All about Surrender of DIN: Practical aspects

All about Surrender of DIN: Practical aspects

Recently MCA has prescribed eForm DIR-3 KYC which needs to be filed annually by every DIN holder and non-filing or delayed the filing of which results in Penalty of Rs. 5000. In view of this surrender of DIN become very important by those DIN holders who are neither Director in any Company and nor Designated Partner in any LLP and also not intending to do so in near future. Further, it is also important to Surrender Duplicate or additional DIN if any.

As per amendment, every person holding DIN have to file e-form DIR-3 KYC every financial year till 30th April. Even if such person not holding any Directorship in any company and not intend to get the appointment in future still required filing e-form DIR-3 KYC.

However, many professionals/ individuals having the question in mind i.e. “Whether a person can surrender his DIN” in case he doesn’t want to use it in future.

Legal Language:

As per Section 153:

Every individual intending to be appointed as director of a Company shall make an application for allotment of Director Identification Number to the Central Government in such form and manner and along with such fees as may be prescribed.

As per Section 155:

Prohibition to Obtain More than One Director Identification Number

No individual, who has already been allotted a Director Identification Number under section 154, shall apply for, obtain or possess another Director Identification Number.

Rule 11 Surrender of DIN:

The Central Government or Regional Director (Northern Region), Delhi or any officer authorised by the Regional Director may, upon being satisfied on verification of particulars or documentary proof attached with the application received along with fee as specified in Companies (Registration Offices and Fees) Rules, 2014] from any person, cancel or deactivate the DIN in case:

a)the DIN is found to be duplicated in respect of the same person provided the data related to both the DIN shall be merged with the validly retained number;

- b)the DIN was obtained in a wrongful manner or by fraudulent means;

- c)of the death of the concerned individual;

- d)the concerned individual has been declared as a person of unsound mind by a competent Court;

- e)if the concerned individual has been adjudicated an insolvent:

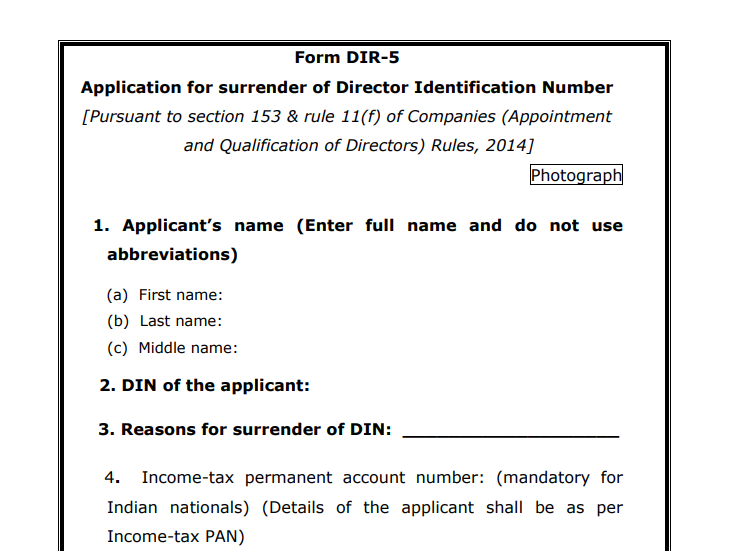

- f)on an application made in Form DIR-5 by the DIN holder to surrender his or her DIN along with the declaration that he has never been appointed as the director in any company and the said DIN has never been used for filing of any document with any authority, the Central Government may deactivate such DIN.

As per Section 159:

If any individual or director of a Company, contravenes any of the provisions of Section 153, such individual or director of the Company shall be punishable with

- imprisonment for a term which may extend to Six months or

- with fine which may extend to Rs. 50,000/- and

- Where the contravention is a continuing one, with a further fine which may extend to Rs. 500/- for every day after the first during which the contravention

Food for Thought:

- Whether an individual (DIN holder) can surrender his DIN, If Such DIN never used?

- Whether an individual (DIN holder) can surrender his DIN, If Such person not holding any directorship at present, but held directorship in past?

Discussion on Provisions:

As per Section 155, it is clear that if a person holding DIN then such person can’t apply for another DIN. If he does so It shall be punishable u/s 159 of Companies Act, 2013.

Grounds for Surrender of DIN:

Regional Director can cancel/surrender DIN on the basis of situation mentioned in Rule 11.

Rule 11 (a-e) mentioned the situation for the surrender of DIN Like (unsound mind, Death, Insolvent etc).

However, Rule 11(f) states that “on an application made in Form DIR-5 by the DIN holder to surrender his or her DIN along with declaration that he has never been appointed as director in any company and the said DIN has never been used for filing of any document with any authority, the Central Government may deactivate such DIN”

Note:

As per Rule 11(f) – when a person made application in DIR-5 for surrender of his DIN to RD has to ensure following conditions:

– That he has never been appointed as the director in any company; and

– The said DIN has never been used for filing of any document with any authority.

Download the Form DIR-5 by clicking the below Image:

FAQ’S – Surrender of DIN

FAQ’s are based on Section 153 and other Relevant Sections of Companies Act, 2013 relevant to Surrender of DIN.

Q.1. Whether it is allowed to have more than one DIN by an individual?

As per Section 155: No individual, who has already been allotted a Director Identification Number under section 154, shall apply for, obtain or possess another Director Identification Number

However, one can opine that if a person has applied or got a second DIN then it shall be considered as non-compliance with Section 155.

Q.2 What shall be the penalty on the individual if a person having two DIN?

As per Section 159: If any individual or director of a company, contravenes any of the provisions of section 152, section 155 and section 156, such individual or director of the company shall be punishable with imprisonment for a term which may extend to six months or with fine which may extend to fifty thousand rupees and where the contravention is a continuing one, with a further fine which may extend to five hundred rupees for every day after the first during which the contravention continues.

However, one can opine that it defaults on the part of the individual and such individual shall be punishable with the file as mentioned above.

Q.3. If a person having two DIN, then whether such a person can surrender DIN?

As per Rule 11 of The Companies (Appointment and qualification of Directors) Rules, 2014 “The Central Government or Regional Director (Northern Region), Noida or any officer authorised by the Regional Director may, upon being satisfied on verification of particulars or documentary proof attached with the application received along with fee as specified in Companies (Registration Offices and Fees) Rules, 2014 from any person, cancel or deactivate the DIN”.

However, one can opine that Rule 11 allowed an individual to surrender of DIN if having more than 2 DIN.

Q.4. In case of 2 DIN, First DIN shall be surrender or Second DIN shall be Surrender?

In Another Word First Din obtained in 2006 and the second DIN obtained in 2010, and then which DIN no. can be surrender.

As per provisions of Companies act read with relevant rules and Updation on the MCA website “ in respect of an individual who is in possession of Duplicate/Multiple DINs, he can retain the Oldest DIN only. DINs obtained later have to be surrendered.”

However, one can opine that DIN has taken on later on (means the second DIN) shall be the surrender by the individual. Surrender of First DIN is not at all allowed.

Q.5. – If a person having 2 DIN. Such person having directorships by second DIN, but no directorship on first DIN. Then whether he can surrender the second DIN. If yes, what shall be status of Directorship?

As per CA, 2013 and from the above-mentioned question it is clear that second DIN can’t be retained by the individual in any of situations.

Therefore, Individual has to surrender the Second DIN. But what shall be status of directorships?

As per Act, in the above-mentioned situation following shall be done:

- The individual has to surrender Second DIN Only.

- RD shall migrate directorship of Second DIN on First DIN.

- After migration second DIN shall be surrender

Q.6. If a person having Single DIN only, whether he can surrender his DIN?

Regional Director can cancel/surrender DIN on the basis of situation mentioned in Rule 11.

Rule 11 (a-e) mentioned the situation for the surrender of DIN Like (unsound mind, Death, Insolvent etc).

However, Rule 11(f) states that “on an application made in Form DIR-5 by the DIN holder to surrender his or her DIN along with declaration that he has never been appointed as director in any company and the said DIN has never been used for filing of any document with any authority, the Central Government may deactivate such DIN”

Note:

As per Rule 11(f) – when a person made application in DIR-5 for the surrender of his DIN to RD has to ensure following conditions:

- That he has never been appointed as the director in any company; and

- The said DIN never been used for filing of any document with any authority.

Therefore, one can opine that Single DIN which never used by the applicant can be surrender. But if it is used ever then can’t be surrender.

In Simple Words:

- Single DIN never used can be surrender.

- Single DIN ever used can’t be surrender.

Q.7. Whether Surrender of DIN is enough or it is mandatory to file COMPOUNDING APPLICATION also with surrender?

As discussed in question no. 2 in case of double din penalty shall be as per Section 159.

As per practical situation, after filing of documents/ forms for Surrender of DIN Regional Director is asking for the acknowledgment of Compounding Petition.

Therefore, one can opine that along with surrender of second DIN, compounding Is mandatory.

Q.8. Which Regional Director having the power of Surrender of DIN?

Regional Director Northern Region, Delhi having the power to deal with all the matters of DIN. Power to cancel DIN is also vested with RD Northern Region.

Conclusion:

As per rule 11(f), a person can apply for surrender of DIN only in the situation when “DIN is unused and never used for appointment as director in any Company” (except situations like unsound mind, death, and insolvent).

Therefore, one can opine that, if a person held directorship in any company during his life using such DIN, that DIN can’t be the surrender by the filing of e-form DIR-5.

CA Sangam Kumar Aggarwal

CA Sangam Kumar Aggarwal

Sangam Aggarwal is a seasoned Tax Practitioner, a Fellow member of ICAI and He has done his LLB in 2014 and has also qualified DISA along with Certificate Course in Concurrent Audit from ICAI. He has also acted as a Co-opted member of the Corporate & Allied Laws and Corporate Governance Committee of NIRC of ICAI (2019-20). He has 12+ years of rich and profound experience in the field of Taxation (Direct & Indirect) and Advisory. He makes Representations for a widely diversified cross-section of industries before Authority for Advance Rulings, CIT (A), ITAT, and other appropriate forums. Sangam Aggarwal has previously worked with IFFCO Tokio General Insurance Co. Ltd. as Manager in Finance & Accounts. He is currently the managing partner of in Chartered Accountants Firm. Sangam Aggarwal is visiting faculty of ICAI and have spoken on different forums of ICAI.