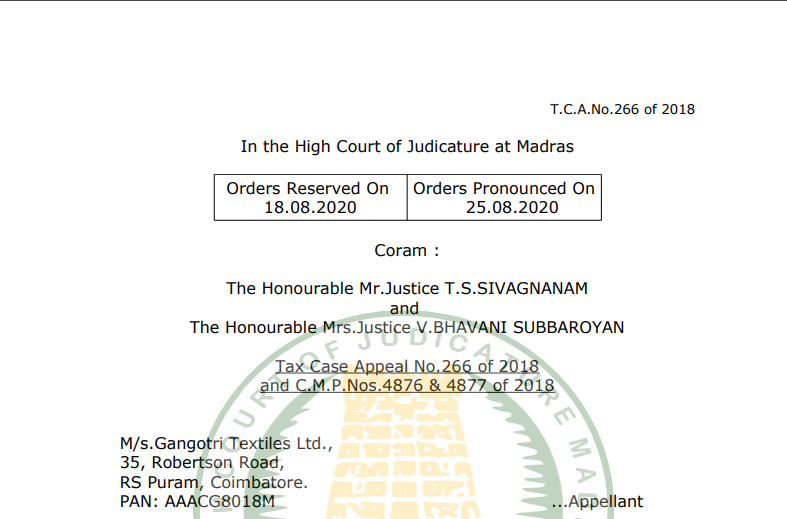

Madras HC in the case of M/s. Gangotri Textiles Ltd.

Table of Contents

Case Covered:

M/s. Gangotri Textiles Ltd.

Versus

The Deputy Commissioner of Income Tax

Facts of the Case:

This appeal by the assessee filed under Section 260A of the Income Tax Act, 1961 (“the Act” for brevity), is directed against the order dated 26.05.2017 passed by the Income Tax Appellate Tribunal, Chennai ‘A’ Bench (for brevity, the Tribunal) in ITA No.3413/Mds/2016 for the assessment year 2012-13.

The appeal is entertained on the following substantial questions of law:

“1. Whether the penalty imposed u/s. 271(1)(c) of the Act for the Assessment Year 2012-13 is sustainable in law despite the invalid initiation of the said proceedings on the issuance of the show cause notice dated 12.03.2015?

2. Whether the penalty imposed u/s. 271(1)(c) of the Act for the Assessment Year 2012-13 is sustainable in law despite the complete disclosure of the sale of windmills and vacant lands in the financial statements which formed part of the annual report and return of income?

3. Whether the penalty under consideration is sustainable on the debatable issue on the reporting of capital gains pertaining to the sale of windmills and vacant lands?

Observations of the Court:

We have carefully perused the penalty order dated 25.09.2015 and we find that the Assessing Officer considered all the factual aspects raised by the assessee and rejected the same to be absolute without bonafide. The decisions relied on by the assessee were also taken note of and each of the decisions was dealt with. The Assessing Officer placed reliance on the decision of the Hon’ble Supreme Court in Mak Data P. Ltd vs. CIT-II [(2018) 38 taxmann.com 448 (SC)] and stated that voluntary disclosure does not release the assessee from the mischief of penalty proceedings under Section 271(1)(c) of the Act. Therefore, we find that the penalty order is a reasoned order.

The learned counsel had argued that the defect in the penalty notice is a question of law that can be raised by the assessee at any point of time. We have considered this submission and we have rejected it. The learned counsel relied on the decision of the Hon’ble Supreme Court in the case of K.Lubna to submit that if the factual foundation for a case has been laid and the legal consequences of the same having been examined, the examination of such legal consequences would be a pure question of law. We have noted the factual position. The assessee understood the notice to be under both heads, namely, furnishing of inaccurate particulars and concealment of income. This is evident from the assessee’s reply dated 08.04.2015 to the show cause notice dated 12.03.2015. Therefore, the decision in the case of K.Lubna does not help the assessee, as there is no substantial question of law arising from such contention.

The Decision of the Court:

Thus, for the above reasons, we find that the order passed by the Tribunal does not call for any interference and the Substantial Questions of law framed for consideration have to be answered against the assessee.

As the result, the tax case appeal is dismissed and the Substantial Questions of law are answered against the assessee. No costs. Consequently, connected miscellaneous petitions are closed.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.