Waiver of late fees on GSTR 3b under litigation

Waiver of late fees on GSTR 3b:

A recent decision of Gujrat high court raised questions about GSTR 3b. Whether it is a prescribed return or not. Now in case of the same applicant another matted is listed. The applicant has requested for waiver of late fees.

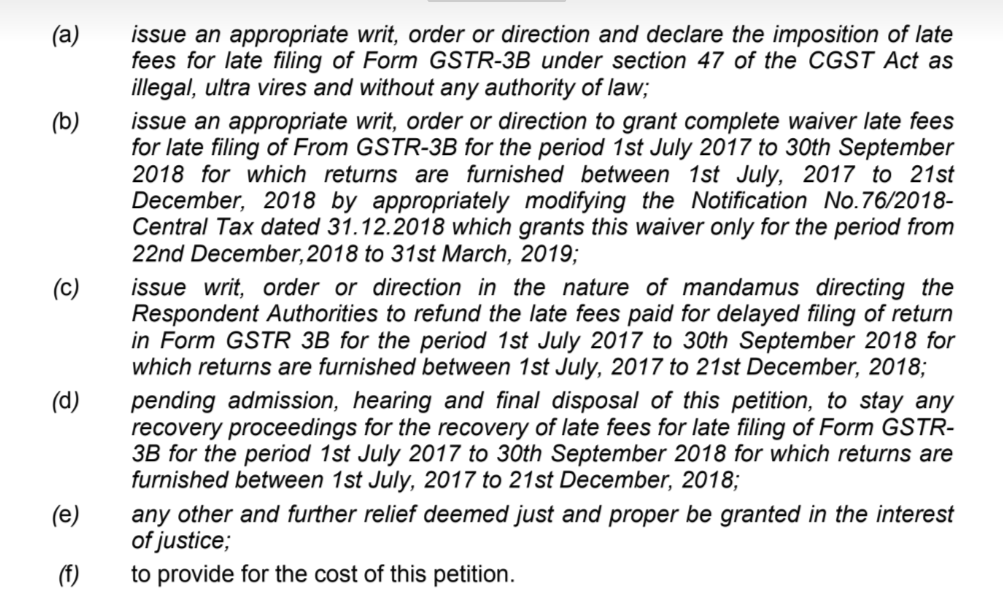

GSTR 3b, if not a return poses a huge issue. Why there should be a levy of late fees for it. Many taxpayers have paid a huge amount of late fees on late filing of this return. Following issues were raised by the applicant:

Issues raised by the applicant in Gujrat High court case:

following issues were raised by the applicant for late fees on GSTR 3b. 31 writs were there on the following issues.

Although for some period the late fees were waived off. But glitches on GST portal and the erroneous draft of this form itself caused hurdles. Taxpayers were not being able to file their returns. They ended up spending a lot of hours in front of the system. Also, notification no.76/2018 is also challenged. In this notification late fees of taxpayers filing return between 22nd December 2018 to 31st March 2019. It was completely arbitrary on the part of the government to waive the late fees for some taxpayers. Although the taxpayers who filed their return even before that date were not allowed the waiver. So even if I file my return before 22nd December I will have to pay entire late fees. But someone filing it after that date will be eligible for a waiver of late fees.

These were the issues which bothered the taxpayers. Even the late fees deposited by the taxpayers where the waiver was given on a later date was never refunded. Thus taxpayers decided to go to the court. Hope this can bring good news for many taxpayers.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.