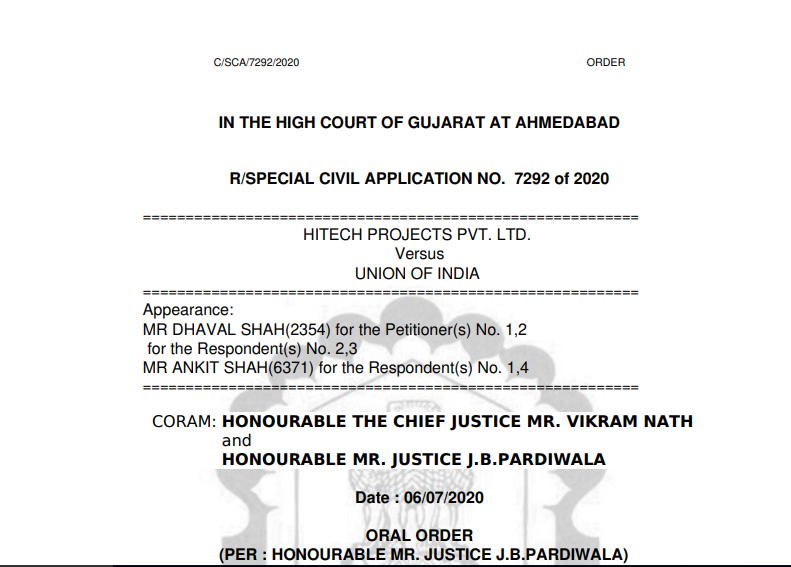

Gujarat HC in the case of Hitech Projects Pvt. Ltd. Versus Union of India

Table of Contents

Case Covered:

Hitech Projects Pvt. Ltd.

Versus

Union of India

Facts of the Case:

The writ applicant No.1 is a company engaged in the work of civil construction since 1996-97. It appears from the materials on the record that a show-cause notice No.V.38/15-54/OA/2016 dated 02.05.2016 was served upon the writ applicants calling upon them to show cause as to why the Central Excise duty amounting to Rs.27,57,942/- for the period between April 2011 and 31.12.2015 should not be recovered under Section 11A(4) of the Central Excise Act, 1944. In other words, the writ applicants were called upon to show cause as to why the RMC falling under the Central Excise Tariff Heading 38245010 should not be demanded and recovered with interest. The writ applicants were also called upon to show cause as to why the excisable goods valued at Rs.15,05,92,859/- should not be confiscated under Rule 25(2) of the Central Excise Rules, 2002 and why the penalty under Rule 25(1) Rules, 2002 read with Section 11AC(1)(c) of the Act, 1944 should not be imposed.

The above-referred show-cause notice also proposed to impose a penalty on one of the partners of the firm viz. Shri Tejas Dalal under Rule 26 of the Rules.

Observations of the Court:

Having heard the learned counsel appearing for the parties and having gone through the materials on record, we are of the view that the writ applicants could not be said to have got a fair opportunity of hearing before the concerned respondent. We are at one with Mr. Dhaval Shah, the learned counsel appearing for the writ applicants that the concerned respondent could not have fixed the personal hearing during the period of lockdown. We are of the view that one opportunity should be given to the writ applicants to put forward their case before the concerned respondent in person.

We do not propose to go into the merits of the various issues raised as regards the claim to avail the benefit under the Scheme. We are of the view that all the relevant aspects of the matter should be explained by the writ applicants before the concerned respondent in person.

The judgement of the Court:

As the result, the impugned communication in Form SVLDRS-3 is hereby quashed and set aside. The matter is remitted to the respondent No.3 herein i.e. the Designated Committee, Ahmedabad-South for fresh hearing on the issues in question. The respondent No.3 shall fix a particular date of personal hearing and intimate the same in writing to the writ applicants. The writ applicants upon receipt of such intimation shall appear before the respondent No.3 and make their submissions. Thereafter, the respondent No.3 shall pass a fresh order in accordance with the law.

Let this entire exercise be undertaken at the earliest and shall be completed in any case within a period of six weeks from the date of the receipt of the writ of this order. We are conscious of the fact that the time period to make the deposit of the requisite amount for the purpose of availing the benefit under The Scheme came to an end on 30.06.2020. The stance of the writ applicants is that they have made the requisite payment towards the deposit, whereas, the stance of the Department is that the amount has not been deposited. Ultimately, it is for the Department to verify from the records available with them as regards the amount deposited by the writ applicants way back in 2015-16. In the event ultimately if some amount has to be deposited, then despite the time limit having expired the Department shall accept the payment in view of the fact that this litigation was pending before this Court.

With the aforesaid directions, this writ application stands disposed of.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.