GST Case 1-Premier Vigilance & Security (P.) Ltd.

GST Case 1-Premier Vigilance & Security (P.) Ltd.

Query: Whether Toll Taxes reimbursed by the client can be claimed as a deduction under Rule 33 from the value of supply, being expenditure incurred as a pure agent.

Facts: Applicant was engaged in transporting cash/coins/bullion in their own vehicles. The agreement between applicant and bank mentioned that toll and parking charges will be paid on actual amount.

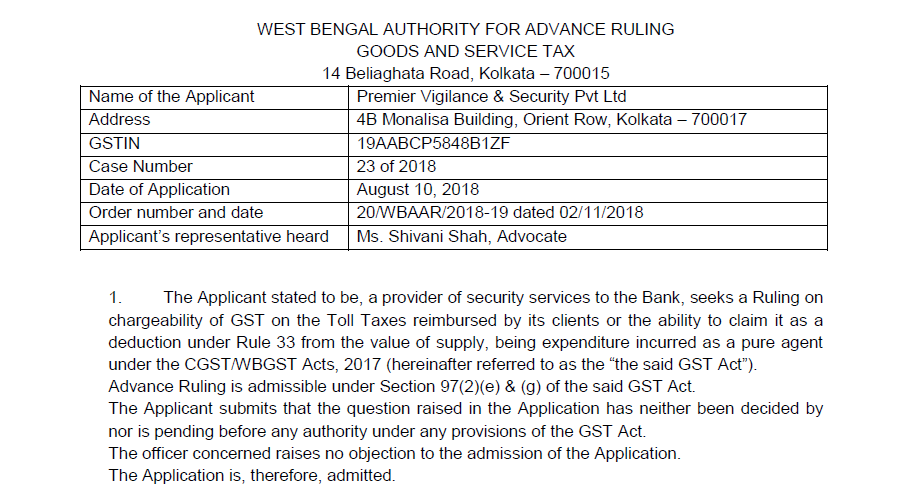

Download the copy order for the review, by clicking the below image:

Observation: Hon’ble AAR observed that vehicles were owned by applicant and toll has been charged for providing service by way of access to a road or bridge. Therefore, applicant admittedly was the beneficiary and liable to pay the toll, which is compulsorily levied on vehicles. The bank never acknowledged payment of toll charges as their own liability but only acknowledged that toll charges would be reimbursed on actual basis. Expenses so incurred are, therefore, cost of service provided to Banks and reimbursement of such expenses is the recovery of a portion of the value of supply made to Banks.

Held: Toll charges paid are not, therefore, to be excluded from the value of supply under Rule 33. GST therefore, be payable at the applicable rate on the entire value of supply, including toll charges paid.