No need for Manual submission for LUT

No need for Manual submission for LUT

On 6th April 2018, Circular No.40/2018 is issued regarding the clarification for the acceptance of the LUT. This circular modifies the previously issued Circular no. 8/2017 dated 4th October 2017. Following are the modifications made with the circular:

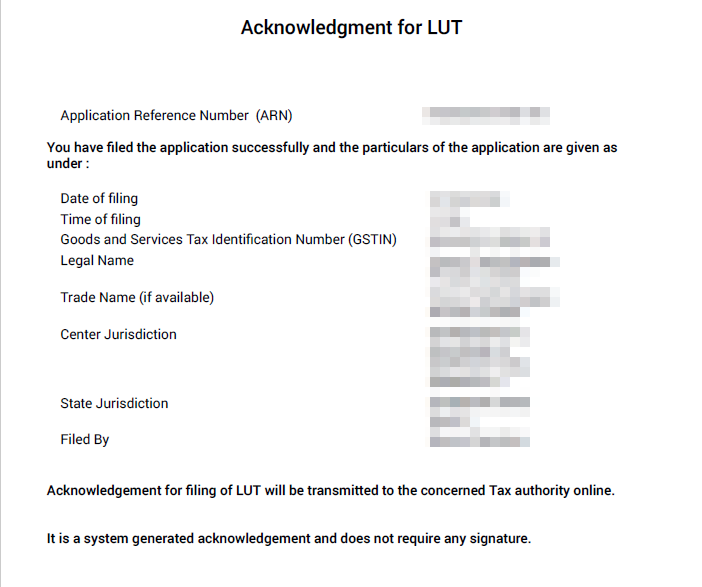

“c) Form for LUT: The registered person (exporters) shall fill and submit FORM GST RFD-11 on the common portal. A LUT shall be deemed to be accepted as soon as an acknowledgement for the same, bearing the Application Reference

Number (ARN), is generated online.

d) Documents for LUT: No document needs to be physically submitted to the jurisdictional office for acceptance of LUT.

e) Acceptance of LUT/bond: An LUT shall be deemed to have been accepted as soon as an acknowledgement for the same, bearing the Application Reference Number (ARN), is generated online. If it is discovered that an exporter whose LUT has been so accepted, was ineligible to furnish a LUT in place of the bond as per Notification No. 37/2017-Central Tax, then the exporter’s LUT will be liable for rejection. In case of rejection, the LUT shall be deemed to have been rejected ab initio.”

According to the modifications, there is no need for Manual submission for LUT is not mandatory for its applicability. LUT will be deemed to be accepted by the government. There is one conditioned mentioned is the circular regarding the ARN(Application Reference Number), without ARN even the online acknowledgement is not accepted.

The exporters can use the benefits of LUT from the date mentioned on the acknowledgement. It will be applicable from the date on which the exporter has applied for the LUT.

LUT acknowledgement for the reference:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.