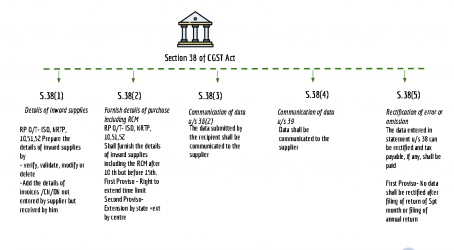

Section 38 of CGST Act Communication of details of inward supplies and input tax credit. (Updated till July 2024)

Section 38. Communication of details of inward supplies and input tax credit as amended by the Finance Act 2023

(1) The details of outward supplies furnished by the registered persons under sub-section (1) of

section 37 and of such other supplies as may be prescribed, and an auto-generated statement

containing the details of input tax credit shall be made available electronically to the recipients of

such supplies in such form and manner, within such time, and subject to such conditions and

restrictions as may be prescribed.

(2) The auto-generated statement under sub-section (1) shall consist of––

(a) details of inward supplies in respect of which credit of input tax may be available to the

recipient; and

(b) details of supplies in respect of which such credit cannot be availed, whether wholly or

partly, by the recipient, on account of the details of the said supplies being furnished

under sub-section (1) of section 37,–

(i) by any registered person within such period of taking registration as may be

prescribed; or

(ii) by any registered person, who has defaulted in payment of tax and where such

default has continued for such period as may be prescribed; or

(iii) by any registered person, the output tax payable by whom in accordance with the

statement of outward supplies furnished by him under the said sub-section during

such period, as may be prescribed, exceeds the output tax paid by him during the

said period by such limit as may be prescribed; or

(iv) by any registered person who, during such period as may be prescribed, has

availed credit of input tax of an amount that exceeds the credit that can be availed

by him in accordance with clause (a), by such limit as may be prescribed; or

(v) by any registered person, who has defaulted in discharging his tax liability in

accordance with the provisions of sub-section (12) of section 49 subject to such

conditions and restrictions as may be prescribed; or

(vi) by such other class of persons as may be prescribed.]

Prem

Prem

designer

Adilabad, India

gst taxation