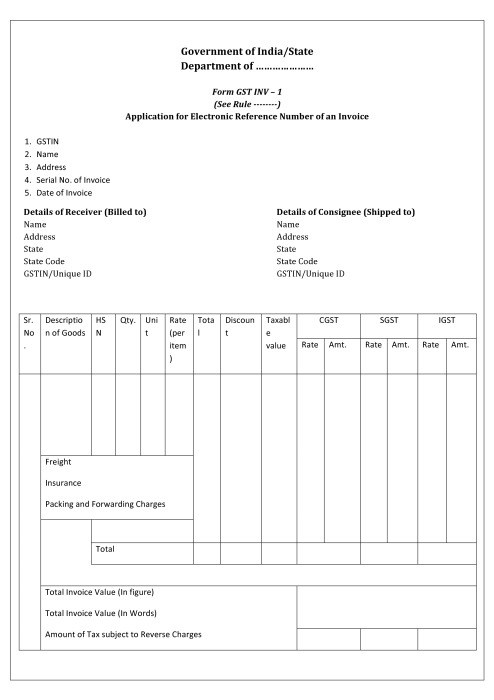

Format of tax invoice in GST

Format of tax invoice in GST

Here we have uploaded the Format of tax invoice in GST. Tax invoice rules are already in public domain.This tax invoice will be issued by all suppliers in GST. It will have 16 items which we have covered in our other post.

Some of the important items are:

(a) name, address and GSTIN of the supplier;

(b) a consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

(c) date of its issue;

(d) name, address and GSTIN or UIN, if registered, of the recipient;

(e) name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more;

(f) HSN code of goods or Accounting Code of services;

(g) description of goods or services;

Provided that the Commissioner may, on the recommendations of the Council, by notification, specify –

(i) the number of digits of HSN code for goods or the Accounting Code for services. A class of registered persons is required to mention those number of digits.This requirement is for such period as may be specified in the said notification, and

(ii) the class of registered persons that would not be required to mention the HSN code for goods or the Accounting Code for services, for such period as may be specified in the said notification:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.