GSTR-3B and GSTR-1 Compliance Calendar for Period February to May 2020

Table of Contents

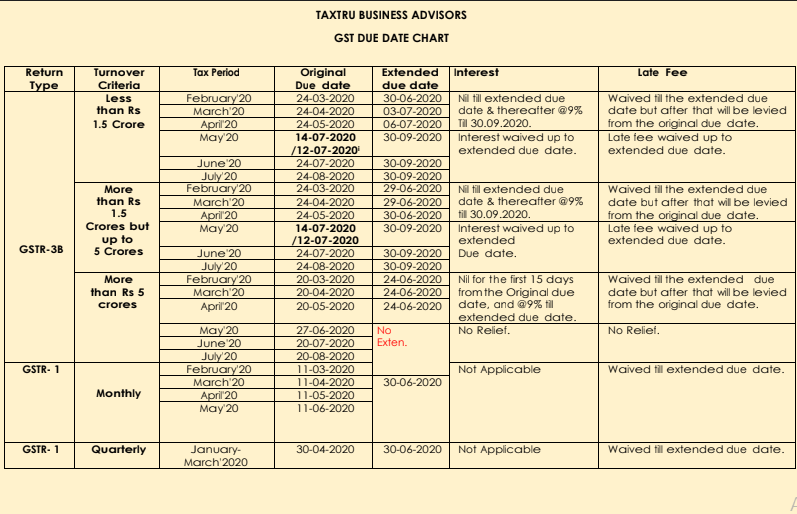

GST Due Date Chart

| Return

Type |

Turnover

Criteria |

Tax Period | Original

Due date |

Extended

due date |

Interest | Late Fee |

| GSTR-3B | Less

than Rs 1.5 Crore |

February’20 | 24-03-2020 | 30-06-2020 | Nil till extended due

date & thereafter @9% Till 30.09.2020. |

Waived till the extended due

date but after that will be levied from the original due date. |

| March’20 | 24-04-2020 | 03-07-2020 | ||||

| April’20 | 24-05-2020 | 06-07-2020 | ||||

| May’20 | 14-07-2020

/12-07-2020 |

30-09-2020 | Interest waived up to

extended due date. |

Late fee waived up to

extended due date. |

||

| June’20 | 24-07-2020 | 30-09-2020 | ||||

| July’20 | 24-08-2020 | 30-09-2020 | ||||

| More

than Rs 1.5 Crores but up to 5 Crores |

February’20 | 24-03-2020 | 29-06-2020 | Nil till extended due

date & thereafter @9% till 30.09.2020. |

Waived till the extended due

date but after that will be levied from the original due date. |

|

| March’20 | 24-04-2020 | 29-06-2020 | ||||

| April’20 | 24-05-2020 | 30-06-2020 | ||||

| May’20 | 14-07-2020

/12-07-2020 |

30-09-2020 | Interest waived up to

extended Due date. |

Late fee waived up to

extended due date. |

||

| June’20 | 24-07-2020 | 30-09-2020 | ||||

| July’20 | 24-08-2020 | 30-09-2020 | ||||

| More

than Rs 5 crores |

February’20 | 20-03-2020 | 24-06-2020 | Nil for the first 15 days

From the Original due date, and @9% till extended due date. |

Waived till the extended due

date but after that will be levied from the original due date. |

|

| March’20 | 20-04-2020 | 24-06-2020 | ||||

| April’20 | 20-05-2020 | 24-06-2020 | ||||

| May’20 | 27-06-2020 | No

Extention |

No Relief. | No Relief. | ||

| June’20 | 20-07-2020 | |||||

| July’20 | 20-08-2020 | |||||

| GSTR- 1 | Monthly | February’20 | 11-03-2020 |

Not Applicable |

Waived till extended due date. |

|

| March’20 | 11-04-2020 | 30-06-2020 | ||||

| April’20 | 11-05-2020 | |||||

| May’20 | 11-06-2020 | |||||

| Quarterly | Quarterly | January-

March’2020 |

30-04-2020 | 30-06-2020 | Not Applicable | Waived till extended due date. |

A Note On “Waiver of Late Fees For GSTR-3B”

The Late fees on late filing of GSTR 3B for the period July 2017 to January 2020 has been waived fully for returns having no tax liability. For cases where there is any tax liability in the return, the maximum late fees would be Rs. 500. The benefit of the reduced late fee would be applicable only for returns which are furnished between 01 July 2020 to 30 September 2020.

Our View:-

- It is to be noted that the relief in late fees is only for GSTR-3B and not for GSTR 1.

- The benefit is available only if returns are filed between 01 July 2020 to 30 September 2020. The benefit is available to all taxpayers.

- Section 47 of the Central Goods and Services Act, 2017 provides that late fees of Rs. 100 per day would be applicable for the late filing of return mentioned under Section 39 of the CGST Act.

(This is subject to a maximum cap of Rs 5,000)

- However, in terms of Notification, No 76/2018 dated 31-12-2018 where tax payable in GSTR 3B is nil, late fees of Rs 10 per day are levied and in other cases, it is Rs 25 per day.

A similar notification is notified under the respective State GST laws.

A. GST council’s decision to waive the late fee for assesses who have not filed any of their GST returns from July 2017 till March 2020 has raised several eyebrows as well. As the waiver has been given with the condition that such return should be filed between July 1st till September 30th, 2020, huge resentment is being witnessed amongst those assesses who have already paid huge penalties and filed their delayed GST returns.

B. Such taxpayers are now seeking refunds of the late fees paid by them citing the reason that this is an injustice to them. Several tax professionals too are of the view that the waiver of late fee should be extended to the taxpayers who already paid these.

C. In our view, the government and the council will take necessary and fair decisions regarding this matter at the earliest.

Related Topic:

GST Returns Due Dates for GTSR 1 and GSTR 3b

Read the copy: