Instructions for Annual return for Composition Dealer

Instructions for Annual return for Composition Dealer

On 4th September 2018, Notification No. 39/2018 was issued in which the Format of Form GSTR-9A was published. It also contains the Instructions for filing and filling the Form GSTR-9A.

Following are the Instructions for filing the Annual Return for Composition Dealer GSTR-9A:

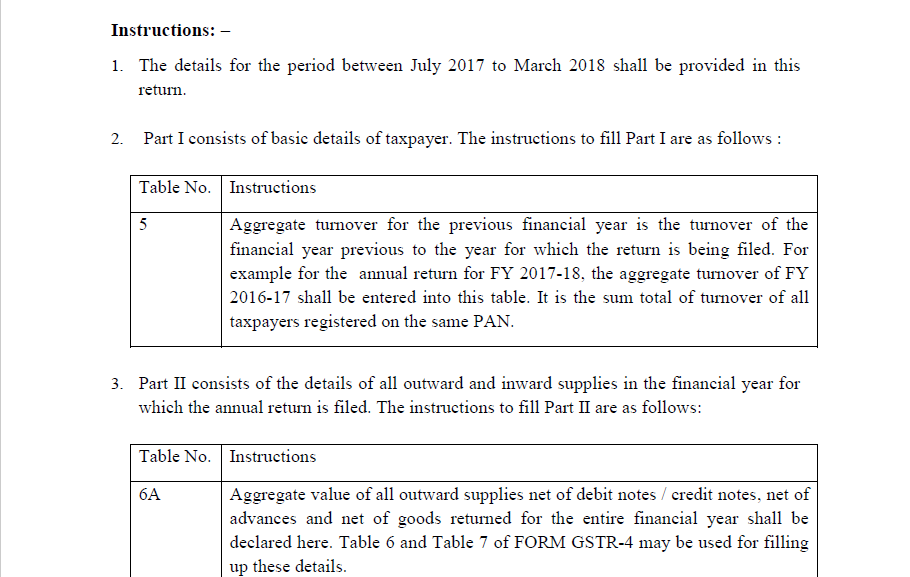

1. The details for the period between July 2017 to March 2018 shall be provided in this return.

2. Part I consists of basic details of the taxpayer. The instructions to fill Part I are as follows :

| Table No. | Instructions |

| 5 | Aggregate turnover for the previous financial year is the turnover of the financial year previous to the year for which the return is being filed. For example for the annual return for FY 2017-18, the aggregate turnover of FY 2016-17 shall be entered into this table. It is the sum total of turnover of all taxpayers registered on the same PAN. |

3. Part II consists of the details of all outward and inward supplies in the financial year for which the annual return is filed. The instructions to fill Part II are as follows:

| Table No. | Instructions |

| 6A | The aggregate value of all outward supplies net of debit notes/credit notes, net of advances and net of goods returned for the entire financial year shall be declared here. Table 6 and Table 7 of Form GSTR-4 may be used for filling up these details. |

| 6B | Aggregate value of exempted, Nil Rated and Non-GST supplies shall be declared here. |

Download the full Instructions for Annual return for Composition Dealer by clicking the below image:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.