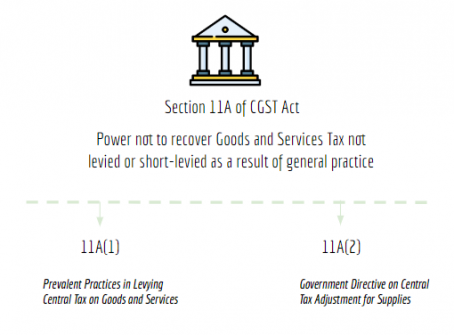

Notwithstanding anything contained in this Act, if the Government is satisfied that ––

(a) a practice was, or is, generally prevalent regarding levy of central tax (including non-levy thereof) on any supply of goods or services or both; and

(b) such supplies were, or are, liable to, –

(i) central tax, in cases where according to the said practice, central tax was not, or is not being, levied, or

(ii) a higher amount of central tax than what was, or is being, levied, in accordance with the said practice, the Government may, on the recommendation of the Council, by notification in the Official Gazette, direct that the whole of the central tax payable on such supplies, or, as the case may be, the central tax in excess of that payable on such supplies, but for the said practice, shall not be required to be paid in respect of the supplies on which the central tax was not, or is not being levied, or was, or is being, short-levied, in accordance with the said practice.

Prem

Prem

designer

Adilabad, India

gst taxation

Recieve the most important tips and updates

Absolutely Free! Unsubscribe anytime.

We adhere 100% to the no-spam policy.