One cant be a party in Cheque bounce case just because they were handling the affairs of business

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

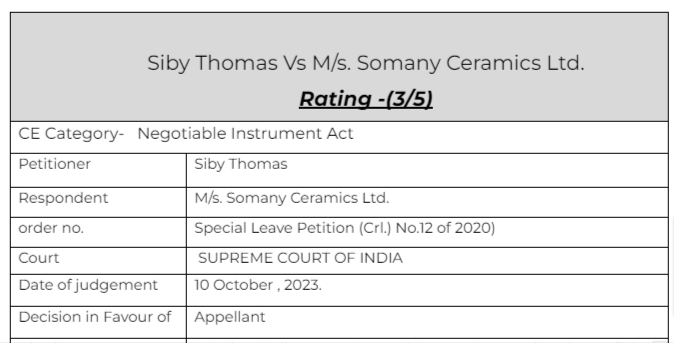

Siby Thomas Vs M/s. Somany Ceramics Ltd

Citations:

- Anita Malhotra v. Apparel Export Promotion Council & Anr

- Ashok Shewakramani & Ors. v. State of Andhra Pradesh & Anr

- S.P. Mani and Mohan Dairy v. Dr. Snehalatha Elangovan

- Gunmala Sales Private Limited v. Anu Mehta

Facts of the cases:

The appellant was made a party in a case of cheque bounce. His contention was that he was not looking after the affairs of the firm at the time of issuance of cheque

Observation & Judgement of the Court:

The honorable Supreme Court held that it is evident that vicarious liability would be attracted only when the ingredients of Section 141(1) of the NI Act, are satisfied. It would also reveal that merely because somebody is managing the affairs of the company, per se, he would not become in charge of the conduct of the business of the company or the person responsible to the company for the conduct of the business of the company.

The upshot of the aforesaid discussion is that the averments in the complaint filed by the respondent are not sufficient to satisfy the mandatory requirements under Section 141(1) of the NI Act. Since the averments in the complaint are insufficient to attract the provisions under Section 141(1) of the NI Act, to create vicarious liability upon the appellant, he is entitled to succeed in this appeal. We are satisfied that the appellant has made out a case for quashing the criminal complaint in relation to him, in the exercise of the jurisdiction under Section 482 of Cr. PC. As a result, the impugned order is set aside and the subject Criminal Complaint filed by the respondent and pending before Ld. CJ (JD) JMIC, Bahadurgarh, in the matter titled as M/s. Somany Ceramics v. M/s. Tile Store etc. vide COMA- 321-2015 (CNRNO: HRJRA1004637-2015), stand quashed only in so far as the appellant, who is accused No. 4, is concerned. The appeal stands allowed as above. There will be no order as to costs.

Read & Download the Full Siby Thomas Vs M/s. Somany Ceramics Ltd

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.