Delhi HC in the case of Del Small Ice Cream Manufacturers Welfare’s Association (Reg.)

Table of Contents

Case Covered:

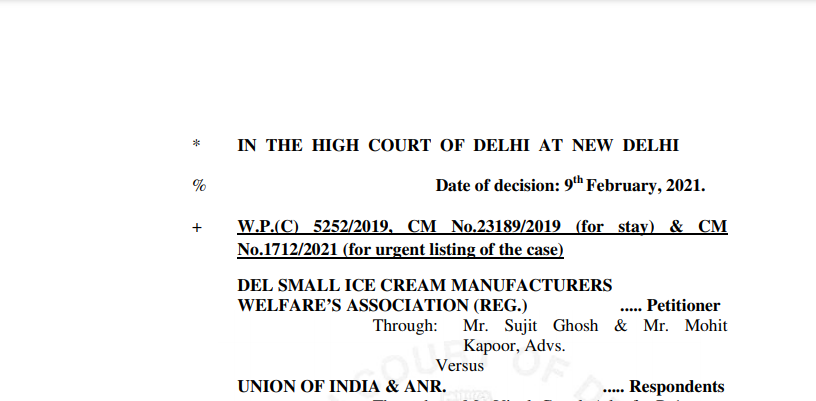

Del Small Ice Cream Manufacturers Welfare’s Association (Reg.)

Versus

Union of India

Facts of the Case:

The petitioner, claiming to represent the interest of more than 50 small scale ice cream manufacturing units operating in the National Capital Territory of Delhi has filed this petition impugning the decision dated 18th June, 2017 of the Goods and Services Tax Council (GST Council), in the exercise of powers under Section 10(2)(e) of the Central Goods & Services Tax Act, 2017, of exclusion of ice cream from the benefits of Composition Scheme under Section 10 of the Act. It is the contention of the petitioner that the said exclusion is in violation of the spirit of Articles 14 and 19 of the Constitution of India and against the principles of natural justice.

Observations:

In this respect, we may record the contention of the counsel for the respondents, that besides pan masala and tobacco, aerated water has also been excluded from the benefit of Section 10(1) of the CGST Act.

Else it is well settled that a State does not have to tax everything in order to tax something and is entitled to pick and choose if it does so reasonably. Mention may also be made of the State of Jammu & Kashmir Vs. Trikuta Roller Flowers Mill (P) Ltd. (2018) 11 SCC 260 holding that grant of refund on CST paid, to boost entrepreneur investment, was primarily an executive economic policy decision, the scope of judicial scrutiny and interference wherewith is limited to on the grounds of mala fide, unreasonableness, arbitrariness or unfairness and that there is no legal or indefeasible right to claim a refund of CST paid. To the same effect is Ugar Sugar Works Ltd. Vs. Delhi Administration (2001) 3 SCC 635.

Related Topic:

Delhi HC in the case of Dhruv Krishan Maggu Versus Union of India

The Decision of the Court:

We, in the circumstances, are of the view that the only direction which can be issued in this petition is, to direct respondent no.2 GST Council to reconsider the exclusion of small scale manufactures of ice cream from the benefit of Section 10(1) of the Act, including on the aforesaid two parameters i.e. the components used in the ice cream and the GST payable thereon and other similar goods having similar tax effect continuing to enjoy the benefit. We direct accordingly.

The respondent no.2 GST Council to take up the aforesaid aspect in its next meeting and to take a decision thereon at the earliest, keeping in view that the ice cream season has just begun, and preferably within three months of today.

The petition is disposed of.

Read & Download the Full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.