Waiver of Interest and Late fees for taxpayers

Table of Contents

- Taxpayers having turnover exceeding 5 Crore:

- Related Topic: RTI revealed that Government levied Zero penalty on Infosys

- Taxpayers having turnover below 5 Crores and have opted for monthly return filing:

- Related Topic: Composition late fees waiver- 5 things to know

- Taxpayers having turnover below 5 Crores and under QRMP Scheme:

- Composition taxpayers:

- Extension in the filing of ITC-04 and GSTR-4

- Cumulative Application of condition specified in Rule 36 (4)

- The due date of other compliances extended to 31st May 2021

- Due dates which have not been extended

- Registration related due date

- Refund related due date

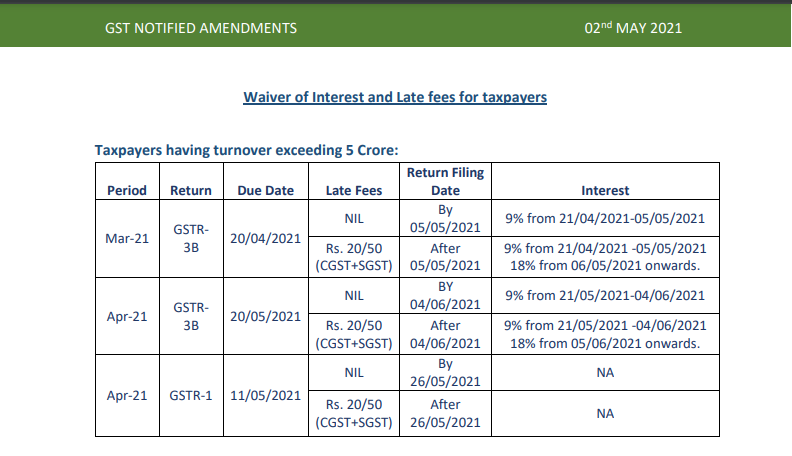

Taxpayers having turnover exceeding 5 Crore:

| Period | Return | Due Date | Late Fees | Return Filing Date | Interest |

| Mar-21 | GSTR3B | 20/04/2021 | NIL | By 05/05/2021 | 9% from 21/04/2021-05/05/2021 |

| Rs. 20/50 (CGST+SGST) | After 05/05/2021 | 9% from 21/04/2021 -05/05/2021 18% from 06/05/2021 onwards. | |||

| Apr-21 | GSTR3B | 20/05/2021 | NIL | BY 04/06/2021 | 9% from 21/05/2021-04/06/2021 |

| Rs. 20/50 (CGST+SGST) | After 04/06/2021 | 9% from 21/05/2021 -04/06/2021 18% from 05/06/2021 onwards. | |||

| Apr-21 | GSTR-1 | 11/05/2021 | NIL | By 26/05/2021 | NA |

| Rs. 20/50 (CGST+SGST) | After 26/05/2021 | NA |

Related Topic:

RTI revealed that Government levied Zero penalty on Infosys

Taxpayers having turnover below 5 Crores and have opted for monthly return filing:

| Period | Return | Due Date | Late Fees | Return Filing Date | Interest |

| Mar-21 | GSTR3B | 20/04/2021 | NIL | By 05/05/2021 | NIL from 21/04/2021- 05/05/2021 |

| NIL | From 06/05/2021 to 20/05/2021 | Interest 9% from 06/05/2021 onwards | |||

| Rs. 20/50 (CGST+SGST) | After 20/05/2021 | NIL from 21/04/2021 -05/05/2021 9% from 06/05/2021 -20/05/2021 18% from 21/05/2021 onwards. | |||

| Apr-21 | GSTR3B | 20/05/2021 | NIL | By 04/06/2021 | Nil from 21/05/2021- 04/06/2021 |

| NIL | From 05/06/2021 to 19/06/2021 | Interest 9% from 05/06/2021 onwards | |||

| Rs. 20/50 (CGST+SGST) | After 19/06/2021 | NIL from 21/05/2021 -04/06/2021 9% from 05/06/2021 -19/06/2021 18% from 20/06/2021 onwards. | |||

| Apr-21 | GSTR-1 | 11/05/2021 | NIL | By 26/05/2021 | NA |

| Rs. 20/50 (CGST+SGST) | After 26/05/2021 | NA |

Related Topic:

Composition late fees waiver- 5 things to know

Taxpayers having turnover below 5 Crores and under QRMP Scheme:

| Period | Return | Due Date | Late Fees | Return Filing Date | Interest |

| Jan-21 to Mar21 | GSTR3B (Type A States) | 22/04/2021 | NIL | By 07/05/2021 | NIL from 23/04/2021-07/05/2021 |

| NIL | From 08/05/2021 to 22/05/2021 | Interest 9% from 08/05/2021 onwards | |||

| Rs. 20/50 (CGST+SGST) | After 22/05/2021 | NIL from 23/04/2021 -07/05/2021 9% from 08/05/2021 -22/05/2021 18% from 23/05/2021 onwards. | |||

| Jan-21 to Mar21 | GSTR3B (Type B states) | 24/04/2021 | NIL | By 09/05/2021 | NIL from 25/04/2021 to 09/05/2021 |

| NIL | From 10/05/2021 to 24/05/2021 | Interest 9% from 10/05/2021 onwards | |||

| Rs. 20/50 (CGST+SGST) | After 24/05/2021 | NIL from 25/04/2021 -09/05/2021 9% from 10/05/2021 -24/05/2021 18% from 25/05/2021 onwards. | |||

| Apr-21 | IFF (All states) | 01/05/2021- 13/05/2021 | NIL | 01/05/2021- 28/05/2021 | NA |

Composition taxpayers:

| Period | Return | Due Date | Rate of Interest | Return Filing Date | Remark |

| Jan-21 to Mar21 | GST CMP-08 | 18/04/2021 | NIL | By 03/05/2021 | NIL from 19/04/2021 to 03/05/2021 |

| 9% | From 04/05/2021 to 18/05/2021 | Interest 9% from 04/05/2021 onwards | |||

| 18% | After 18/05/2021 | NIL from 19/04/2021 -03/04/2021 9% from 04/05/2021 -18/05/2021 18% from 19/05/2021 onwards. |

(Notification No. 08/2021 -CT dt. 01.05.2021)

(Notification No. 09/2021 -CT dt. 01.05.2021)

(Notification No. 12/2021 -CT dt. 01.05.2021)

(Notification No. 13/2021 -CT dt. 01.05.2021)

Extension in the filing of ITC-04 and GSTR-4

| Period | Return Type | Description | Due Date | Extended Due Date |

| Apr’20 – Mar’21 | GSTR-4 | Annual Return for Composition Tax Payers | 30/04/2021 | 31/05/2021 |

| Jan’21-Mar’21 | ITC-04 | Intimation of goods sent on job work | 25/04/2021 | 31/05/2021 |

(Notification No. 10/2021 -CT dt. 01.05.2021)

(Notification No. 11/2021 -CT dt. 01.05.2021)

Cumulative Application of condition specified in Rule 36 (4)

➢ Rule 36(4) of the CGST Act, 2017, restricts availment of ITC to 105% of the ITC reflected in GSTR-2B / 2A as on the due date of filing GSTR-1 by the supplier. With the extensions in GSTR-1 dates, the government has provided that the said restriction shall apply cumulatively for the period April ’21 to May ’21 in GSTR-3B of May’21.

(Notification No. 13/2021 -CT dt. 01.05.2021)

The due date of other compliances extended to 31st May 2021

➢ Where the time limit of any of the following actions falls between 15th April 2021 to 30th May 2021, the due date of the same would get extended to 31st May 2021:

o Due date for completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action by any authority, commission, or tribunal, under the provisions of the Acts

o Filing of any appeal, reply or application or furnishing of any report, document, return, statement, or such other record, by whatever name called, under the provisions of the Acts stated above;

The above extension includes but is not limited to:

➢ Filing of refund claims and other refund-related compliances that fall due between 15th April 2021 to 30th May 2021

➢ Intimation for withdrawal from Composition Scheme under CMP-04

➢ Amendment, Cancellation, and Revocation of Cancellation of Registration

➢ Filing of Form ITC-01 (Exemption / Composition to Normal Scheme/ITC upon new registration), Form ITC-02 (Transfer of ITC upon transfer of business), and Form ITC-03 (Normal to Exemption Scheme)

➢ Assessment related forms including the issuance of a notice, furnishing of reply, passing of order

➢ Departmental audit and Special Audit related compliances

➢ Advance ruling compliances

➢ Appeal provisions including the filing of the appeal, cross objection, etc.

➢ Search and seizure forms including order of seizure, bond for the release of seized goods, order for the release of seized goods, etc.

➢ Demand and recovery forms including the issuance of show cause notice, reply to show cause notice, the passing of the order, payment of demand under the order, etc.

Related Topic:

Composition late fees waiver- 5 things to know

Due dates which have not been extended

➢ Date, when the liability to pay tax, arises in terms of the time of supply

➢ Date when the composition scheme lapses due to crossing of the threshold limit of turnover

➢ Provisions relating to new registration including date of liability for registration

➢ Provisions for the casual taxable person and the non-resident taxable person

➢ Date of issuance of tax invoice, bill of supply, receipt voucher, self-invoice, payment voucher, revised tax invoice, etc.

➢ Arrest provisions still applicable

➢ Due date of intimation to the Commissioner by retiring partner from a partnership firm

➢ Generation, validation, and Verification of e-waybill (except as provided above) and Detention, seizure, and release of goods and conveyance in transit

(Notification No. 14/2021 -CT dt. 01.05.2021)

Registration related due date

➢ Under the provisions of GST registration, where the time limit for action by authorities relating to the issuance of notice in Form GST REG-03, rejection order in Form GST REG-05 or grant of registration in Form GST REG-06 falls between 1st May 2021 to 31st May 2021, the said date stands extended to 15th June 2021.

(Notification No. 14/2021 -CT dt. 01.05.2021)

Refund related due date

➢ Where an SCN of refund has been issued and the date of reply to the same falls between 15th April to 30th May 2021, then the department can issue a refund order within

(i) 15 days from the date of reply or

(ii) 31st May 2021

Whichever is later

(Notification No. 14/2021 -CT dt. 01.05.2021)

Shubham Khaitan

Shubham Khaitan

Kolkata, India