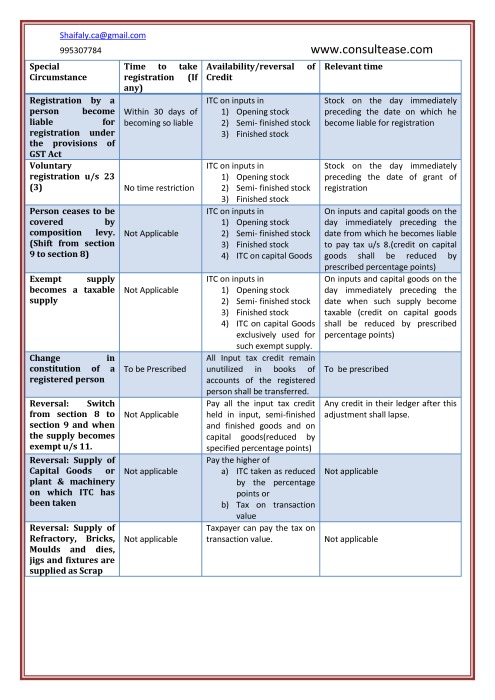

Availability of Input tax credit in special cases

Section of the revised draft of Model GST law provide for the availability of ITC in special cases. We can sum up all of them in the following table. Download PDF here

Following is the brief table on availability of ITC in special Cases.

|

Special Circumstance |

Time to take registration (If any) |

Availability/reversal of Credit |

Relevant time |

|

Registration by a person become liable for registration under the provisions of GST Act |

Within 30 days of becoming so liable |

ITC on inputs in 1) Opening stock 2) Semi- finished stock 3) Finished stock |

Stock on the day immediately preceding the date on which he become liable for registration |

|

Voluntary registration u/s 23 (3) |

No time restriction |

ITC on inputs in 1) Opening stock 2) Semi- finished stock 3) Finished stock |

Stock on the day immediately preceding the date of grant of registration |

|

Person ceases to be covered by composition levy. (Shift from section 9 to section 8) |

Not Applicable |

ITC on inputs in 1) Opening stock 2) Semi- finished stock 3) Finished stock 4) ITC on capital Goods |

On inputs and capital goods on the day immediately preceding the date from which he becomes liable to pay tax u/s 8.(credit on capital goods shall be reduced by prescribed percentage points) |

|

Exempt supply becomes a taxable supply |

Not Applicable |

ITC on inputs in 1) Opening stock 2) Semi- finished stock 3) Finished stock 4) ITC on capital Goods exclusively used for such exempt supply. |

On inputs and capital goods on the day immediately preceding the date when such supply become taxable (credit on capital goods shall be reduced by prescribed percentage points) |

|

Change in constitution of a registered person |

To be Prescribed |

All Input tax credit remain unutilized in books of accounts of the registered person shall be transferred. |

To be prescribed |

|

Reversal: Switch from section 8 to section 9 and when the supply becomes exempt u/s 11. |

Not Applicable |

Pay all the input tax credit held in input, semi-finished and finished goods and on capital goods(reduced by specified percentage points) |

Any credit in their ledger after this adjustment shall lapse. |

|

Reversal: Supply of Capital Goods or plant & machinery on which ITC has been taken |

Not applicable |

Pay the higher of a) ITC taken as reduced by the percentage points or b) Tax on transaction value |

Not applicable |

|

Reversal: Supply of Refractory, Bricks, Moulds and dies, jigs and fixtures are supplied as Scrap |

Not applicable |

Taxpayer can pay the tax on transaction value. |

Not applicable |

Notes: No Input tax credit in case of first four cases if the date of invoice is more than twelve months old.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.