Typographical error in vehicle number- High court decision on penalty

Table of Contents

Commentary on the case-

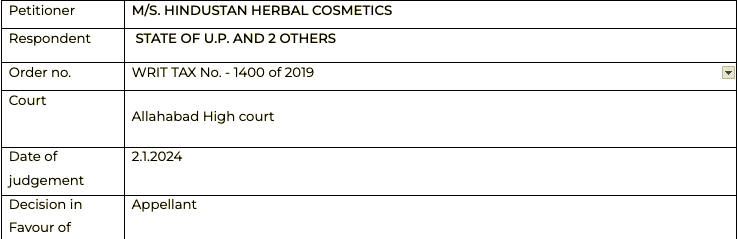

In this judgment there was a typographical error in the vehicle number in E-way bill. The documents were cross checked at a check point and there was difference in vehicle number filled in the part B of the E-way bill and the actual vehicle number.

The department levied a penalty in this case and the matter was listed in high court of Allahabad.

The vehicle number was mentioned incorrectly in the GST E-way bill. The digits were interchanged. But the department tried to levy the penalty for evasion. In this judgment the judgment of Varun beverages and Satyam Shivam papers were discussed.

The court held that a typographical error can’t be said to be the reason for evasion of tax.

Thus the notice was dropped by the honorable Allahabad High court.

Citation

M/s. Varun Beverages Limited v. State of U.P. and 2 others

Pleading

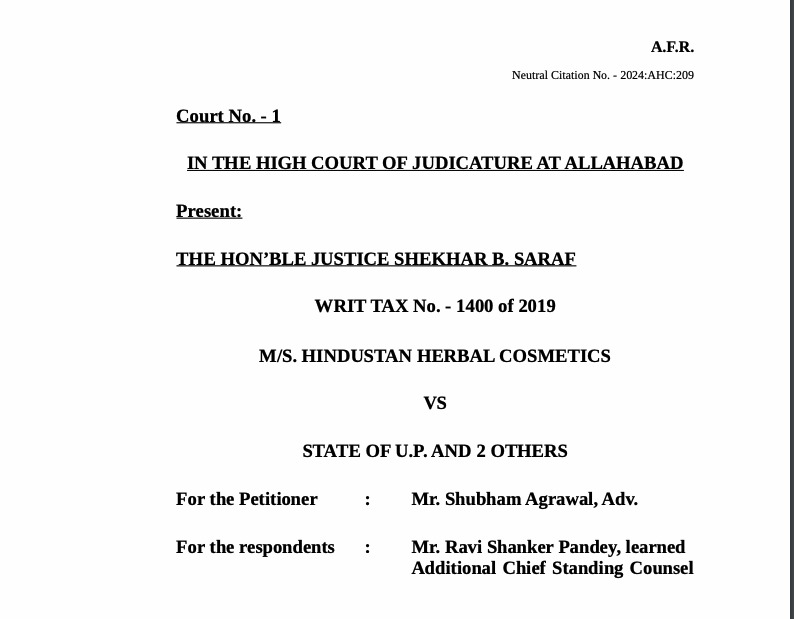

This is an application under Article 226 of the Constitution of India wherein the petitioner assails the order passed by the Additional Commissioner Grade-2 (Appeal), Commercial Tax, Ghaziabad/respondent No.3 dated August 29, 2019 and the order of the imposition of the penalty dated May 24, 2018 passed by the Assistant Commercial, Commercial Tax, Squad Unit-VI, Ghaziabad/ respondent No.2.

Facts

The consignment of goods was sent by the petitioner in Vehicle No.DL1 AA 5332. When the vehicle was in transit, the same was intercepted on 23.5.2018 10.40 P.M. by the Goods and Service Tax authorities.

The seizure order was passed on the ground that the vehicle number in Part-B of the e-way bill was incorrect as the e-way bill showed the vehicle bearing No.DL1 AA 3552 instead of DL1 AA 5332. Apart from the above factual position, it is clear that there was no other infraction on the part of the petitioner.

Furthermore, the authorities have imposed penalty only on the ground that the vehicle number was not mentioned correctly. There is no allegation of any attempt by the petitioner for evasion of tax as the e-way bill, bilty and the tax invoice were matching and the consignee was also a registered dealer.

Counsel on behalf of the petitioner has submitted that number 5332 was typed incorrectly as 3552.

He has submitted that this is so obviously a typographical error and similar mistake has also been made in the impugned order that has been passed by the authority concerned.

He further relies upon a coordinate Bench judgment of this Court in M/s. Varun Beverages Limited v. State of U.P. and 2 others reported in 2023 U.P.T.C. (113) 331 and also upon the judgment of the Supreme Court in Assistant Commissioner (ST) and others v. M/s. Satyam Shivam Papers Pvt. Ltd. And another reported in 2022 U.P.T.C. (110) 269 (SC)

Observation

Upon perusal of the judgments, the principle that emerges is that presence of mens rea for evasion of tax is a sine qua non for imposition of penalty.

A typographical error in the e-way bill without any further material to substantiate the intention to evade tax should not and cannot lead to imposition of penalty.

In the case of M/s. Varun Beverages Limited (supra) there was a typographical error in the e-way bill of 4 letters (HR – 73).

In the present case, instead of ‘5332’, ‘3552’ was incorrectly entered into the e-way bill which clearly appears to be a typographical error.

In certain cases where lapses by the dealers are major, it may be deemed that there is an intention to evade tax but not so in every case.

In light of the above findings, the impugned orders dated 29.8.2019 and 24.5.2018 are quashed and set-aside. The consequential reliefs to be provided to the petitioner within the next four weeks.

Read/download the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.