Consultation Paper on the introduction of provisions relating to appointment/reappointment of persons who fail to get elected as Whole-time directors / Managing Directors at the general meeting of a listed entity

Table of Contents

- Consultation Paper on the introduction of provisions relating to appointment/reappointment of persons who fail to get elected as Whole-time directors / Managing Directors at the general meeting of a listed entity

- 1. Objective

- 2. Extant legal provisions on appointment and re-appointment of directors of a listed entity

- 3. Need for introducing provisions relating to appointment / re-appointment of persons who failed to get elected as Whole-time Directors / Managing Directors at the general meeting of a listed entity:

- 4. Proposal:

- 5. Public Comments:

Consultation Paper on the introduction of provisions relating to appointment/reappointment of persons who fail to get elected as Whole-time directors / Managing Directors at the general meeting of a listed entity

1. Objective

To solicit public comments/views on the proposal to introduce provisions in the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (hereinafter referred to as “LODR Regulations” or “LODR”), relating to appointment/reappointment of persons who fail to get elected as Whole-time Directors/Managing Directors at the general meeting of a listed entity.

2. Extant legal provisions on appointment and re-appointment of directors of a listed entity

2.1. As per Section 152 of the Companies Act, 2013 (CA 2013), every director shall be appointed by the company in a general meeting.

2.2. As per Section 196 of the CA 2013, a managing director, whole-time director, or manager shall be appointed and the terms and conditions of such appointment and remuneration payable are approved by the board of directors at a meeting which shall be subject to approval by a resolution at the next general meeting of the company.

2.3. Appointment and re-appointment of a director (except independent directors) is through an ordinary resolution except in certain cases where the age and/or remuneration payable to such directors is above thresholds fixed in the CA 2013 or the LODR Regulations.

3. Need for introducing provisions relating to appointment / re-appointment of persons who failed to get elected as Whole-time Directors / Managing Directors at the general meeting of a listed entity:

3.1.It is seen that as a practice, companies appoint persons as Managing Directors / Whole-Time directors, by way of seeking approval from shareholders through two different resolutions – one for the appointment of such persons as a director (under section 152) and the second for the appointment of such directors as Managing Director (MD) or Whole-time Director (WTD) along with terms and conditions for their appointment (under sections 196, 197 and 198)

3.2.In case of two different resolutions, there is a possibility of the ordinary resolution for appointment as a director being approved by the shareholders and the second resolution, which could be a special resolution, for designating such appointed directors as WTD / MD along with terms & conditions, including remuneration, being rejected by the shareholders.

3.3. As per Section 161(1) of the CA 2013, the board cannot appoint a person who fails to get elected as a director at a general meeting as an additional director. However, the CA 2013 does not explicitly prohibit the board from re-appointing a person as a MD or WTD, whose appointment to such posts was rejected by the shareholders at the general meeting. Further, the board of a listed entity can continue to appoint such persons as WTD / MD even after subsequent rejections by the shareholders.

3.4. Such appointments by the boards are against the will of the shareholders, who are entrusted by law to approve the appointment of directors to the boards of companies, and also against the spirit of Corporate Governance as envisaged under the LODR Regulations.

3.5. With increased shareholder awareness, rejection of appointment/reappointment of directors by shareholders at general meetings and the possibility of appointment of such directors, as stated above, by listed entities cannot be ruled out. Therefore, a need has been felt for a policy intervention to include specific provisions in the LODR Regulations to deal with such circumstances.

4. Proposal:

4.1.In order to ensure shareholder supremacy in matters of appointment of directors, amendments to the LODR Regulations on the following lines are proposed:

“A person whose appointment or re-appointment as a Managing Director or Whole-time Director has been rejected by the shareholders of a listed entity shall not be appointed again as Managing Director or Whole-time Director, unless the following conditions are satisfied:

a) Its Nomination and Remuneration Committee has recommended such appointment with detailed justification as to why such appointment, despite rejection by shareholders, is recommended;

b) The board has considered and approved the appointment after recording reasons for such appointment despite rejection by shareholders earlier;

The listed entity shall take the following steps after appointment of such directors to the board:

a) The reasons for such appointments to the board shall be disclosed to Stock Exchanges within 24 hours along with the recommendations of the Nomination and Remuneration Committee;

b) Shareholder approval for such appointments shall be obtained in the immediate next general meeting or within three months from the date of appointment by the board, whichever is earlier;

c) The explanatory statement to the Notice to the shareholders for considering the appointment of the director shall contain a detailed explanation and recommendation from the NRC and the board as to why such appointment is placed before the shareholders despite the rejection of the candidature earlier by the shareholders.

In case the shareholders reject the candidature of the persons again, such persons cannot be considered for appointment as director, or continue as a director of that particular listed entity, for a period of two years from the date of rejection by the shareholders”.

4.2.The proposal mentioned above was placed before the Primary Market Advisory Committee (PMAC) of SEBI for consideration. After deliberation, the PMAC has suggested wider deliberation on the proposed changes by way of public consultation.

5. Public Comments:

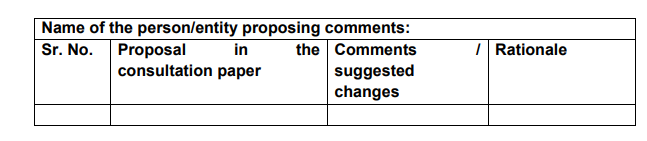

5.1.In view of the above, to take into consideration the views of various stakeholders, public comments are invited on the proposal mentioned in para 4.1 above. Comments may be sent by email, to the addresses given below, in the following format:

5.2.The comments may be sent to Ms. Amy Durga Menon, Deputy General Manager, at amydurga@sebi.gov.in, and to Mr. Rajendran. S, Assistant Manager, at rajendrans@sebi.gov.in, no later than February 12, 2021.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.