Condonation of 1365 days allowed by court

The question was of right to give condonation of delay. Not one or two day but of 1365 days.

In this judgment the court allowed the CoD.

citatio

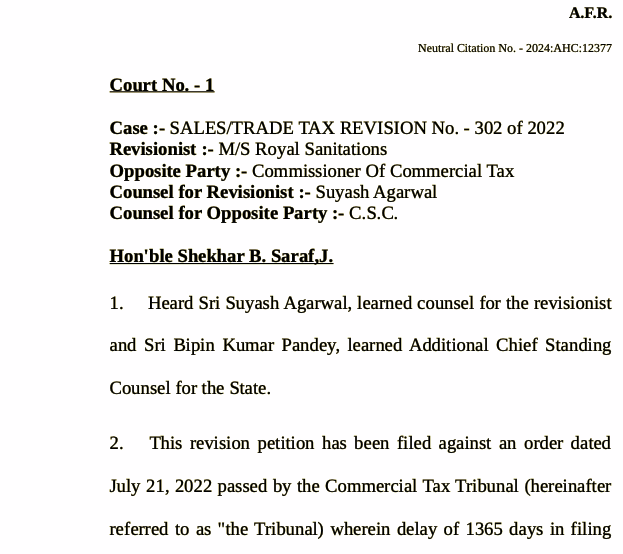

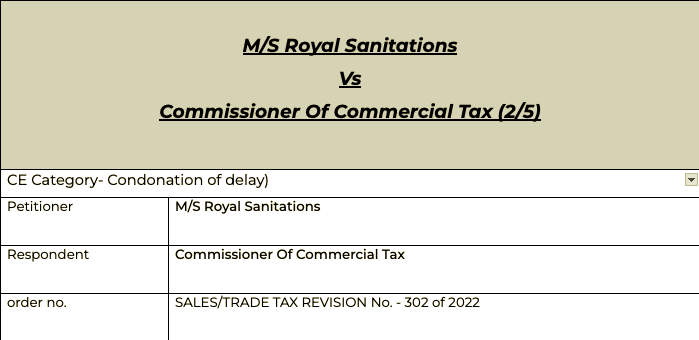

M/s royal sanitation Vs Comm of commercial tax

Citations

M/s Anil Enterprises v. Commissioner of Commercial

Tax, U.P. Lucknow

Postmaster General & Ors. v. Living Media India Limited and Another

- Balakrishnan v. M. Krishnamurthy reported in (1998) 7 SCC 123 Collector, Land Acquisition, Anantnag and Another v. Mst. Katiji and Others

Facts

- Whether the Tribunal was legally justified in condoning the delay of 1365 days in filing the appeal of revenue before the Tribunal contrary to the decision of Supreme court in the matter of Chief Post Master General & Ors Vs. Living Media India Ltd. and Anr and State of M.P. Vs. Bhure Lal?”

Observation

- In light of the above, I am of the view that the delay is explained by the authorities and the appeal is required to be heard by the Tribunal, as so much time has already elapsed. I am also of the view that the hearing of the appeal should be expedited. Accordingly, the Tribunal is directed to hear and decide the appeal within four months from date.

- With the aforesaid observations, the revision petition is disposed of

Read/DL copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.