ITC in the case of Agrawal And Brothers Vs Union Of India

Table of Contents

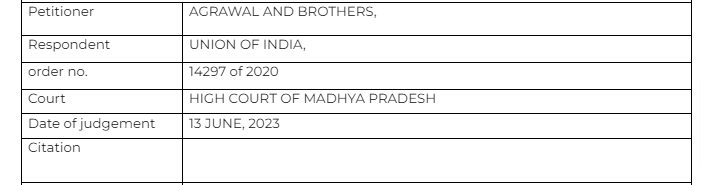

Case Covered:

Agrawal And Brothers Vs Union Of India

Facts of the case

The invoices of the petitioner were not entered in the GSTR 1 of the supplier. The tax was deposited but it was mistakenly deposited in the GST No.23AAIFA875GIZ1 instead of 23AAIFA8751ZI. This amount did not reflected in the 2A of the buyer. Then he had to pay the amount along with interest.

The buyer then approached the court to recover the amount from the supplier

Observations & Judgement of the court

The court allowed the recovery from the supplier as no one should suffer for the default of another person.The Writ Petition is allowed, and respondent No.1 is directed to return the amount of Rs.13,38,544/- to the petitioner within 2 months from today. Respondent No.1 shall be at liberty to submit a claim before the GST department as the same has been paid by the petitioner and if such claim is submitted, the competent authority of respondent No.2 shall decide the same in accordance with the law.

Read & Download the Full Agrawal And Brothers Vs Union Of India pdf:

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.