Finance Minister’s view on West Bengal’s Letter seeking exemption on Covid-19 related items.

In a series of tweets, Finance Minister explained that GST exemption to domestic supplies and commercial import of COVID drugs, vaccines, and oxygen concentrators would make these items costlier for consumers as manufacturers would not be able to offset the taxes paid on inputs.

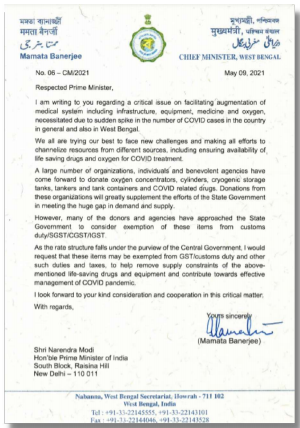

There have been demands from certain sections to exempt GST on certain items like ventilators, personal protective equipment (PPEs), masks, test kits, and sanitizers that are essential medicines for the treatment of COVID-19 saying that GST exemption on these items would lead to a reduction in prices. Now, have a look at West Bengal’s Letter, to which the FM have responded: –

Table of Contents

FM’s Response

- A list of items for COVID relief granted exemption from IGST for imports was issued on 3rd May’21. These were given exemption from Customs Duty/health cess even earlier. (Please have a look at Exhibit-A)

- Full exemption from Customs duties, including IGST, is already available to ALL COVID relief material (not confined to a list) imported by Indian Red Cross for free distribution in the country. (The Indian Red Cross Society (IRCS) is a voluntary humanitarian organization to protect human life and health based in India. It is part of the International Red Cross and Red Crescent Movement, and so shares the Fundamental Principles of the International Red Cross and Red Crescent Movement. The society’s mission is providing relief in times of disasters/emergencies and promoting health & care of vulnerable people and communities.) Why does everything have to go through the red cross? We also don’t know 🙂

- With effect from 3 May 2021, full exemption from all duties has been provided to Remdesivir injections, Remdesivir API, and a chemical for the manufacture of this drug.

- Said exemption is also extended to Medical Oxygen, equipment used for the manufacture, storage, and transportation of oxygen, equipment used for providing oxygen therapy to COVID patients such as Oxygen Concentrators, Ventilators, Non-invasive oxygen masks, Inflammatory diagnostic kits, reagents for COVID testing and COVID vaccines.

- This exemption applies to all above-mentioned goods when imported free of cost for free distribution in the country by any entity, State Govt, relief agency, or autonomous body on the basis of a certificate issued by a State Government.

- In order to augment the availability of these items, the Government has also provided full exemption from basic customs duty and health cess to their commercial imports.

- GST at rates varying from 5% (on vaccines), 12% (COVID drugs, oxygen concentrators) is applicable to domestic supplies and commercial import of these items.

- Now, If IGST ₹100 is collected on an item, ₹50 accrues to the Centre and the States each as CGST and SGST respectively. Further 41% of the CGST revenue is devolved to States. So out of a collection of ₹100, as much as ₹70.50 is the States’ share.

- If full exemption from GST were given, the domestic producers of these items would be unable to offset taxes paid on their inputs and input services and would pass these on to the end consumers by increasing their price.

- COVID vaccines are being provided free of cost by the GoI to those who are 45 yrs of age & above and to all frontline workers. On Government supplies, GST is also paid by the Government.

- From the GST collected on the vaccine, half is earned by the Centre and the other half by the States. Further, 41% of the Centre’s collections also get devolved to the States.

- So States end up receiving almost 70% of the total revenue collected from vaccines. In fact, a nominal 5% GST is in the interest of the domestic manufacturer of vaccines and in the interest of the citizens.

- If full exemption from GST is given, vaccine manufacturers would not be able to offset their input taxes and would pass them on to the end consumer/citizen by increasing the price.

Related Topic:

Faceless Assessment and Appeal

If we see it from a different perspective?

- A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to fund government spending and various public expenditures and to promote the welfare of citizens. In times of crisis, how can we justify GST rates of 5% & 12%?

- The demand of the exemption on not only on the output product but the inputs as well, used for manufacturing the final product. The government may provide exemption on the input /raw material too, being used for manufacturing, to bring the prices down for the end consumers.

- States will not only procure these items but the Private hospitals will also be procuring these. When most of their services are exempted from GST, they will not be able to avail input credit. Naturally, they will pass on this cost to end consumers.

Health care services provided by a clinical establishment, an authorized medical practitioner, or para-medics are exempt. [Sl. No. 74 of notification No. 12/2017- CT(Rate) dated 28.06.2017 as amended refers].

Services provided by senior doctors/ consultants/ technicians hired by the hospitals, whether employees or not, are healthcare services that are exempt. (CBIC circular No. 32/06/2018-GST dated 12-02-2018)

The centre has already passed the buck of vaccination to the states & private hospitals. Now, Finance Minister admits through her calculations that states will have to bear at least 29.5% cost of the total GST collected from them.

Now, they should come up with a reduced rate structure, so that the rule of reversal of ITC on ‘Exempted Goods’ can also be avoided or government can provide the refund Mechanism as well subject to certain conditions. Just Suggesting!

Read & Download the full Copy in pdf:

TaxTru Business Advisors

TaxTru Business Advisors

Consultants