Assessee didnt responded to the Notices- Writ for cancelled registration set aside (Pdf Attach)

Cases Covered:

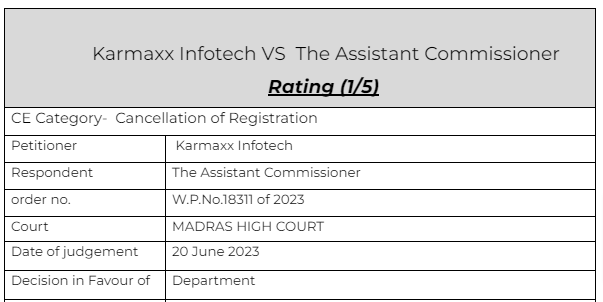

Karmaxx Infotech VS The Assistant Commissioner

Citation:

1. Kaur & Singh v Collector of Central Excise,

Facts of the case

The principal place of business was changed by the taxpayer. But the information was not updated on the GST portal.The unregistered office of the petitioner was visited by the authorities. The officers cancelled his registration citing section 29(2)(e) of the CGST Act.

The applicant filed the writ to get his registration restored.

Observations & Judgement of the court

The unregistered premises of the petitioner was subject to a visit / inspection by the authorities, even prior to the issuance of impugned notice and thus the petitioner is well aware of the sequence of events leading upto the issuance of notice itself.

The query raised at the time of, and post relates to valuation of the goods exemption and thus, this aspect of the matter is also well within the petitioner’s knowledge. In all, the submission that the show-cause notice was non-speaking and the petitioner was aware of the details of the proposals, is found to be misconceived as all facts relating to the same were well within the petitioner’s knowledge.

The mere fact that the reply has been filed at the will and pleasure of the petitioner, beyond the period granted by this officer would not, in my view, entitle the petitioner to the relief sought. For the reasons as aforesaid, I am disinclined to intervene in this matter and dismiss the writ petition. No costs. Connected miscellaneous petitions are closed.

Read & Download the Full Karmaxx Infotech VS The Assistant Commissioner

optional file name

optional file name

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.