GST ON RENT A CAB

GST ON RENT A CAB

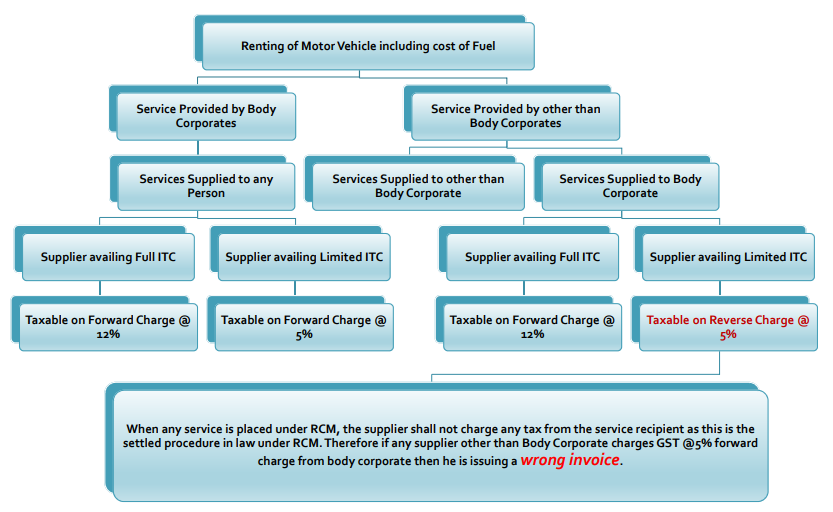

Vide Notification 22/2019 dated 30.09.2019 Rent a cab become under RCM where Any person other than a body corporate, paying central tax at the rate of 5% on renting of motor vehicles with a limited input tax credit.

But Vide Notification 29/2019 dated 31.12.2019 Rent a Cab still under RCM but RCM applies where Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 12% to the service recipient.

That means:

(i) Where the supplier of the service charges GST @ 12% from the service recipient, the service recipient shall not be liable to pay GST under RCM; and,

(ii) Where the supplier of the service doesn’t charge GST @ 12% from the service recipient, the service recipient shall be liable to pay GST under RCM.

When any service is placed under RCM, the supplier shall not charge any tax from the service recipient as this is the settled procedure in law under RCM. Therefore if any supplier other than Body Corporate charges GST @5% forward charge from body corporate then he is issuing a wrong invoice.

Circular No. 130/2019 dated 31.12.2019 also clarifies that notification 29/2019 is merely clarificatory in nature and therefore for the period 01.10.2019 to 31.12.2019 notification 29/2019 applies.

Related Topic:

OUTPUT OUTCOME FRAMEWORK 2020-21

Download the copy:

CA HIMANSHU SINGHAL

CA HIMANSHU SINGHAL