Free E book on anti-profiteering

We have brought you the Free E book on anti-profiteering by the CA Pritham Mahure. Following is the text sample of the Free E book on anti-profiteering:

1. Anti-profiteering – Policy

1.1 Anti-profiteering legislation

we await to celebrate completion of two years of GST in India, clarity about ‘anti-profiteering’ provision has been at the forefront of taxpayers worries.

Though, anti-profiteering provision was introduced with the intent that it should benefit the consumer, however, the question is whether the intent is materialised? Lets decode.

Section 171 of CGST Act, 2017 introduced the much celebrated ‘Antiprofiteering provisions’ to ensure that the benefits arising out of the GST regime are passed on to consumers. In this regard, Rule 122 to 137 of CGST Rules were introduced which deal with anti-profiteering. National Anti-Profiteering Authority is created to ensure compliance of anti-profiteering provisions.

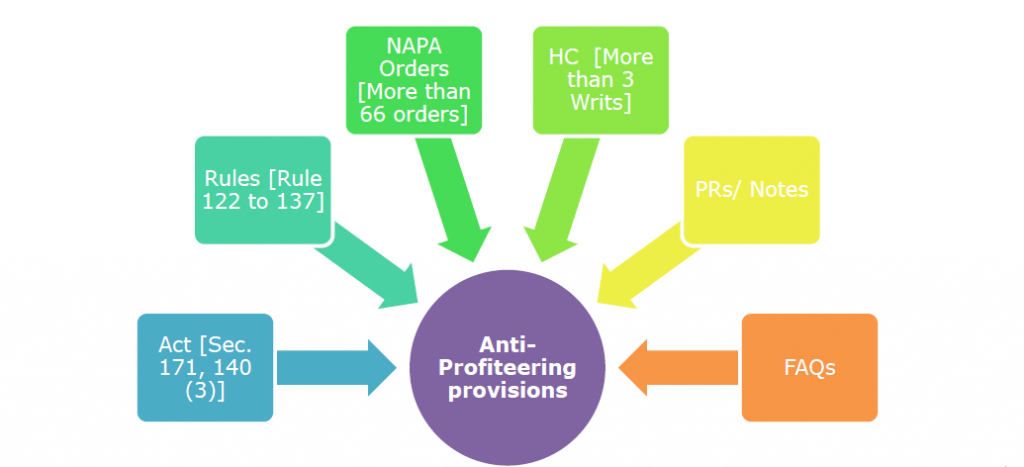

1.2 Anti-Profiteering legislation – Coverage

Anti-profiteering legislation is tabulated below:

1.3 What section 171 says?

171 of CGST Act mandates a supplier to pass on the benefits, due to rate reduction and more credits being available in GST regime, to the consumer by way of commensurate reduction in prices. It is pertinent to note that Section 171 is just 10 lines long! Section 171 of CGST Act reproduced below:

“SECTION 171. Anti-profiteering measure. —

(1) Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices.

(2) The Central Government may, on recommendations of the Council, by notification, constitute an Authority, or empower an existing Authority constituted under any law for the time being in force, to examine whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.

(3) The Authority referred to in sub-section (2) shall exercise such powers and discharge such functions as may be prescribed.”

Related Topic:

E-book on meaning of important terms used in GST by CA Ashok Batra

Analysis

Clause (1) of Section 171 is most critical clause as it lays down the basis for anti-profiteering. However, this clause just has 34 words and most of the critical words used there is un-defined such as:

a. ‘Reduction’ in ‘rate’ of ‘tax’

b. ‘The benefit’ of ‘input tax credit’

c. ‘Commensurate’ ‘reduction’ in ‘prices’

‘Reduction’ in ‘rate’ of ‘tax’

Herein the meaning of the term ‘reduction in tax’ is not very clear. For example, what if rate of tax is reduced but input tax credit is denied? Whether in such cases only net benefit, if any to be passed on? Apparently, based on the NAA Orders it appears that the reference here is to net benefit.

Similarly, does the term ‘tax’ here means GST or even pre-GST taxes (such as Excise, VAT/CST and Service Tax, Entertainment Tax etc? It may be noted that section 9 of CGST Act refer ‘tax’ as Central GST only.

‘The benefit’ of ‘input tax credit’

While discussing rates, Section 171 mentions ‘reduction’ but when it comes to ITC, it only mentions ‘the benefit’ rather than qualifying it by:

– Increased benefit

– Incremental benefit

– Additional benefit

– New benefit etc

When in preceding line of the section there is mention of ‘any reduction’, then conspicuous absence of antonym (such as increased, incremental etc) in the subsequent part of the section 171, could dangerously lead to interpretation that the Legislators wanted that ‘the benefit’ of ITC (i.e. entire ITC and not incremental ITC) should be passed on to recipient.

However, by referring to a few of the NAPA orders one can say that only incremental credit is to be passed on. Also, one can contend that the intention of Anti-profiteering is only to ensure that prices should not be increased in cases where there is additional credit available to the supplier (i.e. based on the intent of the law).

‘Commensurate’ ‘reduction’ in ‘prices’

Again the terms ‘commensurate’ ‘reduction’ and ‘price’ is undefined. Thus, the question that often debated is whether, instead of reducing the price, the GST payer can increase the number of goods? However, the approach of giving more quantity of goods (instead of reducing prices) does not seem to have acceptance of NAA.