Automative Components Technology India Private Limited

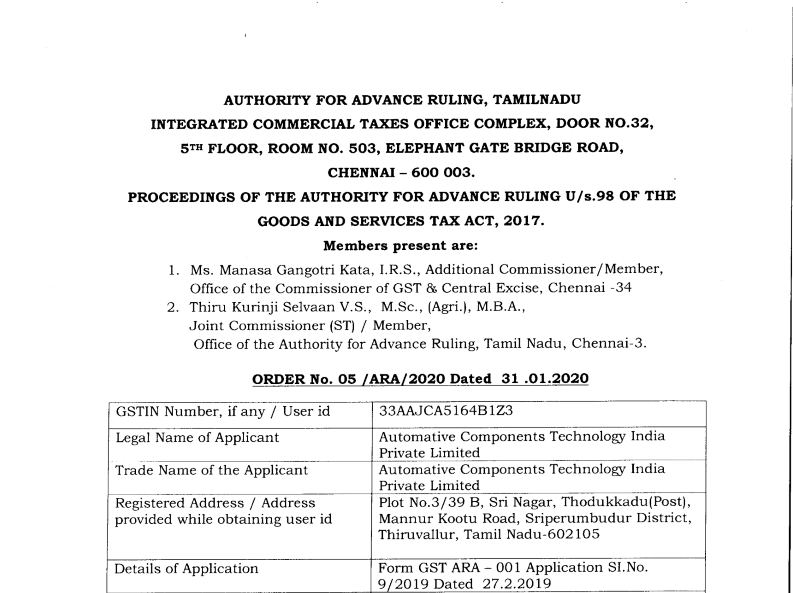

AUTHORITY FOR ADVANCE RULING, TAMILNADU INTEGRATED COMMERCIAL TAXES OFFICE COMPLEX, DOOR NO.32, 5TH FLOOR, ROOM NO. 5O3, ELEPHANT GATE BRIDGE ROAD, CHENNAI - 600OO3. PROCEEDINGS OF THE AUTHORITY FOR ADVANCE RULING U/s.98 OF THE GOODS AND SERVICES TAX ACT,2OI7. Members present are: 1. Ms. Manasa Gangotri Kata, I.R.S., Additional Commissioner/Member, Office of the Commissioner of GST & Central Excise, Chennai -34 2. Thiru Kurinji Selvaan V.S., M.Sc., (Agri.), M.B.A., Joint Commissioner (ST) / Member, Office of the Authority for Advance Ruling, Tamil Nadu, Chennai-3. ORDER No. OS /ARA/2O2O Dated 31.O1.2O2O

GSTIN Number, if any / User id |

33AAJCA516481Z3 |

Legal Name of Applicant |

Automative Components Technologz India Private Limited |

Trade Name of the Applicant |

Automative Components Technologr India Private Limited |

Registered Address / Address provided while obtaining user id |

Plot No.3/39 B, Sri Nagar, Thodukkadu(Post), Mannur Kootu Road, Sriperumbudur District, Thiruvallur, Tamil Nadu-6O2 105 |

Details of Application |

Form GST ARA - 001 Application SLNo. 9 /2OI9 Dated 27.2.2019 |

Concerned Officer |

State: The Assistant Commissioner (ST), Alwarpet Assessment Circle, 46, Pasumpon Muthuramalingam Salai, Taluk Office Building, RA Puram, Chennai- 28. Centre: Chennai Outer, Division- Sriperumpudur. |

Nature of activity(s) (proposed / present) in respect of which advance ruling sought for |

|

A Category |

Wholesale Business |

B Description (in brief) |

The applicant is engaged in the supply of automotive components such as door locks and strikers for various sectors of the automotive industry. |

Issue/s on which advance ruling required |

Determination of liability pay tax on any goods or services or both |

Question(s) on which advance ruling is required |

1. Whether GST will be applicable on the transfer of title in moulds from applicant to Indian buyer? |

2. If yes, whether the Indian buyer would be eligible to take credit of the GST paid to the applicant for said purchase? |

Note:Any appeal against this Advance Ruling order shall lies before the Tamil Nadu State Appellate Authority for Advance Rulings, Chennai as under Sub-Section l1f of CGST Act I TNGST Act 2OL7, within 3O days from the date on the ruling sought to be appealed is communicated. At the outset, we would like to make it clear that the provisions of both the Central Goods and Service Tax Act and the Tamil Nadu Goods and Service Tax Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the same provisions under the Tamil Nadu Goods and Service Tax Act. M/s. Automative Components Technology India Private Limited , Plot No.3/39 B, Sri Nagar, Thodukkadu(Post), Mannur Kootu Road, Sriperumbudur District, Thiruvallur, Tamil Nadu-602105 (hereinafter referred to as the Applicant'or'ACTIJ is registered under GST vide GSTIN 33AANFP5828N IZM. The Applicant has sought Advance Ruling on the following questions: 1. Whether GST will be applicable on the transfer of title in moulds from applicant to Indian buyer? 2. If yes, whether the Indian buyer would be eligible to take credit of the GST paid to the applicant for said purchase? The Applicant has submitted the copy of application in Form GST ARA - 01 and also submitted copy of Challan evidencing payment of application fees of Rs.50O0/- each under Sub-rule (1) of Rule IO4 of CGST Rules 2OI7 and also SGST Rules 2077. 2.1 The applicant has stated that they are engaged in the supply of automotive components such as door locks and strikers (in short 'parts') for various sectors of the automotive industry. They supply such parts to a wide range of customers which inter - alia include moulds and tools (in short 'moulds'). They propose to enter into the below transaction- They agree to supply certain parts, including the moulds to an Indian company (in short 'Indian buyer'), located in the State of Tamil Nadu. In this regard, they place an order for manufacturing the said parts and moulds on a Thailand Company (in short 'Foreign supplier'). Accordingly, the foreign supplier manufactures the parts and the same are physically imported into India. However, the moulds developed by the foreign supplier are retained in Thailand and are not physically imported into India. Thus, there is only a transfer of ownership in the mould from the foreign supplier to Applicant and the foreign supplier retains the physical possession of the moulds. With regard to the invoicing, the foreign supplier raises an invoice on the Applicant for the parts and moulds separately. Similarly, the Applicant raises separate invoices on the Indian buyer i.e., one for the supply of parts and another for transfer of ownership of the moulds from the Applicant to the Indian buyer. The applicant has stated that in the present case as well, only the title in moulds are transferred to the Indian buyer, wherein the moulds physically continue to remain in possession of the foreign supplier. Thus, with regard to the moulds, there are two transactions involved in the present case: T1: Transfer of title in moulds from the foreign supplier to the Applicant. T2: Transfer of title in moulds from the Applicant to the Indian buyer. They have also stated that the moulds are never physically imported into India. The moulds will be disposed as waste in Thailand a.fter its usage for manufacturing the requisite parts. In the above background, with regard to T2 the Applicant is of the view that the transfer of title in moulds (without physical import of the same from Thailand) would not make the said transaction liable to GST under Section 5 of the IGST Act read with Section 7(5)(a) of Integrated Goods and Services Tax Act 2077 and thereby not required to charge IGST on the moulds sold to the Indian buyer. 2.2 As per the applicant's interpretation of law, the transaction between them and the Indian buyer for transfer of title of moulds is not liable to IGST as the same extends beyond territorial jurisdiction. In the present case, as mentioned above, the transaction results in transfer of title in the goods from the foreign supplier to ACTI and thereafter from ACTI to the Indian buyer. However the possession is retained by the foreign supplier which is permissible contractually and the Sale of 'Goods Act also recognizes that goods may be retained by the seller after the sale. To determine the nature f character of the supply as an intrastate or interstate supply it is important to determine Supplier and Place of supply Supplier. As the moulds are supplied by the Applicant to the Indian buyer, by way of transfer in title, the Applicant is said to be the 'Supplier'. With regard to place of supply, sectionl0(1)(c) would get attracted in as much as there is no movement of goods from Thailand by any of the parties to the transaction and thus the place of supply of goods would be Thailand where the goods are notionally delivered to ACTI who in turn notionally delivers the material to Indian buyer. From the above it is seen that the given transaction could get covered under the ambit of Inter- State supply under IGST Act. However, it seems that GST may not take within its fold a transaction wherein the place of supply is outside the territory of India. It thus appears that the transactions mentioned by the applicant may not fall within the purview of SGST/CGST or IGST. Also as per section of IGST Act, it extends to whole of India except state of Jammu & Kashmir and as per the definition of India under Section 2(56) of CGST Act, the transaction in the case is outside the territorial jurisdiction of IGST Act. In light of the above facts the applicant contends that the transaction would not subject to IGST. 2.3 Further, the applicant contends that the said transaction does not constitute import of goods as there is no physical movement of goods into India. Thus the transactions do not qualify as an inter-state or intra state supply of goods and would fall outside the purview of CGST/SGST/IGST. They have also stated that transaction was not taxable under the erstwhile indirect tax. Also the Parliament is empowered to formulate the principles to determine when the supply is said to be made outside the State or in the course of import or export. However, no such principles have been formulated till date for GST' 2.4 Further, the applicant has submitted that if at all tax is applicable on the transaction then input tax credit of the same should be available to the recipient of Supply as the major objective of introducing GST is to allow seamless flow of credit to the trade and Industry to make Indian Business and Indian products cost effective and competitive in international market. The applicant has stated that ITC should be applicable as per section 16(2)(b) of CGST Act 2O17. The Applicant contends that if a transaction is hold to be liable qua the supplier and not the goods or services or both, then in the same analory on the very transaction the credit of input tax needs to be allowed based on the recipient and not whether the goods or services or both had been received or not. If the transaction is deemed to be an inter-state supply and if the same is made liable to GST ' then it should be deemed that such goods have been received from perspective and the credit should accordingly be made available to him. 3.1 The applicant was extended an opportunity of personal hearing on 18.06.2019. However, theY did not appear for the hearing. The applicant was extended another opportunitY on 23.O7.2OI9 for which the applicant sought adjournment by three weeks vide their letter dated IO.O7.2OI9. The applicant was accordingly extended an opportunity of personal hearing on 28.08.2019. The authorised representative of the applicant appeared for personal hearing on 28.OB.2O 19 and furnished a written submission. They submitted the tool utilization certificate which states that the tools are used for Nissan Motors India Private limited/Renault Nissan Automative India Pvt Limited/ Renault India Pvt Limited. They stated that they will submit details of all transactions between them and the recipient in respect of the mould tools and parts involved. They also stated that they will clarify the reason for use of tools for third party. They also stated that they will send all purchase order/MOU agreements for supply of the moulds/rigs and parts manufactured out of these moulds between the applicant and the recipient. They also stated that they will submit the details of disposal of such moulds in the past and any agreements/documentation with the recipient. They further undertook to submit details of how the supply of these moulds were dealt with under Central Excise. They requested time of 3 weeks and requested for another hearing after submission of documents. In the written submissions furnished by the applicant, they had furnished: i. Sample invoice raised by the applicant for supply of tools and moulds to Nissan Motor India Pvt LId(NMIPL) ii. Declaration iii. Tool ownership certificate issued by the applicant to NMIPL iv. Pictures of name plate affixed in the tools and moulds indicating it is property of NMIPL v. Brief Submissions vi. Copy of AAR rulings, Maharashtra in r/o INA Bearings India (P) Ltd 3.2 As per the applicant request another opportunity of hearing was extended and the authorised representative was heard on 26.09.2019. The authorized representative of the applicant submitted a written submission by the applicant clarifying the question raised in the previous hearing. They also submitted purchase order for the tools in which advance ruling is sought. It was conveyed that the second question raised by the applicant which is on the availment of Input Tax Credit by the buyer cannot be answered as not in the purview of Advance Ruling. 3.3 In the written submissions. it is stated as follows:

M/ s. Nissan Motors India Pvt Ltd[in short NMIPL]had placed an order for the manufacture of tool/mold basis which the applicant has placed an order for manufacturing the same with MSC Thailand

The ‘Tool Ownership Certificate’ is issued by the applicant on NMIPL as transfer of title in ownership of tools on payment of consideration. The tools shall be property of NMIPL only

NMIPL have allowed utilization of tool/ mould for manufacturing parts which are commonly used among vehicles manufactured by NMIPL, Renault Nissan Automative India Pvt Ltd, Renault India Pvt Ltd. Thus, the ‘Tool Ownership Certificate’ states that the tools shall be used exclusively for production of parts for NMIPL/ RNAIPL/ RIPL

There is no supply of mould by the applicant to RNAIPL or RIPL in the transaction. The mould shall be the exclusive property of NMIPL.

No such taxable event had occurred in the VAT/ excise regime and thus no invoices/ documents were raised by the applicant

The cost of the mould has not been amortized in the present transaction. The price of the manufactured mould /tools has been received by the applicant by raising a separate invoice

The mould /tool shall be disposed off in the premises of MSC Thailand as may be agreed in the future and no consideration shall be received by the applicant nor NMIPL after the lifecycle of the mould/tool as it attributes no value.

The agreement is not traceable by the applicant nor NMIPL due to change in the management and the earlier staff members are not currently employed with the applicant and NMIPL. However, there are no changes in the modu s of transaction as evident from the documents viz., Purchase Order, Invoice, tool ownership certificate, etc. 4. The applicant is under the administrative control of State. The said jurisdictional authority was addressed to report if there are any pending proceedings in the applicant's case on the issues raised by the applicant in the ARA application and for comments on the issues raised. The said authority did not furnish any report and also has not furnished any comments. Hence, it is construed that there is no proceedings pending in the case of the applicant on the questions seeking Advance Ruling before us. 5.1 We have carefully considered the various submissions made by the applicant. We find that the applicant is engaged in the supply of automotive components. They have stated that they agree to supply certain parts, including moulds to Indian Company located in the State of TamilNadu, for which they place an order for manufacturing the said parts and moulds on a Thailand Company. The parts manufactured are physically imported, while the moulds developed are retained in Thailand and are not physically imported into India, but the ownership in the mould is transferred from the foreign supplier to the Applicant and from the applicant to the Indian buyer by raising of separate invoices. In view of the above the applicant has raised the following questions: 1. Whether GST will be applicable on the transfer of title in moulds from applicant to Indian buyer? 2. If yes, whether the Indian buyer would be eligible to take credit of the GST paid to the applicant for said purchase? 5.2 The definition of 'advance Ruling'under section 95(a) of CGST/TNGST Act is given below for ease of reference, (a) "aduance ruling" means a decision prouided bg the Authoitg or the Appellate Authoitg to an applicant on matters or on questions specified in sub-section (2) of section 97 or sub-section (1) of section 1OO, in relation to the supplg of goods or seruices or both being undertaken or proposed to be undertaken bg the applicant; Section 97(2) of the CGST Act / Tamil Nadu GST Act (TNGST) gives the scope of Advance Ruling Authority, i.e., the question on which the Advance Ruling can be sought. For ease of reference, the section is reproduced as under: 97 (2) The question on which the aduance ruling is sought under this Act, shall be in respect of- (a) classification of any goods or seruices or both; (b) applicabilitg of a notification issued under the prouisions of this Act; (c) determination of time and ualue of supply of goods or seruices or both; (d) admissibility of input tax credit of tax paid or deemed to haue been paid; (e) determination of ttrc liability to pag tax on any goods or seruices or both; (f) whether applicant is required to be registered; (g) whether anA particular thing done by the applicant with respect to ang goods or seruices or both amounts to or results in a supplg of goods or seruices or both, within the meaning of that term. The Act limits the Advance Ruling Authority to decide the issues earmarked for it under Section 97(2) and no other issue can be decided by the Advance Ruling Authority. Of the above questions on which ruling is sought by the applicant, the question at (21 relates to eligibility to credit of tax paid by them at their buyers'end. The eligibility to credit of input tax paid by the applicant alone is covered under clause (d) of Section 97(2) above and the eligibility at the buyers' hand when raised by an applicant do not fall under any of the category specified under Section 97(2) of the Act and therefore not within the ambit of this authority. This position was explained during the personal hearing also. The First Question relating to whether GST is applicable on a transaction is within the ambit of this authority and is taken up for consideration. 6.1 In the case at hand, the applicant is undertaking two transactions- T1: Transfer of title in moulds from the foreign supplier to the Applicant T2: Transfer of title in moulds from the applicant to the Indian buyer. The question raised by the applicant is with respect to transaction at T2 above. It is stated that the moulds manufactured by the foreign supplier is not physically imported and only the title in the moulds are transferred from the foreign supplier to the applicant and thereupon by the applicant to the vendor located in India. The applicant on his interpretation of law has stated that on application of Section 10 (1)(c ) of IGST Act 2Ol7 , the place of supply is Thailand and the supplier is in India, therefore the supply could get covered under the ambit of Inter-State Supply in terms of IGST Act, but IGST levy can be imposed only to supplies within the territorial jurisdiction of the IGST Act. The applicant has stated that the supply in the case at hand takes place outside the territorial jurisdiction of IGST Act and thereby not subject to IGST and has sought to clarify the applicability of GST in the said transaction. 6.2 From the Amendment for Vendor Tooling PO for NMIPL/2O12/K2/IEVT/92 dated 18tt' December 2074 furnished by the applicant, it is seen that Order is placed with the conditions that the Tools mentioned under the PO are 1-OOo/" property of Nissan Motors India Pvt. Ltd; Ordered Tools must be maintained under good condition during production; supplier has to submit the Tool Ownership certificate with clear Tool location; Supplier has to submit the digital Photograph of the actual Tool along-with the tool Ownership Letter; etc.. From the 'Declaration' dated 16.03.2019, related to transfer of Tool Ownership by the applicant to their vendor, it is seen that the declaration is against Invoice no. 201364 dated 16.03.2019 raised on the vendor. Also, it is seen from the 'Tool Ownership Certificate'dated 16.03.2009, with reference to the PO NMIPL/2012/K2/LEVT/92' 001 dated 18t'December 2014, the certificate lists the part number, description of Tools, Location of Tools, etc. Further, in the declaration and in the ToolOwnership Certifacte', it is stated that the moulds and tools shall upon completion of the cycle life of the moulds be disposed off in the premises of such parts manufacturer as maybe agreed in the future between the parties/ approval of Nissan Motors India Pvt Ltd. The applicant has not furnished the agreement between the parties stating that the same is not traceable and has further stated that the modus of transaction is evidenced from the Purchase Order, Invoice, Tool Ownership Certificate, etc described above. From the documents and averments of the applicant, the transaction involved requiring the clarification by the applicant is that the title in the moulds got manufactured by the applicant are transferred to the applicant and thereupon to the applicants' vendor by way of declaration and against invoice indicating the consideration for the moulds. The moulds/tools remains with the manufacturer for manufacturing the parts, i.e., the moulds are supplied free of cost to the parts manufacturer and it is stated that the cost of the moulds are not amortised in the parts cost. 6.3 Having seen the factual position, the relevant statutory provisions are examined as under. Supply is defined under Section 7 of the CGST Act 2Ol7 and the same is reproduced below for reference: 7. (1) For the purposes of this Act, the expression "supplg" includes- (a) all forms of supplg of goods or seruices or both such as sale, transfer, barter, exchange, Iicence, rental, lease or disposal made or agreed to be made for a consideration bg a person in the course or furtherance of business; (b) import of seruices for a consideration uthether or not in the course or furtherance of business; and (c) the actiuities specified in Schedule I, made or agreed to be made without a consideration; (1A) where certain actiuities or transactions constitute a supplg in accordance with the prouisions of sub-section (1), theg shall be treated either as supplg of goods or supplg of seruices as referred to in Schedule II.; Schedule II determines the list of activities to be considered as supply of goods/Services and entry Sl.No. 1 is as follows: 1. Transfer (a) ang transfer of the title in goods is a supply of goods; From the above, it is evident that 'transfer of the title in goods' is supply of goods. In the case at hand there is transfer in title of moulds for a consideration and the supply is in the course of business therefore, the same constitutes supply of goods and GST is liable to be paid on such supply. 7. In view of the above, we rule as under: Ruling 1. GST is applicable on the transfer of title in moulds from the applicant to the India buyer 2. The question is not answered as the same is not in the ambit of this authority as per Section 97(21 of the Act. Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.