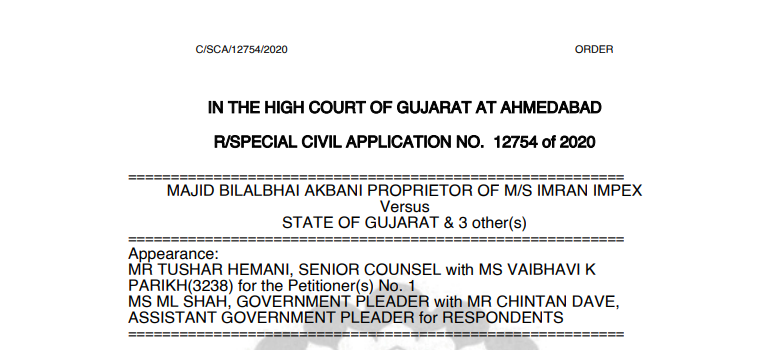

Gujarat HC in the case of Majid Bilalbhai Akbani Proprietor of M/s Imran Impex

Table of Contents

Case Covered:

Majid Bilalbhai Akbani Proprietor of M/s Imran Impex

Versus

State of Gujarat

Facts of the Case:

By this writ application under Article 226 of the Constitution of India, the writ applicant has prayed for the following reliefs:

“(a) to allow the present writ petition;

(b) to quash and set aside the Order of Detention under Section 129(1) of the CGST Act dated 02/10/2020 (Annexure-” A”) issued by Respondent No.4;

(c) to quash and set aside the Show Cause Notice under Section 130 of the CGST Act dated 02/10/2020 (Annexure-“A1”) issued by Respondent No. 4;

(d) pending the hearing and final disposal of this petition, to stay the implementation and operation of the Order of Detention under Section 129(1) of the CGST Act dated 02/10/2020 at Annexure “A” to this petition;

(e) pending the hearing and final disposal of this petition, to stay the implementation and operation of the Show Cause Notice under Section 130 of the CGST Act dated 02/10/2020 at Annexure “Al” to this petition;

(f) pending the admission, hearing, and final disposal of this petition, direct the Respondents to release the Conveyance bearing number GJ-04-X-8194 without payment of tax and penalty;

(g) pending the admission, hearing, and final disposal of this petition, to direct the Respondents to release the Goods worth Rs. 8,99,160/- without payment of tax and penalty;

(h) pending the admission, hearing, and final disposal of this petition, to direct the Respondents to release the Goods worth Io Rs. 8,99,160/- along with the Conveyance bearing number GJ-04-X-8194 without payment of tax and penalty;

(i) any other and further relief deemed just and proper be granted in the interest of justice;

(j) To provide for the cost of this petition.”

Observations of the Court:

Having heard the learned counsel appearing for the parties and having gone through the materials on record, we are of the view that we should not interfere at this stage of show cause notice as the inquiry is in progress. However, considering the fact that when the vehicle was intercepted, the driver was able to produce a valid E-way bill and also the invoice, at least, the goods and the conveyance should be ordered to be released subject to the final outcome of the confiscation.

The Decision of the Court:

We do not propose to observe anything further as the same may cause prejudice to either of the parties. We dispose of this writ application with a direction to respondent No.2 to release the vehicle and the goods after obtaining a bond of Rs.11,73,480/- from the writ applicant. The inquiry with respect to Form GST MOV-10 shall proceed further in accordance with the law.

With the above, this writ application stands partly allowed.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.