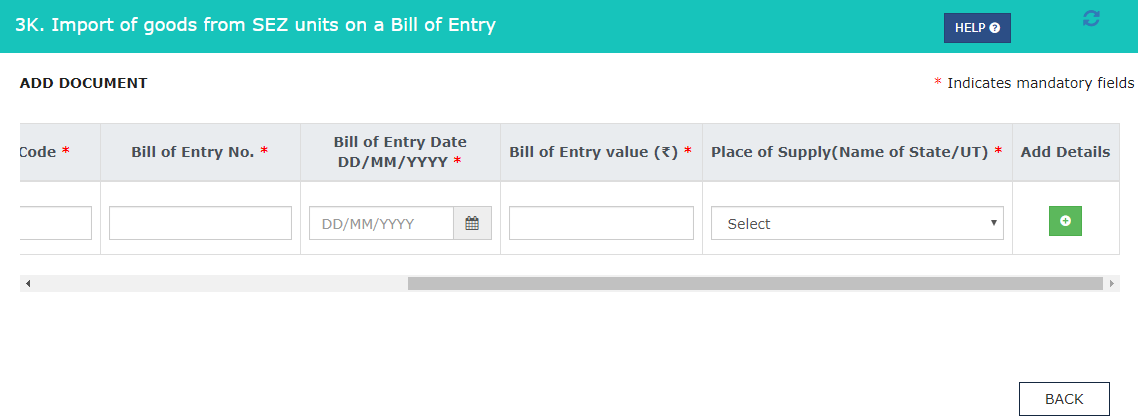

Table-3K. Import of goods from SEZ units on a Bill of Entry.

Table-4. Details of the supplies made through e-commerce operators liable to collect tax under section 52 ( out of any outward supplies declared in table 3)

Annex 2 of New GST return

Table-3A – (3B). Supplies from registered persons (B2B) – ( From table-3B of ANX-1)

Table-3A – (3G). Deemed Exports (DE) – (From table-3G of ANX-1)

Table-4. Summary of Input Tax Credit

RET-01:

Table-3. Summary of outward supplies, inward supplies attracting reverse charge, debit/credit notes, etc. and tax.

Table-3A. Details of outward supplies.

Table-3B. Details of inward supplies attracting reverse charge.

Table-3C. Details of debit/credit notes issued, advances received/ adjusted and other reduction in liabilities.

Table-3D & E. Details of supplies having no liability and total tax liability.

Table-4. Summary of inward supplies for claiming input tax credit (ITC).

Table-4A. Details of ITC based on auto-population from FORM GST ANX-1, action taken in FORM GST ANX-2 and other claims.

Table-4B. Details of reversals of credit.

Table-4C. ITC available (net of reversals) (4A-4B).

Table-6. Interest and late fee liability details.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.