ITAT in the case of DCIT Versus Five Star Construction P. Ltd.

Table of Contents

Case Covered:

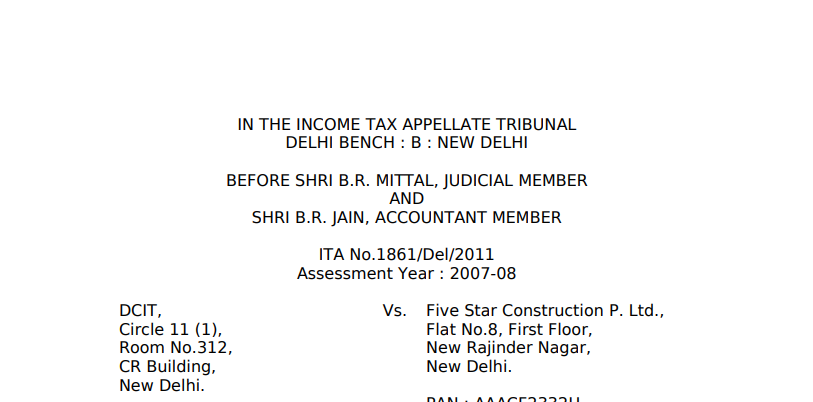

DCIT

Versus

Five Star Construction P. Ltd.

Facts of the Case:

This appeal by the revenue for Assessment Year 2007-08 against the order dated 15.02.2011 passed by Ld. CIT (A)-XIII, New Delhi, raises the following grounds:-

“1. On the facts and circumstances of the case and in law, the CIT (A) has erred in deleting the addition of Rs.37,29,738/- on account of mobilization advance.

2. On the facts and circumstances of the case and in law, the CIT (A) has erred in deleting the addition of Rs.14,29,256/- on account of terms of Section 41 (1) of the IT Act.”

Briefly, the fats are that the assessee company is in the business of construction activities. It has declared income of ` 32,41,870/- from the said business. During the course of assessment proceedings, the Assessing Officer noticed that the assessee has received mobilization advances to the extent of ` 37,29,738/- from M/s Matrix Buildwell Private Limited. Even TDS has been deducted on these receipts. As the assessee did not disclose these receipts as his income for the year under consideration, he required the assessee to justify and explain the said receipt. The assessee furnished written submissions which were duly considered. The Assessing Officer, thereafter, being not satisfied with the explanation of the assessee, proceeded to treat the receipt of ` 37,29,738/- as assessee’s income from business and brought the same to taxation.

Related Topic:

ITAT: Validity of a Notice issued to an amalgamating company which is no more existent.

Observations:

This bill reveals that the assessee has adjusted an amount of ` 2,00,146/- out of mobilization advance amount and the balance of the running bill amount has been routed through the running account of the builder client. The amount received as mobilization advance is not towards a contract receipt, but is merely an advance for mobilizing resources by the assessee for carrying out the work of its customer/client. This amount is required to be adjusted proportionately against the running bills for the work certified. The amount of mobilization account that has been adjusted during the year under consideration has been included as assessee’s income whereas the balance outstanding remains as a current liability for the year. The same is liable to be adjusted against the future running bills in the subsequent year. Essential this receipt was not in the nature of income. Merely because tax at source has been deducted by the builder, the receipt of mobilization money cannot be deemed as income of the assessee for the year under consideration. We, therefore, do not find any error in the decision reached by the Ld. CIT (A) in deleting the addition on this count. Finding no merit in this ground raised by the revenue, the same stands rejected.

Order:

We have heard the parties with reference to the material on record. Admittedly, the assessee has not written back the credit balance in its accounts. This is a case of a private limited company wherein the liabilities are appearing in its books of account. The balance sheet being a public document, it cannot be said that the assessee has not acknowledged the debt towards its creditors. The liability under the circumstances cannot be taken to be a ceased liability. The Ld. CIT (A), therefore, cannot be said to have erred in deleting the addition. As provisions of Section 41 (1) of the Act are not applicable to a case like this and finding no merit in this ground, the same is also rejected.

In the result, the appeal filed by the revenue is dismissed.

The order pronounced in the open court on 02.11.2012.

Read & Download the full Order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.