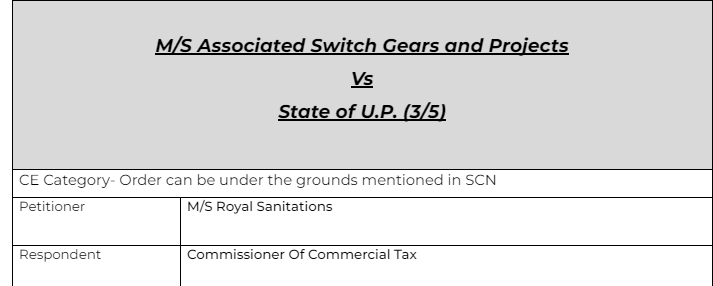

Order cant override the ground given in SCN

Table of Contents

Comment

The honourable court rejected the order passed by the appellate authority. It is well settled that unless the foundation of the case is made out in the show-cause notice, the Revenue cannot in Court argue a case not made out in its showcause notice.

Details of the case

citations

Commissioner of Customs, Mumbai -v- Toyo Engineering Ltd

Commissioner of Central Excise, Bhubaneshwar -v- Champdany Industries Ltd

Commissioner of Central Excise, Chandigarh -v- Shital International

Ramlala -v- State of U.P and Ors.

The Board of High School and Intermediate Education, U.P. -v- Kumari Chitra Srivastava,

Jitendra Kumar -v- State of U.P. and Anr

pleading

This is a writ petition under Article 226 of the Constitution of India wherein the petitioner is aggrieved by the order dated August 20, 2019, passed in appeal by the Respondent No. 2/Additional Commissioner GradeII (Appeal), Commercial/State Tax, Gautam Budh Nagar and the penalty order dated July 24, 2018, passed by the Respondent No. 3/Assistant Commissioner, State Tax/Commercial Tax, Gautam Budh Nagar.

Facts

In the show cause notice at the time of detention, that is, that the vehicle was travelling to a destination not mentioned in the invoice, was accepted in appeal by the authorities. However, the appellate authority has imposed a penalty on a different ground, that is, that the

e-Way Bill had expired though the same was accompanied with goods.

It is pertinent to mention here that the Supreme Court on numerous occasions has upheld that the authorities cannot transgress the boundaries of the show cause notice.

Observation

In the present case, it is evident that the authorities have travelled beyond reasons provided in the show cause notice and imposed penalty on the ground that was never provided to the petitioner in the show cause notice. The petitioner never had any opportunity to defend itself on the said ground, and therefore, the show cause notice is directly in teeth of the principles of natural justice, namely, the principle of audi alteram partem. 13. Therefore, the impugned orders in the instant case, cannot be allowed to stand. Accordingly, a writ of certiorari is issued against the impugned orders dated August 20, 2019 and July 24, 2018. These orders are hereby quashed and set aside. This Court also directs the amount deposited by the petitioner to be refunded within a period of 4 weeks from the date of this order. Other consequential reliefs to follow.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.