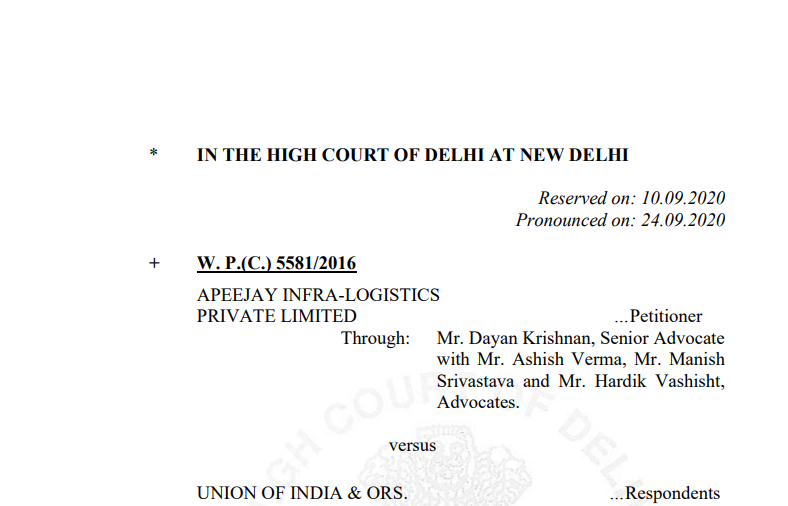

Delhi HC in the case of Apeejay Infra-Logistics Private Limited Versus Union of India

Table of Contents

Case Covered:

Apeejay Infra-Logistics Private Limited

Versus

Union of India

Facts of the Case:

The Petitioner, a private Container Freight Station [hereinafter referred to as ‘CFS’] at Haldia, West Bengal, challenges Regulation 5(2) of the Handling of Cargo in Customs Areas Regulations, 2009 and also impugns Revenue’s demand for Cost Recovery Charges [hereinafter referred to as ‘CRC’] towards the cost of the Customs staff posted at the station. Insofar as the challenge to the Regulations is concerned, the same does not survive, in view of the authoritative decision of this court in Allied ICD Services Ltd. Vs. Union of India and Ors., 2018 SCC OnLine Del 10816:(2018) 364 ELT 59, wherein the impugned provision has been upheld. The said judgment is now pending a challenge by way of a Special Leave Petition before the Supreme Court, however, there is no stay against the same. The only remaining prayer in the present petition that merits consideration is the one that has been made in the alternative, impugning the demand raised by the respondents for recovery of CRC of customs employees posted at the Petitioner’s station.

The factual background giving rise to the present petition is that pursuant to a policy decision taken vide Circular No.128/95-Cus dated 14.12.1995, the appointment of custodians of ICDs/CFSs/ACCs/EPZs was opened to the private sector and standard guidelines were issued in this regard, with the aim to de-congest ports and establish custom clearance facility in the interior parts of the country. The ICDs/CFSs/ACCs/EPZs so established were to function akin any other port and their operators were appointed as custodians under Section 45 of the Customs Act, 1962. The above-referred 1995 Circular provided, inter alia, that custodians of the ICDs/CFSs/ACCs/EPZs premises (such as the Petitioner herein) were responsible to pay for the Customs personnel posted at such premises, and had to furnish an undertaking to this effect, agreeing to bear the costs of such staff.

Observations of the Court:

According to the petitioner’s written rejoinder submissions, the rationale behind such incentivization was to promote the import/export of goods, to encourage business efficacy by targeting an increase in the actual business of importing/exporting of TEUs, and not the quantum of paper-work required for the same. Firstly, we must point out that this is an inference of the Petitioner which lacks material foundation. Secondly, this argument is wholly misconceived and self-contradictory. We cannot interpret business efficacy in the manner that the Petitioner contends. We also cannot agree with the Petitioner’s rationale that actual business is only TEUs, and not the documents i.e. BoE/SB, or that efficacy will always be achieved when more TEUs are imported/exported in one BoE/SB, and not when the same TEU is imported/exported through multiple BoEs/SBs. If we accept this contention, it would mean that those CFS which have a higher volume of paper-work should be deemed as inefficient and be denied the exemption, which cannot be correct. Clause 1 (iii) of the Exemption Circularis not to be rendered dead letter or meaningless. In our opinion, the quantum of documentation vis-a-vis TEUs would be driven by the requirements of each business, and it is not for the court to construe a provision merely on the perceived understanding of some data analysis. Both conditions foresee different parameters for evaluating the performance of CFS. The statistical ratio cannot be used to interpret the provision. A converse situation can also occur when one document may relate to multiple containers. Thus, criteria (ii) and (iii) of clause 1 are independent of each other and are to be met independently. It is not for the court to side with an interpretation on the ground that it makes more business sense. This Court cannot sit in judgment over the commercial or business prudence of a governmental decision unless the decision is in clear violation of any statutory provisions or perverse or for extraneous considerations or improper motives. It is not the prerogative of this court to intervene in whether the requirement of 1200 BoE/SB renders the requirement of 1200 TEUs toothless or is commercially unsound. The threshold for seeking exemption is not met in the present factual matrix. The benchmarking parameters are to be applied cumulatively and not disjunctively.

The Decision of the Court:

In view of the above, there is no merit in the present petition in respect of the surviving prayers made in the petition, noted hereinabove. Dismissed. The interim order dated 3rd June 2016, as confirmed vide order dated 21st January 2019, stands vacated.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.