Major Changes in GST Rules!

Table of Contents

Major Changes in GST Rules!

How many times the Rules amended?

2017 → 14 times

2018 → 14 times

2019 → 9 times

2020 → 14 times

Total → 51 times!

What’s new – Changes made through Not. No. 94/2020-CT!

- Input Tax Credit

- Returns

- Re-conciliation

- Registration

Legal provisions

Changes!

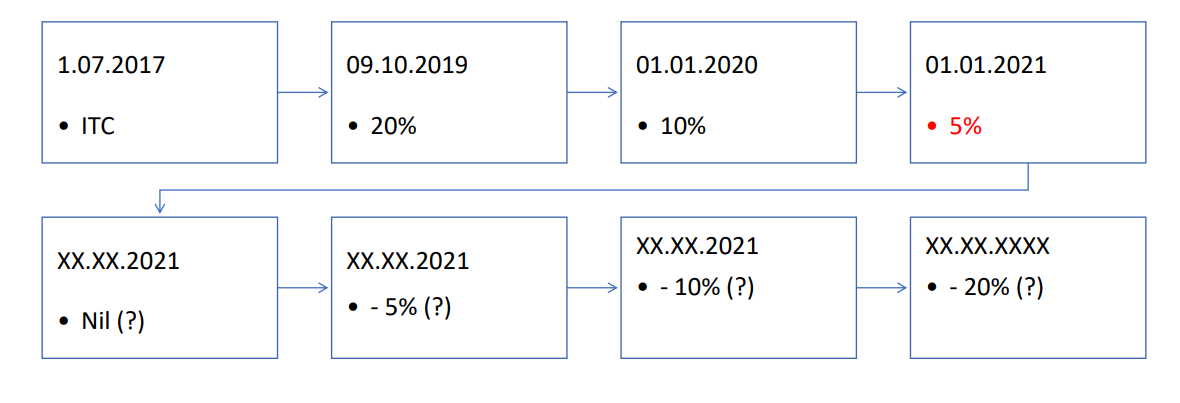

1. From 10% to 5% [Rule 36 (4)]

1.1 Changes in Rule 36 (4) [w.e.f. 1.01.2021]

5% → (c) for the figures and words “10 percent.”, the figure and words “5 percent.” shall be substituted

Uploaded (QRMP related) → (a) for the word “uploaded”, at both the places where it occurs, the word “furnished” shall be substituted

IFF added (QRMP related) → (b) after the words, brackets, and figures “by the suppliers under sub-section (1) of section 37”, at both the places where they occur, the words, letters, and figure “in FORM GSTR-1 or using the invoice furnishing facility” shall be inserted

1.2 Rule 36 (4) – Changes!

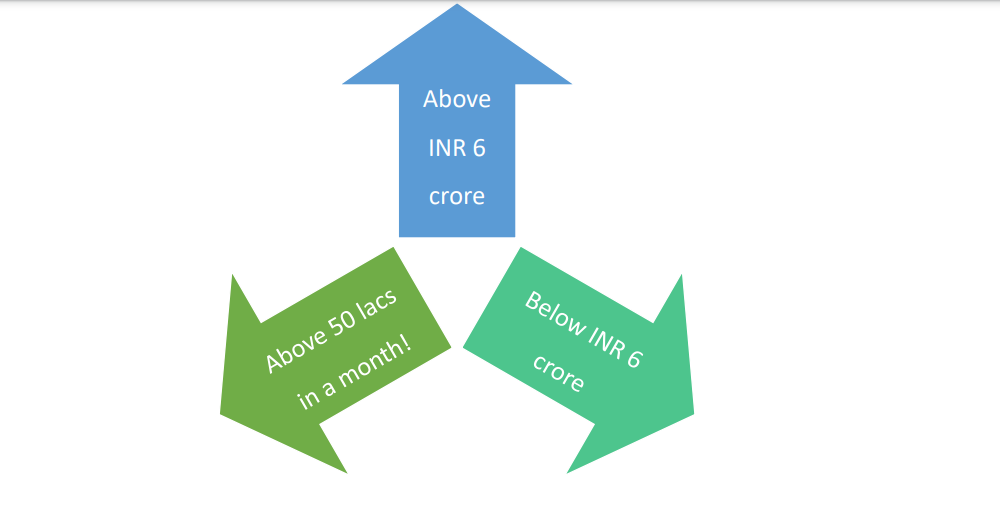

2. Pay 1% in cash! [Rule 86B]

2.1 New Year Surprise!

From 1.01.2021

2.2 Why!

Fake-invoicing!

2.3 Who should be aware?

2.4 Pay 1% in cash!

- Pay atleast 1% of tax liability through cash ledger

- If value of taxable supply other than exempt supply and zero-rated supply

- In a month

- Exceeds fifty lakh rupees

2.5 Why?

Why pay 1% in cash?

• In case of fake-invoicing, typically, entire GST liability is paid through credit so!

• Fake-traders may be charging 1% or more!

Why exempt supply and zerorated supply excluded?

• As GST is not applicable thereon (so no issue of fake credit)

Why monthly turnover than annual?

• Mostly fake-supplier vanish after few months (so they may not complete a year)

2.6 Not applicable if – Income Tax!

Who?

1. Registered person

2. Proprietor

3. Karta

4. Any of its two partners

5. Managing Director or Whole-time Directors

6. Members of Managing Committee of Associations

7. Board of Trustees

8. As the case may be

What

• Have paid more than one lakh rupees as Income-tax

• In each of the last two financial years for which the time limit to file return of income under subsection (1) of section 139 of the said Act has expired