Provisions for GST Migration

Provisions for GST migration are covered in chapter XXVII –Transitional Provisions

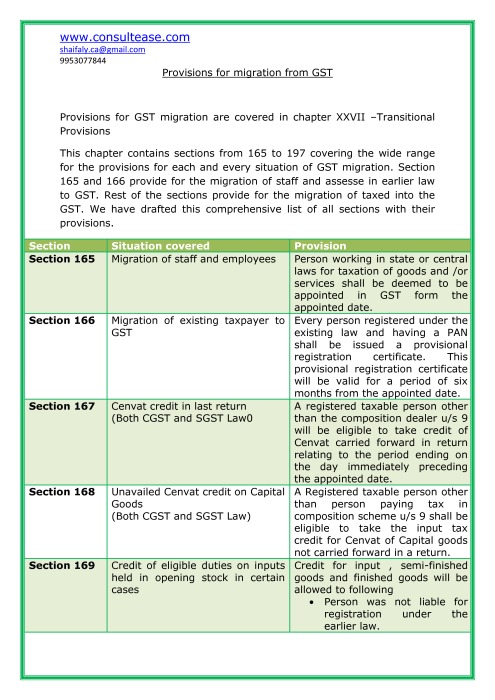

This chapter contains sections from 165 to 197 covering the wide range for the provisions for each and every situation of GST migration. Section 165 and 166 provide for the migration of staff and assesse in earlier law to GST. Rest of the sections provide for the migration of taxed into the GST. We have drafted this comprehensive list of all sections with their provisions.(Pls find pdf attached in last of this post)

|

Section |

Situation covered |

Provision |

|

Section 165 |

Migration of staff and employees |

Person working in state or central laws for taxation of goods and /or services shall be deemed to be appointed in GST form the appointed date. |

|

Section 166 |

Migration of existing taxpayer to GST |

Every person registered under the existing law and having a PAN shall be issued a provisional registration certificate. This provisional registration certificate will be valid for a period of six months from the appointed date. |

|

Section 167 |

Cenvat credit in last return (Both CGST and SGST Law0 |

A registered taxable person other than the composition dealer u/s 9 will be eligible to take credit of Cenvat carried forward in return relating to the period ending on the day immediately preceding the appointed date. |

|

Section 168 |

Unavailed Cenvat credit on Capital Goods (Both CGST and SGST Law) |

A Registered taxable person other than person paying tax in composition scheme u/s 9 shall be eligible to take the input tax credit for Cenvat of Capital goods not carried forward in a return. |

|

Section 169 |

Credit of eligible duties on inputs held in opening stock in certain cases |

Credit for input , semi-finished goods and finished goods will be allowed to following · Person was not liable for registration under the earlier law. · Person engaged in manufacturing of exempted goods or providing the exempted services · Providing works contract services and was availing the benefit of notification number 26/2012 service tax. · Is a First stage dealer or second stage dealer or registered importer

|

|

Section 170 |

Credit of eligible duties and taxes (Only in CGST Law) |

A registered /taxable person engaged in manufacturing of both taxable and exempted goods will be eligible for Cenvat credit in following manner · For Taxable part: the amount of Cenvat credit carried forward in a return furnished under the earlier law by him in terms of section 167 · For exempted part: Amount of eligible duties in respect of input, semi-finished goods and finished goods on the appointed date. |

|

Section 171 |

Credit of input and input services in transit (Both CGST and SGST Law) |

Credit of inputs and input services will be available · when their tax was paid before the appointed date · but input or input services were received after the appointed date · Documents for the same was recorded in books within 30 days of appointed date |

|

Section 172 |

Credit available on switching from composition scheme in earlier law to normal scheme in GST (Both CGST and SGST Law) |

A person switching from composition levy in earlier law to normal taxation in this Law will be eligible for credit of: · Input · Semi-finished goods · Finished goods In stock immediately preceding the appointed date. This credit will be subject to the fulfilment of following conditions: (1)such inputs and / or goods are used or intended to be used for making taxable supplies under this Act; (2)the said person is not paying tax under section 9; (3)the said taxable person is eligible for input tax credit on such inputs under this Act; (4) the said taxable person is in possession of invoice and/or other prescribed documents evidencing payment of duty under the earlier law in respect of inputs; and (5)such invoices and /or other prescribed documents were issued not earlier than twelve months immediately preceding the appointed day |

|

Section 173 |

Exempted goods returned to the place of business on or after the appointed day (Both CGST and SGST Law) |

The exempted goods removed not more than six months earlier and returned within six months of appointed date. No tax under this Law except following cases: · If goods are returned after six months the person returning the goods shall be liable for tax. If the goods are returned by person not registered under this Act no tax is payable.

|

|

Section 174 |

Duty (Tax – in SGST Act) paid goods returned to the place of business on or after the appointed day (Both CGST and SGST Law) |

For CGST: When the goods were removed on payment of duty are returned to any place of business then the duty paid shall be refunded · If the goods were removed not earlier than six months from the appointed date. · Goods are returned within six months of appointed date · Goods are identifiable to the satisfaction of proper officer · If the goods are supplied by a registered taxable person it should be deemed to be a supply. For SGST: Where the tax was paid on goods at the time of sales are returned within a period of six months. The supplier will be eligible for refund of duties.

|

|

Section 175 |

Inputs removed for job work and returned on or after the appointed day (Both CGST Law and SGST Law) |

When any inputs removed before the appointed date and returned within 30 days of appointed date. No tax will be chargeable under GST Act. |

|

Section 176 |

Semi-finished goods removed for job work and returned on or after the appointed day (Both CGST Law and SGST Law) |

When any semi-finished goods removed before the appointed date and returned within 30 days of appointed date. No tax will be chargeable under GST Act. |

|

Section 177 |

Finished goods removed for carrying out certain processes and returned on or after the appointed day (Both CGST Law and SGST Law) |

When any finished goods removed before the appointed date and returned within 30 days of appointed date. No tax will be chargeable under GST Act. |

|

Section 178 |

Issue of supplementary invoices, debit or credit notes where price is revised in pursuance of a contract (Both CGST and SGST Law) |

Where any supplementary invoice or debit note or credit note is issued within 30 days of price revisions. That invoice or debit note or credit note shall be deemed to be issued in respect of supply made under this Act. |

|

Section 179 |

Pending refund claims to be disposed of under earlier law (both CGST and SGST Law) |

Pending refund claims shall be disposed of under the provisions of earlier law and any amount payable shall be paid in cash subject to the provisions of section 11(b)(2) |

|

Section 180 |

Refund claims filed after the appointed day for goods cleared or services provided before the appointed day and exported before or after the appointed day to be disposed of under earlier law (Only in CGST Law) |

Where the refund claim made after the appointed date · Duty or taxes were paid before the appointed date · For Goods or services exported before or after the appointed date · shall be disposed of in accordance with the provisions of earlier law · where any claim for refund of Cenvat credit is fully or partially rejected, the amount so rejected shall lapse. No ITC will be available for that rejected part. · no refund claim shall be allowed of any amount of Cenvat credit where the balance of the said amount as on the appointed day has been carried forward under this Act |

|

Section 181 |

Refund claims filed after the appointed day for payments received and tax deposited before the appointed day in respect of services not provided (only in CGST Law) |

· Every refund claim filed after the appointed date · For the taxes deposited under the earlier law · But services are not provided · Shall be disposed of in accordance of the provisions of previous law · Any amount of refund shall be paid in cash. · This payment will be subject to the provisions of section 11(b)(2) of Central Excise law 1944. |

|

Section 182 |

Claim of cenvat credit to be disposed of under the earlier law

(Both CGST and SGST Law) |

Where the amount was recoverable from taxpayer: · Recovered as arrears of tax under this Act. · the amount so recovered shall not be admissible as input tax credit under this Act Where any amount is refundable to the taxpayer: · Such amount shall be refunded in cash under the earlier law. · Such refund will be subject to the provisions of section 11(b)(2) of Central excise Act 1944.(If related to excise) · Section 11(b)(2) provide the instances when the refund shall be paid to the taxpayer otherwise it is transferred to investor protection fund.

|

|

Section 183 |

Finalization of proceedings relating to output duty or tax liability (CGST and SGST Law) |

Where the amount was recoverable from taxpayer: · Recovered as arrears of tax under this Act. · the amount so recovered shall not be admissible as input tax credit under this Act Where any amount is refundable to the taxpayer: · Such amount shall be refunded in cash under the earlier law. · Such refund will be subject to the provisions of section 11(b)(2) of Central excise Act 1944.(If related to excise) · Section 11(b)(2) provide the instances when the refund shall be paid to the taxpayer otherwise it is transferred to investor protection fund.

|

|

Section 184 |

Treatment of the amount recovered or refunded in pursuance of assessment or adjudication proceedings.

(Both CGST and SGST Law) |

Where the amount was recoverable from taxpayer: · Recovered as arrears of tax under this Act. · the amount so recovered shall not be admissible as input tax credit under this Act Where any amount is refundable to the taxpayer: · Such amount shall be refunded in cash under the earlier law. · Such refund will be subject to the provisions of section 11(b)(2) of Central excise Act 1944.(If related to excise) · Section 11(b)(2) provide the instances when the refund shall be paid to the taxpayer otherwise it is transferred to investor protection fund.

|

|

Section 185 |

Treatment of the amount recovered or refunded pursuant to revision of returns (Both CGST and SGST Law) |

Where a return filed in previous law is revised in GST Law and any amount is recoverable: · Any amount recoverable or any cenvat credit inadmissible will be a) Recovered as arrear of tax under this Act b) Amount so recovered shall not be admissible as ITC under this Act. Where a return is revised and any amount is payable: · The amount payable will be allowed only if return is revised within the time limit allowed.(after appointed date) · Such amount shall be refunded in cash under the earlier law. · Such refund will be subject to the provisions of section 11(b)(2) of Central excise Act 1944.(If related to excise) · Section 11(b)(2) provide the instances when the refund shall be paid to the taxpayer otherwise it is transferred to investor protection fund.

|

|

Section 186 |

Treatment of long term construction / works contracts (Both CGST and SGST Law) |

Following supply shall be liable for the tax under the GST Act Where: · Goods and/or services supplied on or after the appointed date · in pursuance of a contract entered into prior the appointed date |

|

Section 187 |

Progressive or periodic supply of goods or services

(For both CGST and SGST) |

Tax will not be payable under GST Where · The supply of goods/services made after the appointed date · Consideration (full or part) received before the appointed date. · Duty/tax payable thereon was paid under the earlier law.

|

|

Section 188 |

Taxability of supply of services when point of taxation arose before appointed date |

If the point of taxation for any services arose before the appointed date the tax will be payable under the earlier law |

|

Section 189 |

Taxability of supply of goods when point of taxation arose before appointed date |

If the point of taxation for any Goods arose before the appointed date the tax will be payable under the earlier law |

|

Section 190 |

Credit distribution of service tax by ISD |

the input tax credit on account of any services received prior to the appointed day by an Input Service Distributor shall be eligible for distribution as credit under this Act even if the invoice(s) relating to such services is received on or after the appointed day. |

|

Section 191 |

Provision for transfer of unutilized Cenvat Credit by taxable person having centralized registration under the earlier law |

· The taxable person having the centralised registration earlier will be eligible to take the amount of tax furnished by him in return in previous law to his electronic credit ledger in GST · Original Return: Credit will be allowed if the taxable person files the return for the period ending on day immediately preceding the appointed day with three moths of appointed date. · Revised return: In case of revised return credit will be available only where the credit has been reduced from that claimed earlier · the taxable person shall not be allowed to take credit unless the said amount admissible as input tax credit under this Act · such credit may be transferred to any of the registered taxable persons having the same PAN for which the centralized registration was obtained under the earlier law |

|

Section 192 |

Tax paid on goods lying with agents to be allowed as credit |

Agent will be able to take credit of goods (of principal) laying at their place at appointed date on fulfilling the following conditions: · the agent is a registered taxable person under this Act (GST Act) · both the principal and the agent declare the details of stock of goods lying with such agent in prescribed form. · the invoices for such goods had been issued not earlier than twelve months immediately preceding the appointed day. · The principal has either no The p the principal has either reversed or not availed of the input tax credit in respect of such goods |

|

Section 193

(Only in SGST law) |

Tax paid on capital goods lying with agents to be allowed as credit |

Agent will be able to take credit for the capital goods (of principal) laying at their place at appointed date · the agent is a registered taxable person under this Act (GST) · both the principal and the agent declare the details of the stock of capital goods lying with such agent in prescribed form · the invoices for such capital goods had been issued not earlier than twelve months · The principal has either not taken the credit on that goods or has reversed the said credit. |

|

Section 194 |

Treatment of branch transfers |

Any amount reversed in earlier law will not be allowed in this Act. |

|

Section 195 |

Goods sent on approval basis returned on or after the appointed day |

· When the goods were sent not more than six months back from the appointed dare an returned within six months from appointed date: no tax under GST · This period of six months can be extended by further two months. · Tax liability of recipient of Goods: the tax shall be payable by the person returning the goods if such goods are liable to tax under this Act, and are returned after a period of six months or the extended period · Tax liability of supplier of Goods: tax shall be payable by the person who has sent the goods on approval basis if such goods are liable to tax under this Act, and are not returned within a period of six months or the extended period |

|

Section 196 |

Deduction of tax source |

When the goods on which TDS was required to be deducted under the earlier law. · The sale is made in earlier law · Invoice was raised before the appointed date No requirement for TDS in GST at the time of payment for such supply even if payment is after the appointed date. Section 48 of GST Act provide for the deduction of TDS at the time of payment. This section clarify that if the sale and invoice were done before appointed date no TDS will be deducted at the time payment. |

|

Section 197 |

Transitional provisions for availing Cenvat credit in reversed in earlier law |

Credit reversed: Credit reversed in earlier law Reason of reversal: due to non- payment of consideration in three months Allowance in GST: will be allowed if the taxable person has made the payment within three months from appointed date |

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.