Section 16(4) is pain for all taxpayers since the GST was introduced. A long litigation is in place. But there is a good news.

The provision putting a time limit on taking credit after the November of the year end. Its validity was in challenge. In a recent judgement by Patna high court the validity of this provision was upheld.

Author can be reached at shaifaly.ca@gmail.com

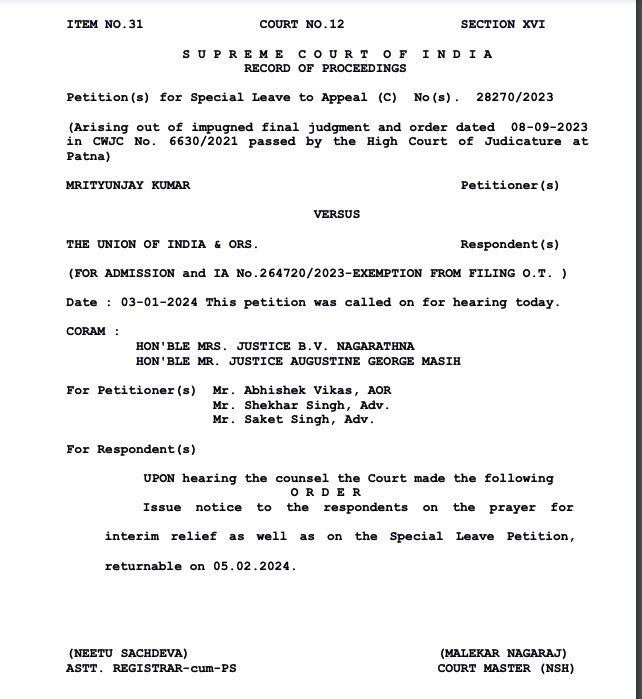

But the Supreme court has issued a notice against that order in an SLP filed in case of Mritunjay kumar Vs Union of India.

Read (download) judgement