E-book on meaning of important terms used in GST by CA Ashok Batra

Introduction

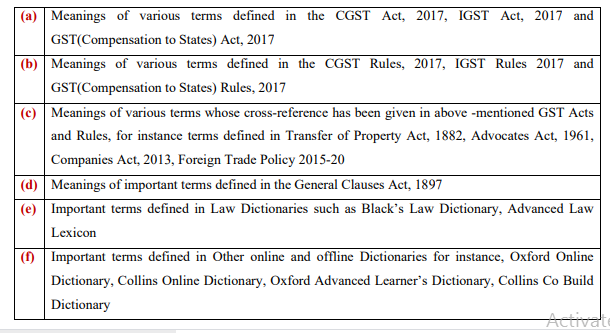

In order to carefully grasp and properly understand the Goods and Services Tax (GST), it becomes essential not only for indirect taxes professionals but for the tax administrators to have the knowledge of the precise meanings of the various terms used in the GST Acts, Rules and Notifications, etc. Further, as GST Law is still evolving and Government is frequently issuing new Notifications and Circulars to redress the issues of all the concerned stakeholders, keeping track of meanings of the various terms becomes really an uphill task. Keeping in mind the practical difficulty of the tax professionals and tax administrators, a modest attempt has been made to make an all-inclusive list, consisting of the following:

It is sincerely hoped that this E-Book becomes a quick source for reference and consequently saves the precious time of the readers.

Related Topic:

Download Updated GST E-book on Real estate

Meanings Of Important Terms Used In GST Law

| S. No. | Term | Meaning and Source |

| 1. | Abandoned | Oxford Advanced Learner’s Dictionary [7th Edition]

Deserted, discarded, forsaken, vacant |

| 2. | Abet | Oxford Online Dictionary

Assist, help, support, back, encourage Section 3(1) of the General Clauses Act, 1897 “Abet”, with its grammatical variations and cognate expressions, shall have the same meaning as in the Indian Penal Code

|

| 3. | Access | Oxford Advanced Learner’s Dictionary [7th Edition]

Right of entry, admission, right to use |

| 4. | Account | Explanation (a) to Sec. 13(8) of the IGST Act, 2017

“Account” means an account bearing interest to the depositor and includes a non-resident external account and a non-resident ordinary account |

| 5. | Act | Explanation (a) to Rule 97 of the CGST Rules, 2017

‘Act’ means the Central Goods and Services Tax Act, 2017 or the Central Excise Act, 1944 as the case may be Advanced Law Lexicon Something done; the process of doing or performing Section 3(2) of the General Clauses Act, 1897 “Act”, used with reference to an offense or a civil wrong, shall include a series of acts, and words which refer to acts done extend also to illegal omissions |

| 6. | A complete tax period | N. No. 85/2020-CT, dated 10.11.2020

“A complete tax period” means a tax period in which the person is registered from the first day of the tax period till the last day of the tax period |

| 7. | Actionable claim | Section 2(1) of the CGST Act, 2017

“Actionable claim” shall have the same meaning as assigned to it in section 3 of the Transfer of Property Act, 1882 Section 3 of the Transfer of Property Act, 1882 “Actionable claim” means a claim to any debt, other than a debt secured by mortgage of immovable property or by hypothecation or pledge of movable property, or to any beneficial interest in movable property not in the possession, either actual or constructive, of the claimant, which the civil courts recognize as affording grounds for relief, whether such debt or beneficial interest be existent, accruing, conditional or contingent. |

| 8. | Additions | Oxford Advanced Learner’s Dictionary [7th Edition]

Add-ons, accompaniments, added extras |

| 9. | Admission | Oxford Advanced Learner’s Dictionary [7th Edition]

Fee, charge, price, Entry fee, Ticket price |

| 10. | Address of delivery | Section 2(2) of the CGST Act, 2017

“address of delivery” means the address of the recipient of goods or services or both indicated on the tax invoice issued by a registered person for delivery of such goods or services or both |

| 11. | Address on record | Section 2(3) of the CGST Act, 2017

“Address on record” means the address of the recipient as available in the records of the supplier |

| 12. | Adjudicating authority | Section 2(4) of the CGST Act, 2017

For 01.07.2017 to 31.01.2019 “Adjudicating Authority” means any authority, appointed or authorized to pass any order or decision under this Act, but does not include the Central Board of Excise and Customs, the Revisional Authority, the Authority for Advance Ruling, the Appellate Authority for Advance Ruling, the Appellate Authority and the Appellate Tribunal. For 01.02.2019 to a date immediately preceding the date to be notified Adjudicating Authority” means any authority, appointed or authorized to pass any order or decision under this Act, but does not include the Central Board of Indirect Taxes and Customs, the Revisional Authority, the Authority for Advance Ruling, the Appellate Authority for Advance Ruling, the Appellate Authority, the Appellate Tribunal, and the Authority referred to in sub-section (2) of section 171 With effect from a date to be notified- Section 92 of the Finance (No. 2) Act, 2019 “Adjudicating Authority” means any authority, appointed or authorized to pass any order or decision under this Act but does not include the Central Board of Indirect Taxes and Customs, the Revisional Authority, the Authority for Advance Ruling, the National Appellate Authority for Advance Ruling, the Appellate Authority for Advance Ruling, the Appellate Authority, the Appellate Tribunal, and the Authority referred to in sub-section (2) of section 171 |

| 13. | Adjusted Total Turnover | Rule 89(4) of the CGST Rules, 2017 For 01.07.2017 to 22.10.2017

“Adjusted Total Turnover” means the turnover in a State or a Union territory, as defined under sub-section (112) of section 2, excluding the value of exempt supplies other than zero-rated supplies, during the relevant period- for 23.10.2017 to 03.09.2018 –N. No. 03/2018-CT, dated 23.01.2018 “Adjusted Total turnover” means the turnover in a State or a Union territory, as defined under sub-section (112) of section 2, excluding– (a) The value of exempt supplies other than zero-rated supplies; and (b) The turnover of supplies in respect of which refund is claimed under sub-rules (4A) or (4B) or both, if any, during the relevant period With effect from 04.09.2018 –N. No. 39/2018-CT, dated 04.09.2018 “Adjusted Total Turnover” means the sum total of the value of- (a) The turnover in a State or a Union territory, as defined under clause (112) of section 2, excluding the turnover of services; and (b) The turnover of zero-rated supply of services determined in terms of clause (D) above and non-zero-rated supply of services, excluding- (i) The value of exempt supplies other than zero-rated supplies; and (ii) The turnover of supplies in respect of which refund is claimed under sub-rule (4A) or sub-rule (4B) or both, if any, during the relevant period |

| 14. | Advance authorization | Explanation 1 to N. No. 48/2017-CT, dated 18.10.2017 For 01.07.2017 to 14.01.2019

“Advance Authorisation” means an authorization issued by the Director-General of Foreign Trade under Chapter 4 of the Foreign Trade Policy 2015-20 for import or domestic procurement of inputs on a pre-import basis for physical exports With effect from 15.01.2019 – N. No. 01/2019-CT, dated 15.01.2019 “Advance Authorisation” means an authorization issued by the Director-General of Foreign Trade under Chapter 4 of the Foreign Trade Policy 2015-20 for import or domestic procurement of inputs for physical exports Chapter 4 of the Foreign Trade Policy 2015-20 “Advance Authorization” means- (a) Advance Authorisation is issued to allow duty-free import of input, which is physically incorporated in export product (making normal allowance for wastage). In addition, fuel, oil, the catalyst which is consumed/utilized in the process of production of export products, may also be allowed. (b) Advance Authorisation is issued for inputs in relation to the resultant product, on the following basis: (i) As per Standard Input Output Norms (SION) notified (available in Hand Book of Procedures), OR (ii) On the basis of self-declaration as per paragraph 4.07 of Handbook of Procedures |

Read & download a full copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.