Wrongly paid GST can be shifted to correct head

Table of Contents

Introduction:

Wrongly paid GST can be shifted easily now. Have you also paid GST in the wrong head and now stuck due to that. Many are there like you. Tax wrongly paid under any head can be shifted to correct head now. CBIC made a change in CGST rules and inserted a provision in this regard. Section 77 of CGST Act provide that wrongly paid tax shall be claimed as refund & correct tax shall be paid. But this mechanism was causing hardship on the taxpayer. The facility of shifting is made available now.

Related Topic:

Claim of ITC under wrong head in GSTR 3B due to wrong filing of GSTR-1 by the supplier

How wrongly paid tax will be shifted to the correct head?

There are two types of heads in taxation. Taxes like CGST, SGST, IGST, Cess are the major head. Then there are minor heads. Minor heads will cover late fees, interest, penalty, and others. Any payment in the major or minor head can be shifted.

- Shifting from one minor head to other minor head in same major head. e.g. Tax can be shifted to penelty, fees etc.

- Major head item can be shifted to other major head. e.g. CGST to IGST

- One minor head can be shifted to minor head of other major head. e.g. CGST interest can be shifted to IGST interest.

- any minor head can be shifted to other minor head or other major head. e.g. Interest of IGST can be shifted to fees of CGST.

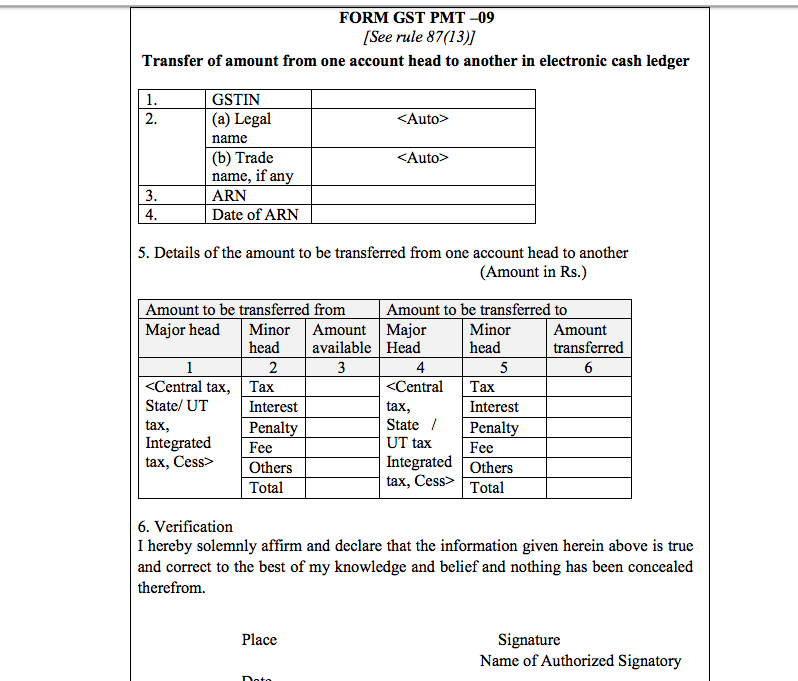

wrongly paid GST will be shifted using PMT 09

This is the prescribed form for shifting of wrongly paid GST. Following is the format of GST PMT 09.

Any shifting from one head to another head is possible. Instructions given for shifting are following.

Instructions – 1. Major head refers to – Integrated tax, Central tax, State/UT tax and Cess.

2. Minor head refers to – tax, interest, penalty, fee and others.

3. The form may be filled up if amount from one major / minor head is intended to be transferred to another major/minor head. Minor head for transfer of amount may be same or different.

4. The amount from one minor head can also be transferred to another minor head under the same major head.

Thus you can shifty wrongly paid GST now. It is quite easy. PMT 09 will be available on GST portal soon.