GST Valuation rules released by GSTIN

GST Valuation rules released

GST Valuation rules are released. These rules contains the provisions for determination of value of a supply in various scenarios.

The major provisions covered in GST valuation rules are:

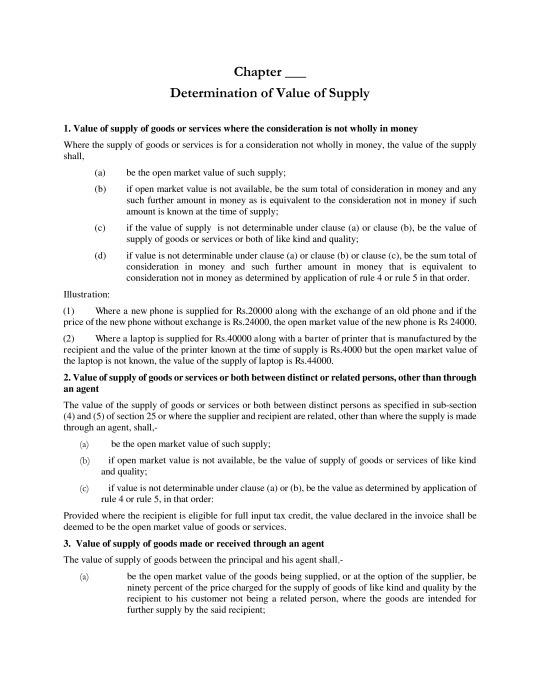

- Valueof supply of goods or services where the consideration is not wholly in money

- Value of supply of goods or services or both between distinct or related persons, other than through an agent

- Valueofsupply of goods made or received through an agent

- Value of supply of goods or services or both based on cost

- Residual method for determination of value of supply of goods or services or both

- Determination of value in respect of certain supplies

- Value of supply of services in case of pure agent

- Rate of exchange of currency, other than Indian rupees, for determination of value

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.