GSTR-4

Table of Contents

GSTR-4

Form GSTR-4 (Annual Return) is a yearly return to be filed by taxpayers opting for composition scheme on an annual basis. Unlike a normal taxpayer who needs to furnish three monthly returns, a dealer opting for the composition scheme is required to furnish only one return.

Previously this return was filled every quarter, but with effect from FY2019-20 CMP-08 replaced Quarterly GSTR-4, in turn, GSTR-4 is now required to be filed annually.

CMP-08 – Form CMP-08 is a special statement-cum-challan to declare the details or summary of his/her self-assessed tax payable for a given quarter filled by taxpayer opting Composition Scheme.

Due date to file Form CMP-08 is on or before the 18th of the month succeeding the quarter of a Financial Year.

Late Fee – In case of any delay of filing Form CMP-08 taxpayer is liable to late fees of Rs.200 per day for every day of delay[Subject to a maximum of Rs.5000]. i.e. Rs 100 per day under CGST and Rs 100 per day under SGST.

What is the Due Date to file GSTR-4?

Form GSTR-4 has to be filed on an annual basis. The due date for filing GSTR 4 is 30th April following the relevant financial year. [NOTE- The due date to file GSTR-4 (Annual Return) for FY 2019-20 has been extended to 31st August

2020]

Example:- GSTR-4 for FY 2019-20 should be filed by 30th April 2020.

Who should file GSTR- 4?

A taxpayer who has opted for Composition Scheme/special composition scheme[Notified for the Service provider vide the CGST (Rate) notification number 2/2019 dated 7-03-2019] is required to File Form GSTR-4.

GSTR-4 Table Summary

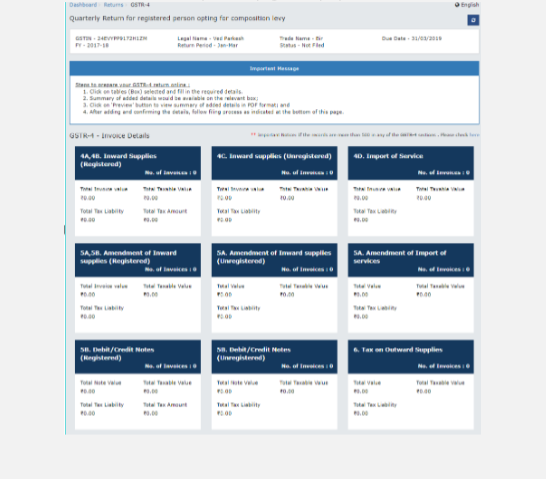

Table 4B & 4B → Inward Supplies (Registered)

To add details of inward supplies received from a registered supplier (with or without reverse charge)

Table 4C → Inward Supplies (Unregistered)

To add details of inward supplies received from an unregistered supplier

Table 4D → Import of Service

To add details of import of service

Table 5A,5B. → Amendment of Inward supplies (Registered)

To add amendment details of inward supplies received from a registered supplier (with or without reverse charge)

Table 5A → Amendment of Inward supplies (Unregistered)

to add amendment details of inward supplies received from an unregistered supplier

Table 5A → Amendment of Import of services

To add amendment details of import of service

Table 5B → Debit/Credit Notes (Registered)

To add details of credit or debit notes issued/ received to/from the registered recipients

Table 5B → Debit/Credit Notes (Unregistered)

To add details of credit or debit notes issued to the unregistered recipients

Table 6 → Tax on Outward Supplies

To add details of tax on outward supplies made (Net of advance and goods returned)

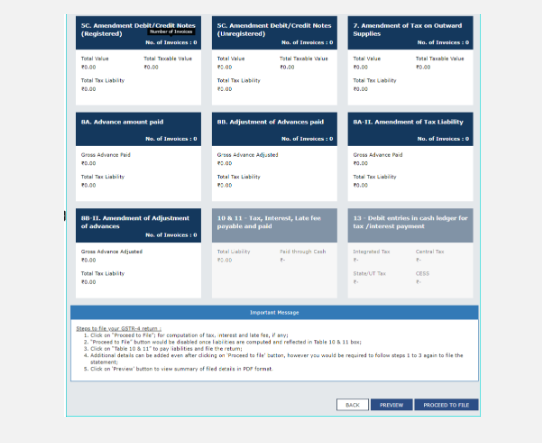

Table 5C →Amendment Debit/Credit Notes (Registered)

To add amendment details of credit or debit notes issued/received to/from the registered recipients

Table 5C → Amendment Debit/Credit Notes (Unregistered)

To add amendment details of credit or debit notes issued to the unregistered recipients

Table 7 → Amendment of Tax on Outward Supplies

To add amendment details of tax on outward supplies made (Net of advance and goods returned)

Table 8A → Advance amount paid

To add details of advance amount paid for reverse charge supplies in the tax

Table 8B → Adjustment of Advances paid

To add details of advance amount on which tax was paid in the earlier period but the invoice has been received in the current period

Table 8A-II → Amendment of Tax Liability

: To add details of amendment of advance amount paid for reverse charge supplies in the tax period

Table 8B-ii → Amendment of Adjustment of advances

: To add amendment details of advance amount on which tax was paid in an earlier period but an invoice has been received in the current period

GSTR-4 Filing Process

1. Login to your dashboard, click on Services >Returns >Annual Return>Select FY>Search>GSTR 4>Prepare online.

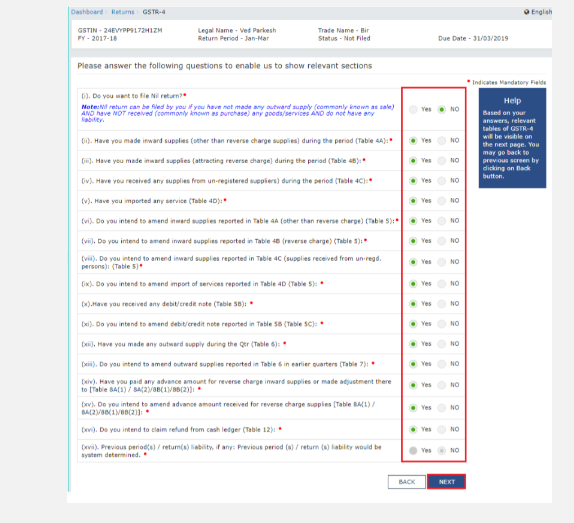

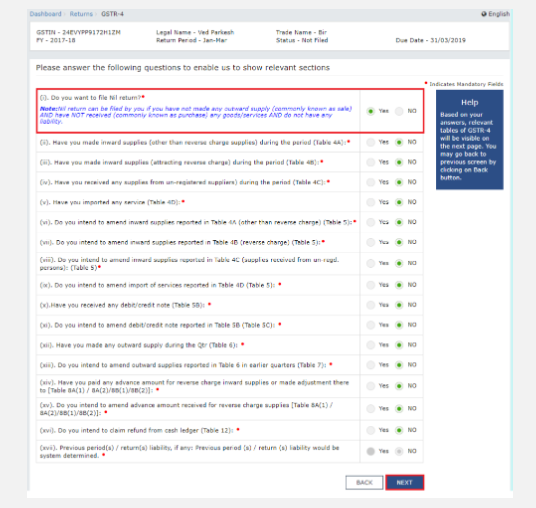

2. A list of questions is displayed. You need to answer all the questions to

show the relevant sections applicable to you.

3. Click the NEXT button. Based on your answers, relevant tables of GSTR-4 will only be visible here. You may go back to the previous screen by clicking on the BACK button.

The GSTR-4 – Quarterly Return page is displayed.

To File Nil Return [ can be filed only if there is no outward or inward supply & no tax liability, ]

Select Yes for option (i).

Submit & Verify Return via OTP or DSC.

NOTE: After Filing GSTR-4 it cannot be Revised.

Late Fees & Penalty

A late fee of Rs. 200 per day is levied if the GSTR-4 is not filed within the due date.

The maximum late fee that can be charged cannot exceed Rs. 5,000.