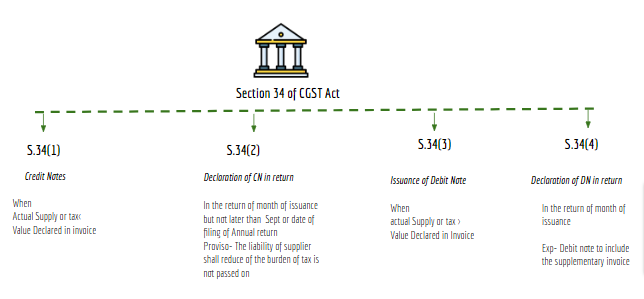

Section 34 of CGST Act: Debit and Credit note (updated till on July 2024)

Table of Contents

Section 34 of the CGST Act as amended by the Finance Act 2023

Note: Section 34 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Text On Section:

“(1) Where a tax invoice has [Where one or more tax invoices have] been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient a credit note [one or more

credit notes for supplies made in a financial year] containing such particulars as may be prescribe.

(2) Any registered person who issues a credit note in relation to a supply of goods or services or both shall declare the details of such credit note in the return for the month during which such credit note has been issued but not later than September [the thirtieth day of November] following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier, and the tax liability shall be adjusted in such manner as may be prescribed:

Provided that no reduction in output tax liability of the supplier shall be permitted, if the incidence of tax and interest on such supply has been passed on to any other person.

(3) Where a tax invoice has [Where one or more tax invoices have] been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to be less than the taxable value or tax payable in respect of such supply, the registered person, who has supplied such goods or services or both, shall issue to the recipient a debit note [one or more debit notes for supplies made in a financial year] containing such particulars as may be prescribed.

(4) Any registered person who issues a debit note in relation to a supply of goods or services or both shall declare the details of such debit note in the return for the month during which such debit note has been issued and the tax liability shall be adjusted in such manner as may be prescribed.

Explanation.––For the purposes of this Act, the expression “debit note” shall include a supplementary invoice.”

(As given in CGST Act)

Chart of the section :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.