Brief Analysis of Notifications Issued on 3rd April 2020

Table of Contents

- Brief Analysis of Notifications Issued on 3rd April 2020

- INTEREST ON DELAY PAYMENT OF TAX PERIOD FOR FEBRUARY, MARCH, APRIL 2020

- LATE FEES ON FILING OF GSTR 3B

- DUE DATE OF FILING OF GSTR 3B FOR MAY 2020

- LATE FEES ON FILING OF GSTR 1

- LATE FEES ON FILING OF GSTR 4 AND CMP-08

- NEW APPLICATION FOR COMPOSITION SCHEME FOR FY 2020-21

- GENERAL EXTENSION OF TIME LIMIT FOR COMPLIANCE SUBJECT TO CONDITIONS

- CONDITIONS FOR INPUT TAX CREDIT

- Download the copy:

Brief Analysis of Notifications Issued on 3rd April 2020

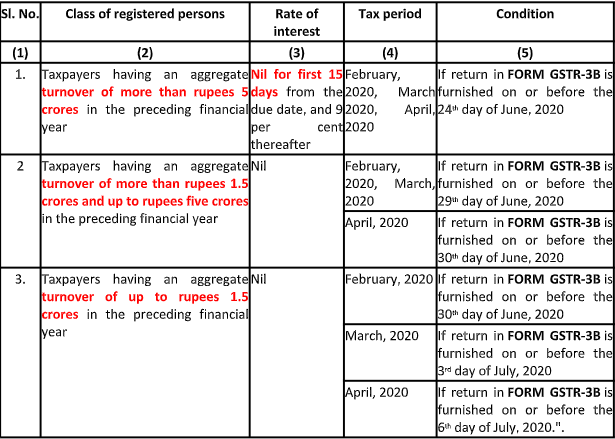

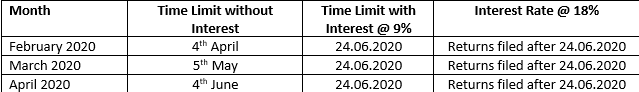

INTEREST ON DELAY PAYMENT OF TAX PERIOD FOR FEBRUARY, MARCH, APRIL 2020

Notification No- 31/2020 dated 03.04.2020

Our Comments:

Turnover above Rs. 5 Crore

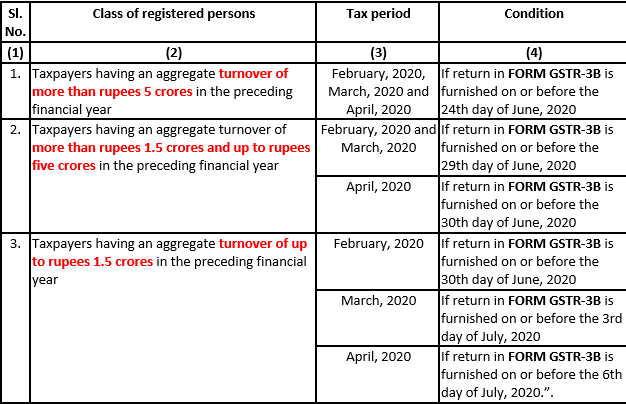

LATE FEES ON FILING OF GSTR 3B

Notification No- 32/2020 dated 03.04.2020

No Late Fees shall be charged for February 2020, April 2020 and May 2020 provided the conditions as set forth has been complied

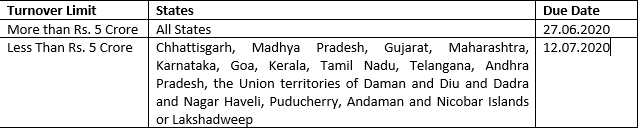

DUE DATE OF FILING OF GSTR 3B FOR MAY 2020

Notification No- 36/2020 dated 03.04.2020

LATE FEES ON FILING OF GSTR 1

Notification No- 33/2020 dated 03.04.2020

No Late Fees on the filing of GSTR 1 shall be charged for March 2020, April 2020 and May 2020 and for the quarter ending 31st March 2020 provided return in Form GSTR 1 has been furnished on or before 30.06.2020

LATE FEES ON FILING OF GSTR 4 AND CMP-08

Notification No- 34/2020 dated 03.04.2020

persons shall furnish a statement, containing the details of payment of self-assessed tax in FORM GST CMP-08 of the Central Goods and Services Tax Rules, 2017, for the quarter ending 31st March 2020, till the 7th day of July 2020

persons shall furnish the return in FORM GSTR-4 of the Central Goods and Services Tax Rules, 2017, for the financial year ending 31st March 2020, till the 15th day of July 2020

NEW APPLICATION FOR COMPOSITION SCHEME FOR FY 2020-21

Notification No- 30/2020 dated 03.04.2020

A person who opts to pay to tax under the composite scheme may make an application on or before 30.06.2020

Further such person shall file the declaration in ITC-03 on or before 31.07.2020

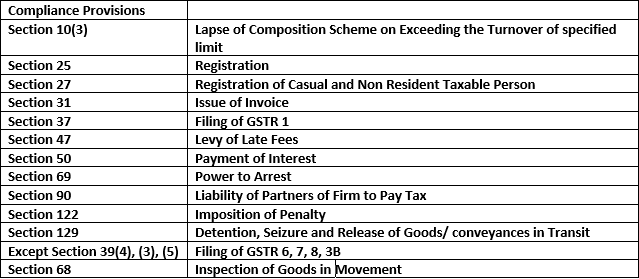

GENERAL EXTENSION OF TIME LIMIT FOR COMPLIANCE SUBJECT TO CONDITIONS

Notification No- 35/2020 dated 03.04.2020

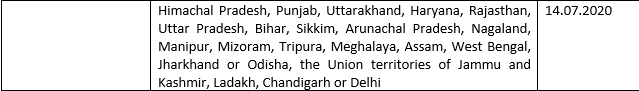

Any time limit for completion or compliance of any action, by any authority or by any person, has been specified in, or prescribed or notified under the said Act, which falls during the period from the 20th day of March 2020 to the 29th day of June 2020, and where completion or compliance of such action has

not been made within such time, then, the time limit for completion or compliance of such action shall be extended up to the 30th day of June 2020

(a) completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action, by whatever name called, by any authority, commission or tribunal, by whatever name called, under the provisions of the Acts stated above; or

(b) filing of any appeal, reply or application or furnishing of any report, document, return, statement or such other record, by whatever name called, under the provisions of the Acts stated above;

However, the above extensions shall not be applicable for

E-way bill has been generated under rule 138 of the Central Goods and Services Tax Rules, 2017 and its period of validity expires during the period 20th day of March 2020 to 15th day of April 2020, the validity period of such e-way bill shall be deemed to have been extended till the 30th day of April 2020.

CONDITIONS FOR INPUT TAX CREDIT

Notification No- 30/2020 dated 03.04.2020

The conditions prescribed in Rule 36(4) of CGST Rules 2017 for the availment of the credit of Input Tax restricting the credit up to 110% of the Invoices uploaded by the supplier has been relaxed for the tax period February, March, April, May, June, July and August 2020.

The condition for availing the credit shall apply cumulatively instead of month to month basis.

Download the copy:

CA Rachit Agarwal

CA Rachit Agarwal