Intention to evade tax is mandatory for section 130 of CGST Act (Pdf Attach)

Table of Contents

Cases Covered:

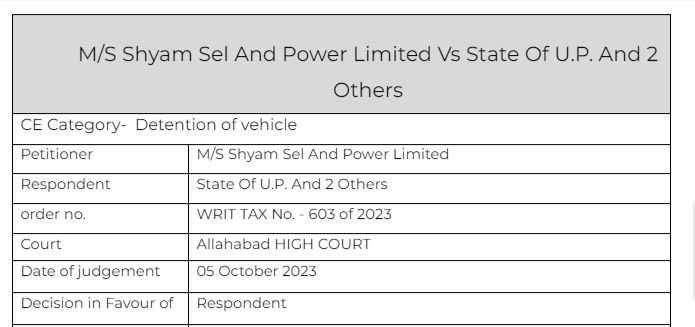

M/S Shyam Sel And Power Limited Vs State Of U.P. And 2 Others

Citations:

1. Assistant Commissioner (ST) & Others Vs. M/s Satyam Shivam Papers Private Limited & Another

2. M/s Gobind Tobacco Manufacturing Company & Another Vs. State of U.P. & Others

Facts of the cases:

The petitioner has GSTIN No. 19AAECS9421J1ZZ having its registered Office at the 2nd Floor, 5 SS Chamber, Chittaranjan Avenue, Jamuria, West Bengal. His goods were intercepted on 2 19.11.2021 at Maharajpur, Kanpur and on verification, it was found that e-way bill no. 8211 9011 4043 had been cancelled by the purchasing dealer; whereupon, form GST MOV 06 dated 22.11.2021 was prepared and the goods were seized. Subsequently, GST MOV 07 dated 22.11.2021 was prepared seeking a response from the petitioner.

The petitioner submitted the response that all e-way bills were duly filled up and the petitioner was not aware of the cancellation of e-way bills by the purchasing dealer, but the petitioner submitted that the goods in question were sold by the registered dealer to a registered purchasing dealer and were accompanied along with genuine documents. Dissatisfied with the reply, the impugned order dated 25.11.2021 was passed under section 129(3) of the CGST Act imposing the penalty. Feeling aggrieved by the aforesaid order, the petitioner preferred an appeal, which has also been dismissed by the impugned order dated 18.06.2022. Hence, the present writ petition.

Observation & Judgement of the Court:

For invoking the proceeding under section 129(3) of the CGST Act, section 130 of the CGST Act was required to be read together, where the intent to evade payment of tax is mandatory, but while issuing notice or while passing the order of detention, seizure or demand of penalty, tax, no such intent of the petitioner was observed. Once the dealer has intimated the attending and mediating circumstances under which e-way bill of the purchasing dealer was canceled, it was a minor breach. The authority could have initiated proceedings under section 122 of the CGST Act instead of proceedings under section 129 of the CGST Act

Comment:

The intention to evade tax is mandatory to invoke section 130 of the CGST Act. Even if there is any minor breach in E-way bill, the intent is important. If there is no intent to evade tax the detention is not valid.

The author can be reached at shaifaly.ca@gmail.com

Read & Download the Full M/S Shyam Sel And Power Limited Vs State Of U.P. And 2 others

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.