Refund cant be rejected without giving an opportunity of being heard

Cases Covered:

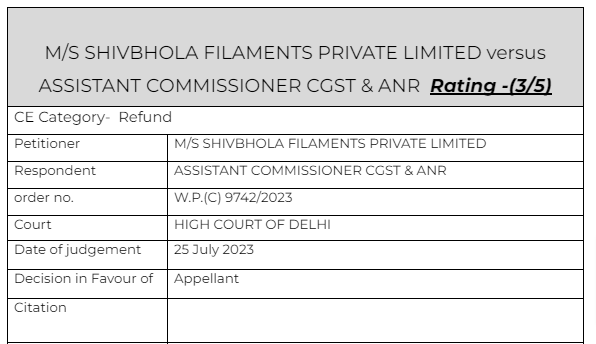

M/S SHIVBHOLA FILAMENTS PRIVATE LIMITED versus ASSISTANT COMMISSIONER CGST & ANR

Facts of the Cases:

The petitioner filed the refund application under the inverted rated supply. The petitioner received “Notice of Rejection of Application for Refund” dated 18.12.2020 (hereafter ‘Show Cause Notice’) in respect of each of its refund applications. The petitioner was also called upon to show cause as to why its refund applications should not be rejected.

The aforementioned notices indicated that the petitioner’s applications for refund were proposed to be rejected for the reason that there was mismatch with the returns filed by the petitioner in form GSTR 2A.

Later On his refund was rejected on the same ground of mismatch

Observations & Judgement of the court:

The court observed that

“In view of the above, we consider it apposite to set aside the impugned Order-in-Appeal dated 18.11.2021 as well as the orders dated 31.12.2020 passed by the Adjudicating Authority (annexed with the petition as Annexure P/4) and restore the petitioner’s applications for refund before the Adjudicating Authority for determining the amount of refund payable to the petitioner after affording the petitioner an opportunity to be heard. The petitioner is also at liberty to file a written explanation along with a statement reconciling the quantum of refund claimed with the amounts as disclosed in the returns, within a period of two weeks from today. In the event, the petitioner files any such detailed explanation and reconciliation statements, the Adjudicating Authority shall consider the same and pass a speaking order”

Comments:

The refund was rejected without giving the proper opportunity

Read & Download the Full M/S SHIVBHOLA FILAMENTS PRIVATE LIMITED versus ASSISTANT COMMISSIONER CGST & ANR

optional file name

optional file name

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.