Allahabad HC in the case of Awadh Bar Association Versus Union of India

Table of Contents

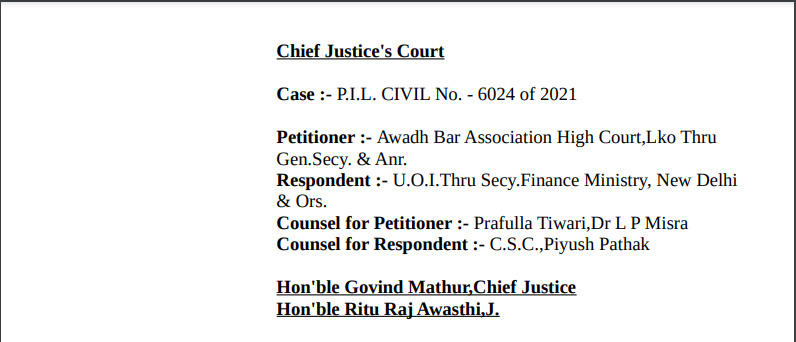

Case Covered:

Awadh Bar Association

Versus

Union of India

Order:

At the threshold, it is stated by the learned Additional Solicitor General of India that respondent nos. 1 and 2 have taken a decision to file a Special Leave Petition to assail the correctness of the judgment dated 09.02.2021 in Writ Tax No. 655 of 2018 passed by a coordinate Bench of this Court at Allahabad.

This petition for writ is preferred on behalf of Awadh Bar Association High Court, Lucknow, and Sri Sharad Pathak, Secretary of the Awadh Bar Association High Court, Lucknow.

The grievance of the petitioners is with regard to the decision of the Goods and Services Tax Council on Agenda Item No. 6 undertaken in its 39th meeting held on 14.03.2020.

Several contentions have been raised by learned counsel for the petitioners while questioning the correctness of the decision aforesaid. Having considered the same, we deem it appropriate to admit this petition for the writ and to hear the same finally at the earliest.

Accordingly, the writ petition is admitted for hearing. No post-admission notice be issued as the parties are already represented by their counsels.

Related Topic:

Allahabad HC in the case of Aparna Purohit Versus The state of U.P.

Having considered the arguments advanced and also the instructions communicated to us on behalf of respondent nos. 1 and 2, we deem it appropriate to direct respondent nos. 1 and 2 for not establishing Goods and Services Tax Appellate Tribunal for the State of Uttar Pradesh without leave of this Court.

Let this petition for writ be listed for final disposal on 15.03.2021.

In the meanwhile, respondents, if desire, may file a counter affidavit to the petition for the writ.

Read the Order:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.