Exemption in GST#1 Charitable activities in GST

Whether charitable activities are a business?

The charitable activities are not leviable to tax. But this is important that the activities should be charitable in real. The first test to decide upon is whether the activities of the entity will fall in definition of business or not. The term business is defined in section 2(17) of CGST Act 2017. It includes any trade, commerce, manufacture, profession, vocation, adventure, wager or any other similar activity, whether or not it is for a pecuniary benefit. Any activity should not be one of these to get out of business definition. It will be a business even if any of these activity is done without a peculiar benefit.

Exemptions for charitable activities even if they are business:

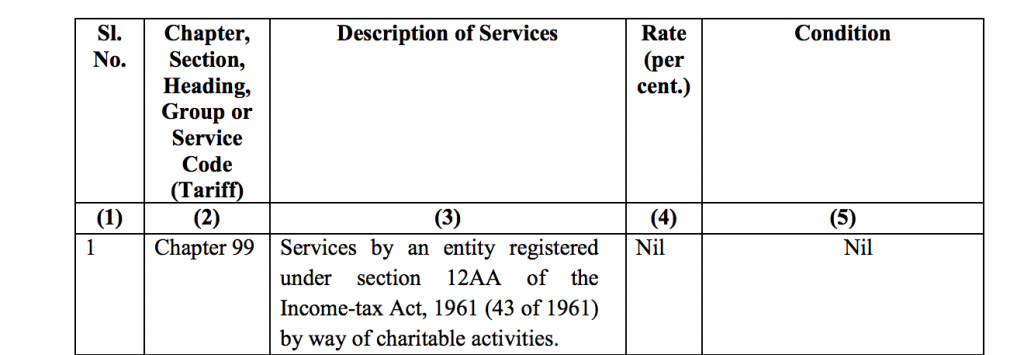

Charitable institution in 12AA of Income Tax Act 1961 are covered by entry 1 of 12/2017(CTR). The entry reads as:

Following four entries covers the exemption for the charitable activities or entities.

| Entry No. | Coverage |

| 1 | Exemption for charitable activities done by 12AA registered entities. |

| 13 | Religious ceremony or renting of rooms or shop in religious place . |

| 80 | Services of training or coaching related to art, culture or sports |

Entry no 1 of 12/2017 for charitable institutions registered in 12AA:

Charitable activities

Meaning of charitable activity:

This entry covers the institutions registered in income tax as a charitable institution. They enjoy exemption from tax under income tax Act. Here in GST they are allowed to have an exemption from GST in case they are engaged in charitable activity. This term is not defined in CGST Act. It is defined in notification no. 12/2017 CTR itself. Para 2r of notification no. 12/2017 defines the charitable activities as follows.

“(r) “charitable activities” means activities relating to – (i) public health by way of, –

(A) care or counselling of (I) terminally ill persons or persons with severe physical or mental disability; (II) persons afflicted with HIV or AIDS; (III) persons addicted to a dependence-forming substance such as narcotics drugs or alcohol; or

(B) public awareness of preventive health, family planning or prevention of HIV infection;

(ii) advancement of religion , spirituality or yoga;

(iii) advancement of educational programmes or skill development relating to,-

(A) abandoned, orphaned or homeless children;

(B) physically or mentally abused and traumatized persons;

(C) prisoners; or

(D) persons over the age of 65 years residing in a rural area;

(iv) preservation of environment including watershed, forests and wildlife; “

Only 4 activities are covered in this definition.

As you can see in above definition only three major activities are covered in Charitable activities. Although in income tax the definition of charitable activities is very wide.

If we summarise the above activities only the following activities will fall in charitable activities.

- Public health

- Advancement of religion , spirituality or yoga

- Advancement of educational programmes or skill development relating to

- Preservation of environment including watershed, forests and wildlife

Related Topic:

Serviced apartments are also eligible for exemption under 12/2017

This is very narrowed down version of charitable activities. Many charitable activities will not fall under above definition.

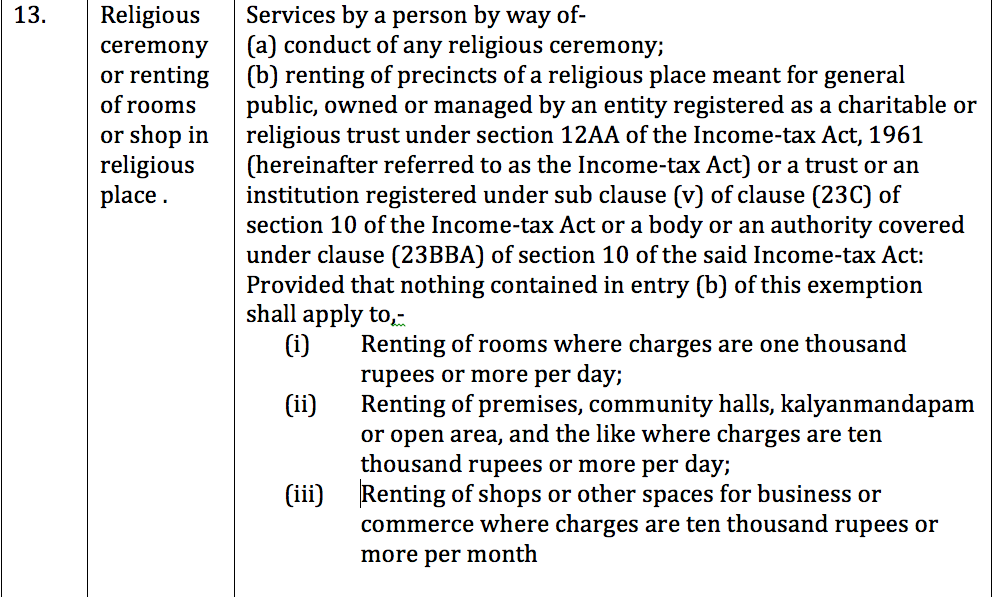

Entry no. 13 of 12/2017: religious ceremony or renting of religious place:

This entry includes the following:

- Conduct of any religious ceremony by any entity.

- Renting of a religious place by following sub to a limit of room charges Rs. 1000 per day, hall charges upto Rs. 10,000 per day and renting of shop upto Rs. 10,000 per month.

- Entity registered in 12AA of income tax Act.

- A trust

- An institution registered u/s 10(23C)(V)

- An authority covered u/s 10(23BBA)

Any renting other than above will be taxable under GST

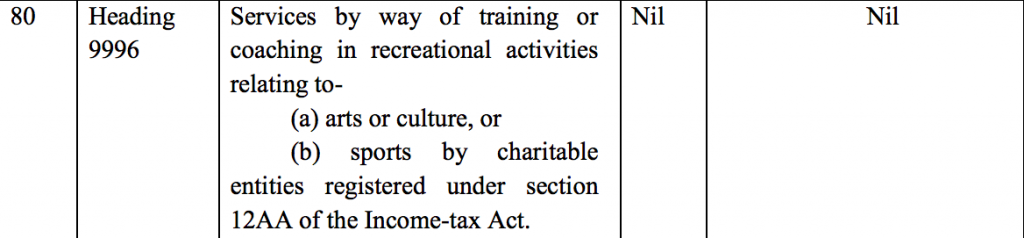

Entry No. 80 of 12/2017: Training or coaching of art, culture, sport:

In this entry Services by way of training or coaching in recreational activities related to

- Arts and culture

- Sports by charitable entities registered u/s 12AA

Most of the terms used in this entry are not defined anywhere in law.

Author can be connected at this email shaifaly.ca@gmail.com

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.