The officer searched u/s 67of GST can’t adjudicate- Madras HC

Table of Contents

Comment-

A search was conducted at the premises of the taxpayer. Lateron the same officer issues the notice. The SC decision in case of Ashok Kumar Yadav and others v. State of Haryana and others, (1985) 4 SCC 417. It was upheld that no one can be a judge in his own case. This harms the principles of natural justice.

A Circular dated 09.02.2018 of the Central Board of Excise and Customs in this connection was also relied upon. The department was asked to transfer the case to some other officer.

| CE Citation- CE Citation- GST/2024/68 | |

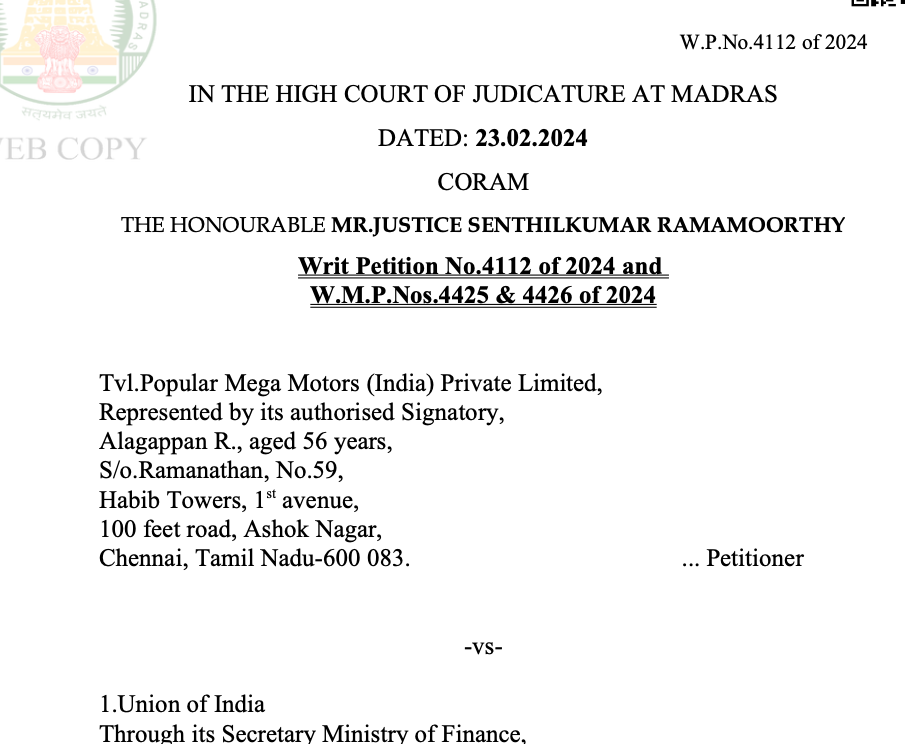

| Petitioner | Tvl.Popular Mega Motors (India) Private Limited, |

| Respondent | Union of India |

| Order no. | Writ Petition No.4112 of 2024 and W.M.P.Nos.4425 & 4426 of 2024 |

| Court | HIGH COURT OF JUDICATURE AT MADRAS |

| Date of judgement | 23.02.2024 |

| Decision in Favour of | Taxpayer |

| Citation | Ashok Kumar Yadav and others v. State of Haryana and others, (1985) 4 SCC 417

Circular dated 09.02.2018 of the Central Board of Excise and Customs Circular No.13/2022- TNGST dated 08.11.2022, |

Pleading

To shift the hearing from the officer who conducted the search to some other officer

Facts –

Search proceedings were conducted at the premises of the taxpayer

The show cause notice primarily on the ground that such notice was issued by the officer who undertook inspection under Section 67.

The jurisprudence in this context was presented. The request of TP was that the case should be transferred to the Commissioner. Although a date for personal hearing was given. But the personal hearing was scheduled with the same officer who conducted the search.

Read/download the original copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.