Garnishee proceeding against a company after insolvency, upheld by Ranchi High Court

Table of Contents

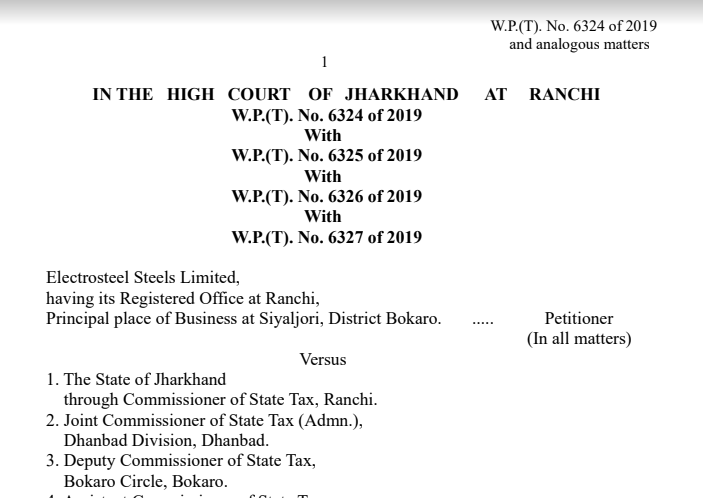

Case Covered:

Electrosteel Steels Limited

Versus

The State of Jharkhand

Read the full text of the case here.

Facts of the case:

In all these writ applications, the petitioner Company has challenged the garnishee order bearing No.727 dated 21.11.2019, issued under Section 46 of the Jharkhand Value Added Tax Act, 2005 (hereinafter referred to as the ‘JVAT Act’), as contained in Annexure-4 to the writ applications, issued by the respondent No.3, Deputy Commissioner of Commercial Taxes, Bokaro Circle, Bokaro, to the Respondent No.5, State Bank of India, in its branch situated in the campus of the petitioner Company, asking the respondent Bank to pay into the Government Treasury, the sum of Rs.37,41,41,602/-, on account of tax/penalty due under the JVAT Act, from the petitioner Company, who failed to deposit the taxes for the period from 2011-12 & 2012-13, from the Bank account of the Company. The petitioner Company has also challenged the letter No.733 dated 22.11.2009, as contained in Annexure-5 to the writ applications, issued by the State Tax Officer, Bokaro Circle, Bokaro, to the Respondent Bank, to deposit the amount of Rs.75,57,000/- by way of demand draft in favour of the Deputy Commissioner, Commercial Taxes, Bokaro Circle, Bokaro, in view of the fact that pursuant to the aforesaid garnishee order dated 21.11.2019, the respondent Bank had furnished the information that only the amount of Rs.75,57,000/- was available in the petitioner’s account.

Observations of the court:

In that view of the matter, we are not inclined to entertain these writ applications, even though there is a resolution plan in favour of the petitioner Company, approved by the Adjudicating Authority, i.e., the NCLT, for the simple reason that it was never brought to the knowledge of the Commercial Tax authorities of the State of Jharkhand that the corporate insolvency resolution process had been initiated against the petitioner Company, and no public announcement of the corporate insolvency resolution process was made in the State of Jharkhand. Section 31 of the IB Code clearly lays down that the approved resolution plan shall be binding only on those stakeholders who were involved in the resolution plan. Admittedly, the State Government was never involved in the corporate insolvency resolution process, and as such, the resolution plan cannot be said to be binding on it.

The judgement of the court:

For the aforesaid reasons, we find that the writ petitioner is not entitled to any relief whatsoever, There is no merit in these writ applications and all these writ applications are accordingly, dismissed.