GST Audit and GST audit report

Requirement of GST Audit in FORM GSTR 9C:

When Section 35(5) of CGST Act provide for the requirement of GST Audit by a professional. This audit can be conducted by a CA or CMA. Form prescribed by CBIC for Audit in GST in FORMS GSTR 9C.

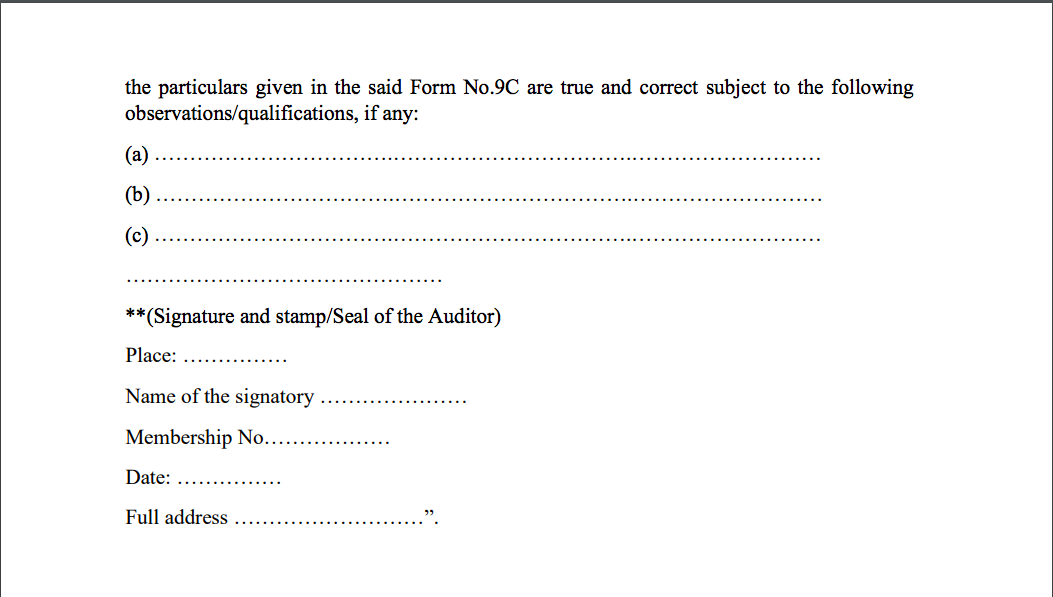

GST Audit report is a certification. The format of report is also attached here. The certification is covering two conditions. First when the audit is also conducted by same person. Second when the audit is conducted by some other professional.

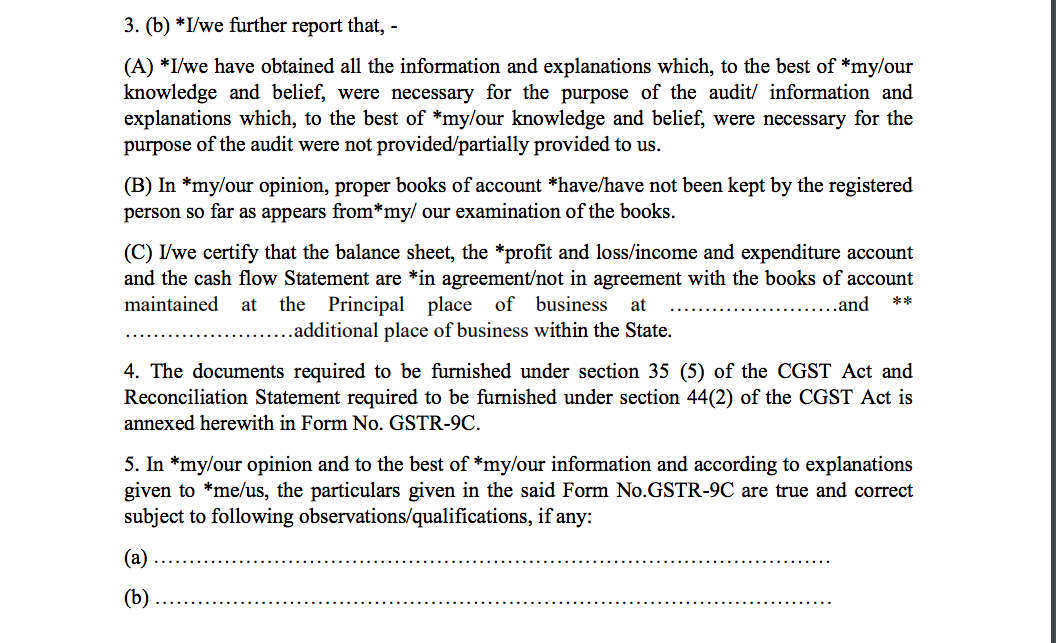

Certification Part of GST Audit Report in FORM GSTR 9C when a person has also conducted the Audit

Following certification is required by GST auditor.Certification in cases where the reconciliation statement (FORM GSTR-9C) is drawn up by the person who had conducted the audit:

Related Topic:

Draft Disclosures for GST Audit Report

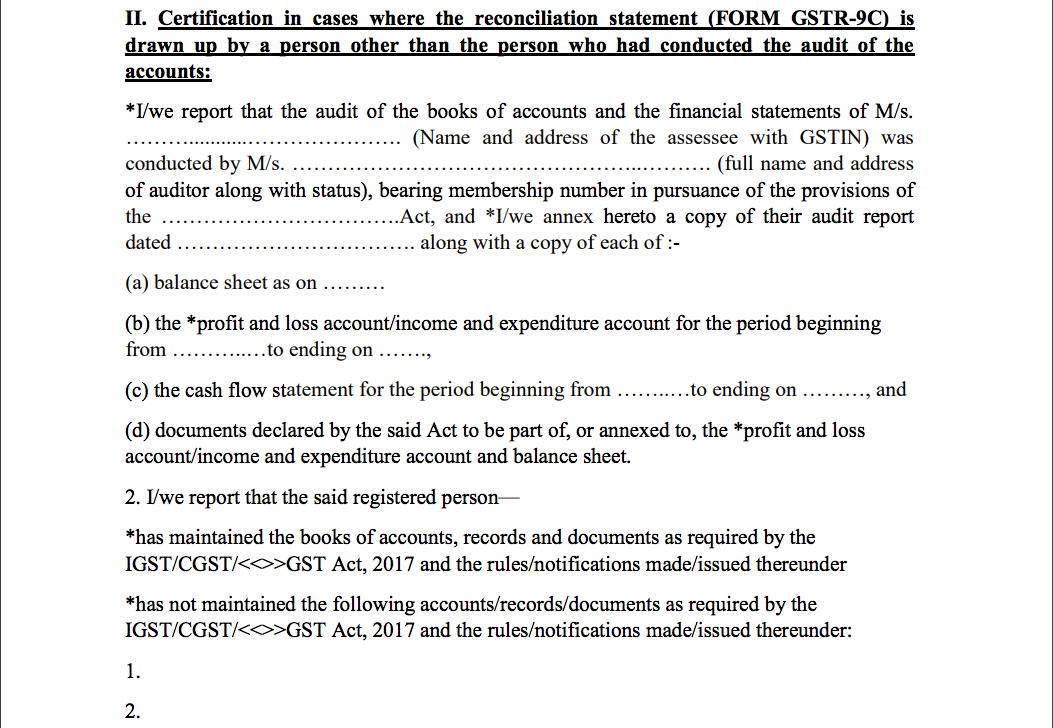

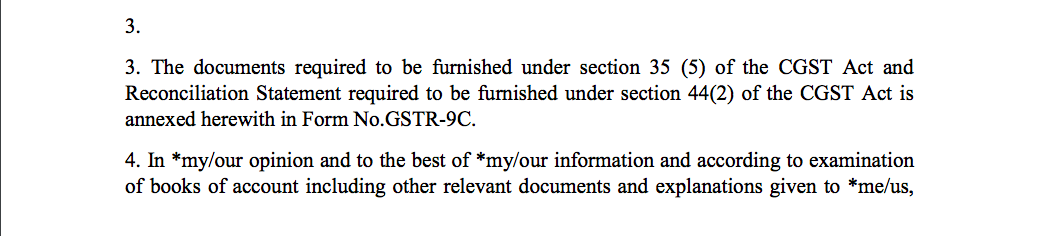

Certification Part of GST Audit Report in FORM GSTR 9C when Audit is conducted by someone else:

In this certification some of the undertakings are removed. Also the auditor is required to mention the details of auditor who conducted the normal audit.

Reconciliation part of GST Audit report in Form GSTR 9C

This is first portion of Form GSTR 9C. There are various reconciliations in GSTR 9C. The date in audited financials is reconciled with the data of GST annual return. In GST annual return data declared in various GST returns filed during the year is compiled.

Part I of GST Audit report in Form GSTR 9C: Basic information

In this part basic information relation to taxable person are compiled.

- Financial Year

- GSITN

- Legal Name

- Trade Name

- Are you liable for audit under any Act?

Out of the above fields first four will be auto populated. The last one will be required to be filled by the taxpayer.

GST audit report part I basic info

Part II of GST Audit Report GSTR 9C:

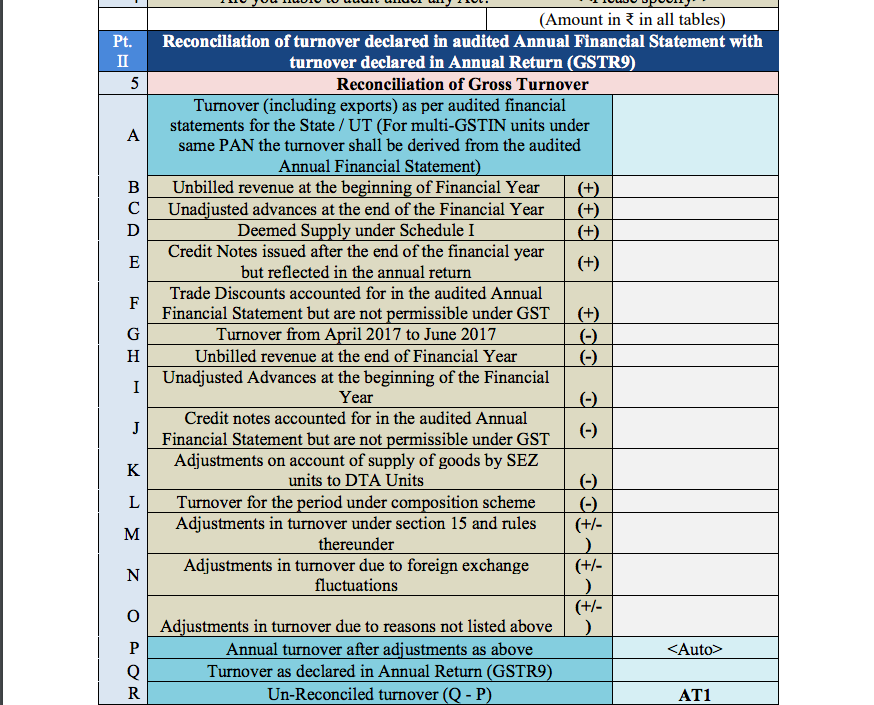

Table 5 of GST Audit report Form GSTR 9C: Reconciliation of turnover declared in audited Annual Financial Statement with turnover declared in GSTR 9

This is the first reconciliation in Audit report under GST. Here the turnover declared in financials will be compared with the turnover declared in returns. Necessary adjustments will also be made. There is also a requirement to mention the reasons for any difference in both of the turnover.

Following is the information we need to give in this reconciliation:

Credit Notes issued after the end of the financial year but reflected in the annual return (+)

The turnover as per the audited Annual Financial Statement shall be declared here. There may be cases where multiple GSTINs (State-wise) registrations exist on the same PAN. This is common for persons / entities with presence over multiple States. Such persons / entities, will have to internally derive their GSTIN wise turnover and declare the same here. This shall include export turnover (if any). It may be noted that reference to audited Annual Financial Statement includes reference to books of accounts in case of persons / entities having presence over multiple States.

| 5. | Reconciliation of Gross Turnover | Instruction to fill this coloumn |

| A. |

Turnover (including exports) as per audited financial statements for the State / UT (For multi-GSTIN units under same PAN the turnover shall be derived from the audited Annual Financial Statement)

|

|

| B. |

Unbilled revenue at the beginning of Financial Year (+) |

Unbilled revenue which was recorded in the books of accounts on the basis of accrual system of accounting in the last financial year and was carried forward to the current financial year shall be declared here. In other words, when GST is payable during the financial year on such revenue (which was recognized earlier), the value of such revenue shall be declared here.

(For example, if rupees Ten Crores of unbilled revenue existed for the financial year 2016-17, and during the current financial year, GST was paid on rupees Four Crores of such revenue, then value of rupees Four Crores rupees shall be declared here) |

| C. |

Unadjusted advances at the end of the Financial Year (+) |

Value of all advances for which GST has been paid but the same has not been recognized as revenue in the audited Annual Financial Statement shall be declared here. |

| D. |

Deemed Supply under Schedule I (+) |

Aggregate value of deemed supplies under Schedule I of the CGST Act, 2017 shall be declared here. Any deemed supply which is already part of the turnover in the audited Annual Financial Statement is not required to be included here. |

| E. | Aggregate value of credit notes which were issued after 31st of March for any supply accounted in the current financial year but such credit notes were reflected in the annual return (GSTR-9)shall be declared here. | |

| F. |

Trade Discounts accounted for in the audited Annual Financial Statement but are not permissible under GST (+) |

Trade discounts which are accounted for in the audited Annual Financial Statement but on which GST was leviable (being not permissible) shall be declared here. |

| G. |

Turnover from April 2017 to June 2017 (-) |

Turnover included in the audited Annual Financial Statement for April 2017 to June 2017 shall be declared here. |

| H. |

Unbilled revenue at the end of Financial Year (-) |

Unbilled revenue which was recorded in the books of accounts on the basis of accrual system of accounting during the current financial year but GST was not payable on such revenue in the same financial year shall be declared here. |

| I. |

Unadjusted Advances at the beginning of the Financial Year (-) |

Value of all advances for which GST has not been paid but the same has been recognized as revenue in the audited Annual Financial Statement shall be declared here. |

| J. |

Credit notes accounted for in the audited Annual Financial Statement but are not permissible under GST (-) |

Aggregate value of credit notes which have been accounted for in the audited Annual Financial Statement but were not admissible under Section 34 of the CGST Act shall be declared here. |

| K. |

Adjustments on account of supply of goods by SEZ units to DTA Units (-) |

Aggregate value of all goods supplied by SEZs to DTA units for which the DTA units have filed bill of entry shall be declared here. |

| L. |

Turnover for the period under composition scheme (-) |

There may be cases where registered persons might have opted out of the composition scheme during the current financial year. Their turnover as per the audited Annual Financial Statement would include turnover both as composition taxpayer as well as normal taxpayer. Therefore, the turnover for which GST was paid under the composition scheme shall be declared here. |

| M. |

Adjustments in turnover under section 15 and rules thereunder (+/-) |

There may be cases where the taxable value and the invoice value differ due to valuation principles under section 15 of the CGST Act, 2017 and rules thereunder. Therefore, any difference between the turnover reported in the Annual Return (GSTR 9) and turnover reported in the audited Annual Financial Statement due to difference in valuation of supplies shall be declared here. |

| N. |

Adjustments in turnover due to foreign exchange fluctuations (+/-) |

Any difference between the turnover reported in the Annual Return (GSTR9) and turnover reported in the audited Annual Financial Statement due to foreign exchange fluctuations shall be declared here. |

| O. |

Adjustments in turnover due to reasons not listed above (+/-) |

Any difference between the turnover reported in the Annual Return (GSTR9) and turnover reported in the audited Annual Financial Statement due to reasons not listed above shall be declared here. |

| P. |

Annual turnover after adjustments as above (+/-) |

This field is auto populated as per the fields filled in 5A – 5O. |

| Q. | Turnover as declared in Annual Return (GSTR9) | Annual turnover as declared in the Annual Return (GSTR 9) shall be declared here. This turnover may be derived from Sr. No. 5N, 10 and 11 of Annual Return (GSTR 9). |

| R. | Un-Reconciled turnover (Q – P) AT1 | This will be the value of the unreconciled turnover as per the information provided in the table 5. |

Format of table 5 of GST Audit report GSTR 9C:

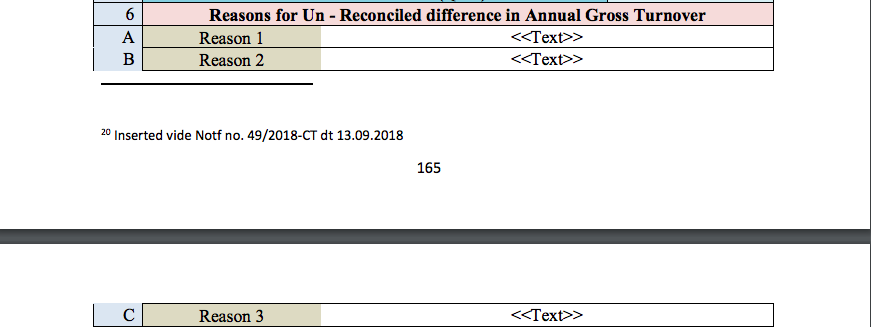

Table 6 of GST Audit Report FORM GSTR 9C:Reasons for Un – Reconciled difference in Annual Gross Turnover

A Reason 1

B Reason 2

C Reason 3

Reasons for difference in Annual Gross turnover in GSTR 9 and in Financial is required to be mentioned here.

Format of table 6 of GST Audit report GSTR 9C:

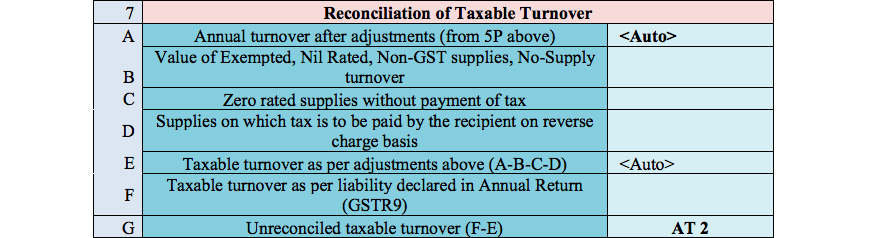

Table 7 of GST Audit Report FORM GSTR 9C:Reconciliation of Taxable Turnover

The table provides for reconciliation of taxable turnover from the audited annual turnover after adjustments with the taxable turnover declared in annual return (GSTR-9).

Annual turnover as derived in Table 5P above would be auto-populated here.Value of Exempted, Nil Rated, Non-GST supplies, No-Supply turnoverValue of exempted, nil rated, non-GST and no-supply turnover shall be declared here. This shall be reported net of credit notes, debit notes and amendments if any.Value of zero rated supplies (including supplies to SEZs) on which tax is not paid shall be declared here. This shall be reported net of credit notes, debit notes and amendments if any.Supplies on which tax is to be paid by the recipient on reverse charge basis The taxable turnover is derived as the difference between the annual turnover after adjustments declared in Table 7A above and the sum of all supplies (exempted, non-GST, reverse charge etc.) declared in Table 7B, 7C and 7D above.Taxable turnover as declared in Table 4N of the Annual Return (GSTR9) shall be declared here.

| Table 7 | ||

| A. | Annual turnover after adjustments (from 5P above) | |

| B. | ||

| C. |

Zero rated supplies without payment of tax |

|

| D. | Value of reverse charge supplies on which tax is to be paid by the recipient shall be declared here. This shall be reported net of credit notes, debit notes and amendments if any. | |

| E. |

Taxable turnover as per adjustments above (A-B-C-D) |

|

| F. | Taxable turnover as per liability declared in Annual Return (GSTR9) | |

| G. | Unreconciled taxable turnover (F-E) AT2 | This will be the value of the unreconciled turnover as per the information provided in the table 7. |

Format of Table 7 of GST Audit report GSTR 9C

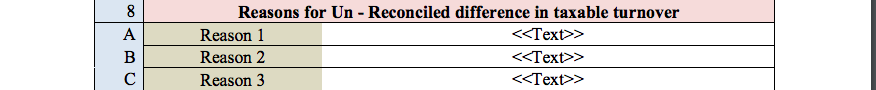

Table 8 of GST Audit Report Form GSTR 9C:Reasons for Un – Reconciled difference in taxable turnover

Reasons for non-reconciliation between adjusted annual taxable turnover as derived from Table 7E above and the taxable turnover declared in Table 7F shall be specified here.

GST Audit report table 8

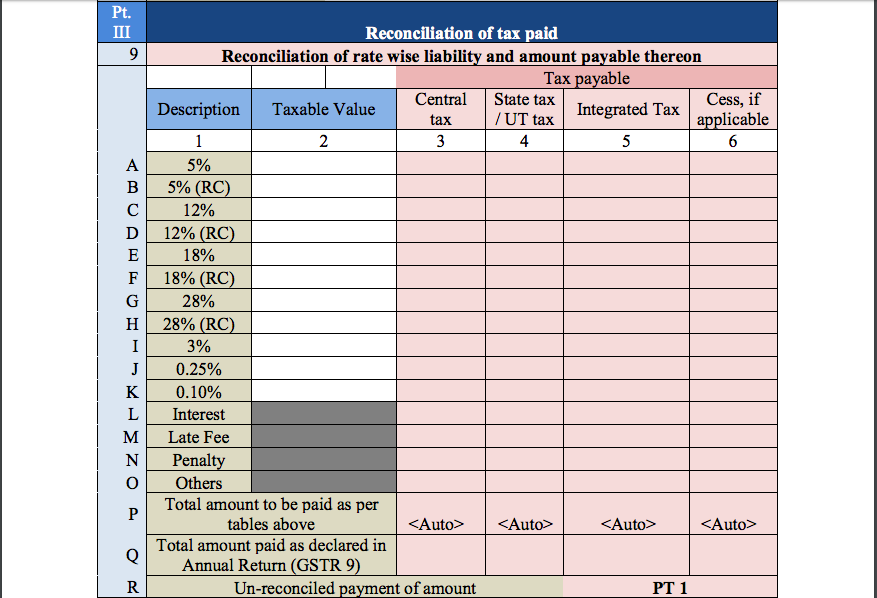

Part-III. Reconciliation of tax paid

Part III consists of reconciliation of the tax payable as per declaration in the reconciliation statement and the actual tax paid as declared in Annual Return (GSTR9).

Table 9 of GST Audit Report Form GSTR 9C:Reasons for Un – Reconciled difference in taxable turnover

Reconciliation of rate wise liability and amount payable thereon.The table provides for reconciliation of tax paid as per reconciliation statement and amount of tax paid as declared in Annual Return (GSTR 9). Under the head labelled “RC” supplies where tax was paid on reverse charge basis by the recipient (i.e. the person for whom reconciliation statement has been prepared ) shall be declared.

5%Taxable value and tax payable both are required to be mentionedTotal amount to be paid as per tables above

| Table 9 | Reconciliation of rate wise liability and amount payable thereon | |

| A. | ||

| B. | 5% RC | |

| C. | 12% | |

| D. | 12% RC | |

| E. | 18% | |

| F. | 18% RC | |

| G. | 28% | |

| H. | 28% RC | |

| I. | 3% | |

| J. | .25% | |

| K. | .10% | |

| L. | Interest | |

| M. | Late Fees | |

| N. | Penalty | |

| O. | Others | |

| P. | ||

| Q. |

Total amount paid as declared in Annual Return (GSTR 9) |

The amount payable as declared in Table 9 of the Annual Return (GSTR9) shall be declared here. It should also contain any differential tax paid on Table 10 or 11 of the Annual Return (GSTR9). |

| R. |

Un-reconciled payment of amount |

This will be the value of the unreconciled payment of tax to the government as per the information provided in the table 9. |

Format of Table table 9 of GST audit report GSTR 9C

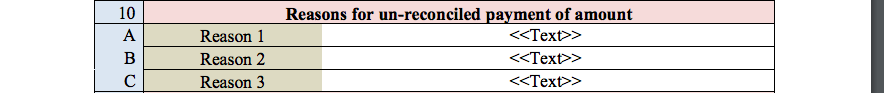

Table 10 of GST Audit report form GSTR 9C:

Reasons for un-reconciled payment of amount.Reasons for non-reconciliation between payable / liability declared in Table 9P above and the amount payable in Table 9Q shall be specified here.

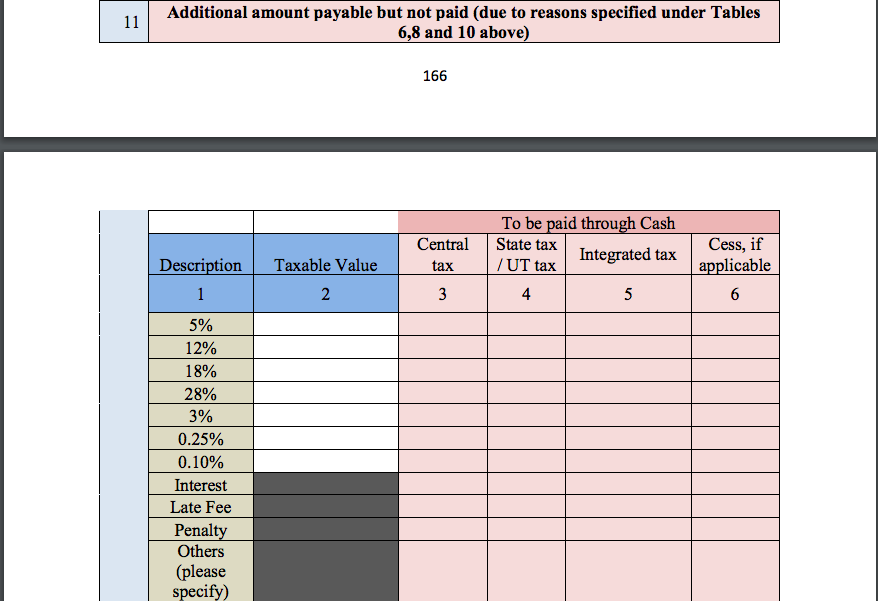

Table 11 of GST Audit report form GSTR 9C:Additional amount payable but not paid (due to reasons specified under Tables 6,8 and 10 above)

Any amount which is payable due to reasons specified under Table 6, 8 and 10 above shall be declared here

GST Audit report table 11

Part IV: Reconciliation of Input Tax Credit(ITC)

Table 12 of GST Audit Report Form GSTR 9C:Reconciliation of Net Input Tax Credit (ITC)

ITC availed as per audited Annual Financial Statement for the State/ UT (For multi-GSTIN units under same PAN this should be derived from books of accounts)ITC availed (after reversals) as per the audited Annual Financial Statement shall be declared here. There may be cases where multiple GSTINs (State-wise) registrations exist on the same PAN. This is common for persons / entities with presence over multiple States. Such persons / entities, will have to internally derive their ITC for each individual GSTIN and declare the same here. It may be noted that reference to audited Annual Financial Statement includes reference to books of accounts in case of persons / entities having presence over multiple States.Any ITC which was booked in the audited Annual Financial Statement of earlier financial year(s)but availed in the ITC ledger in the financial year for which the reconciliation statement is being filed for shall be declared here. This shall include transitional credit which was booked in earlier years but availed during Financial Year 2017-18.ITC booked in current Financial Year to be claimed in subsequent Financial Years (-)Any ITC which has been booked in the audited Annual Financial Statement of the current financial year but the same has not been credited to the ITC ledger for the said financial year shall be declared here.ITC availed as per audited Annual Financial Statement or books of accounts as derived from values declared in Table 12A, 12B and 12C above will be auto-populated here. Net ITC available for utilization as declared in Table 7J of Annual Return (GSTR9) shall be declared here.

ITC booked in earlier Financial Years claimed in current Financial Year (+)

| Table 12 | Reconciliation of Net Input Tax Credit (ITC) | |

| A. | ||

| B. | ||

| C. | ||

| D. | ITC availed as per audited financial statements or books of account (<Auto>) | |

| E. | ITC claimed in Annual Return (GSTR9) | |

| F. | Un-reconciled ITC (ITC1) | This will be the value of the unreconciled ITC as per the information provided in the table 12. |

GST Audit report table 13

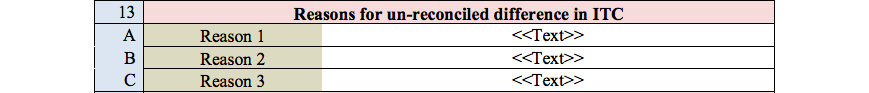

Table 13 of GST Audit Report GSTR 9C: Reasons for un-reconciled difference in ITC

Reasons for non-reconciliation of ITC as per audited Annual Financial Statement or books of account (Table 12D) and the net ITC (Table12E) availed in the Annual Return (GSTR9) shall be specified here.

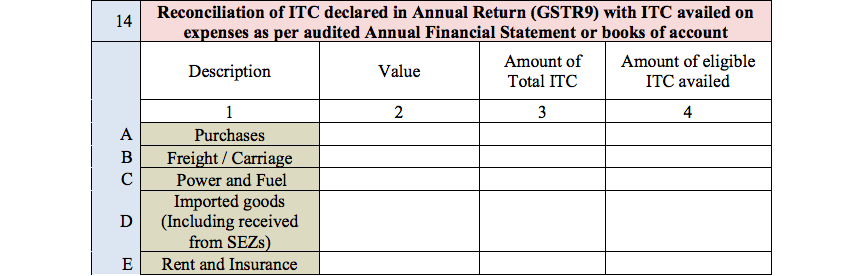

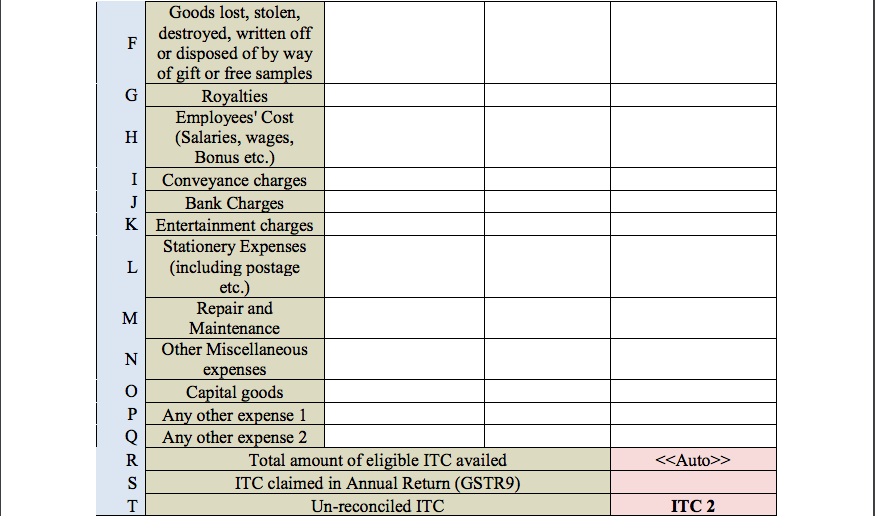

Table 14 of GST Audit Report FORM GSTR 9C: Reconciliation of ITC declared in Annual Return (GSTR9) with ITC availed on expenses as per audited Annual Financial Statement or books of account

This table is for reconciliation of ITC declared in the Annual Return (GSTR9) against the expenses booked in the audited Annual Financial Statement or books of account. The various sub-heads specified under this table are general expenses in the audited Annual Financial Statement or books of account on which ITC may or may not be available. Further, this is only an indicative list of heads under which expenses are generally booked. Taxpayers may add or delete any of these heads but all heads of expenses on which GST has been paid / was payable are to be declared here.

Reconciliation of ITC declared in Annual Return (GSTR9) with ITC availed on expenses as per audited Annual Financial Statement or books of account.

Total amount of eligible ITC availed Total ITC declared in Table 14A to 14Q above shall be auto populated here. Net ITC availed as declared in the Annual Return (GSTR9) shall be declared here. Table 7J of the Annual Return (GSTR9) may be used for filing this Table.

Table 14 |

||

| A. | Purchases | |

| B. | Freight / Carriage | |

| C. | Power and Fuel | |

| D. | Imported goods (Including received from SEZs) | |

| E. | Rent and Insurance | |

| F. | Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples | |

| G. | Royalties | |

| H. | Employees’ Cost (Salaries, wages, Bonus etc.) | |

| I. | Conveyance charges | |

| J. | Bank Charges | |

| K. | Entertainment charges | |

| L. | Stationery Expenses (including postage etc.) | |

| M. | Repair and Maintenance | |

| N. | Other Miscellaneous expenses | |

| O. | Capital goods | |

| P. | Any other expense 1 | |

| Q. | Any other expense 2 | |

| R. | ||

| S. | ITC claimed in Annual Return (GSTR9) | |

| T. | Un-reconciled ITC | This will be the value of the unreconciled ITC as per the information provided in the table 14. |

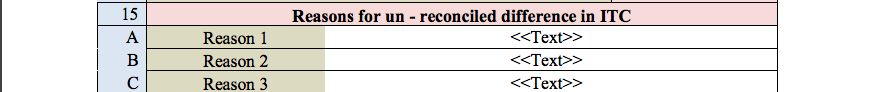

Table 15 of GST Audit Report FORM GSTR 9C:Reasons for un – reconciled difference in ITC

Reasons for non-reconciliation between ITC availed on the various expenses declared in Table 14R and ITC declared in Table 14S shall be specified here.

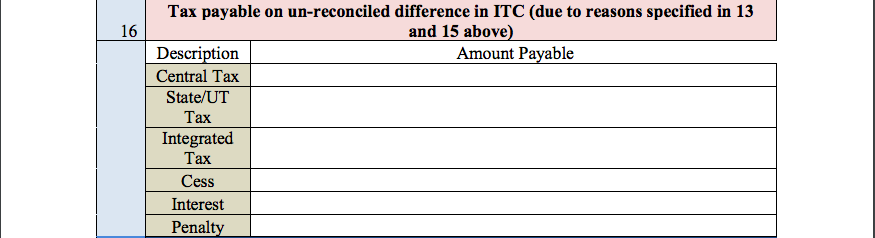

Table 16 of GST Audit Report GSTR 9C: Tax payable on un-reconciled difference in ITC (due to reasons specified in 13 and 15 above)

Any amount which is payable due to reasons specified in Table 13 and 15 above shall be declared here.

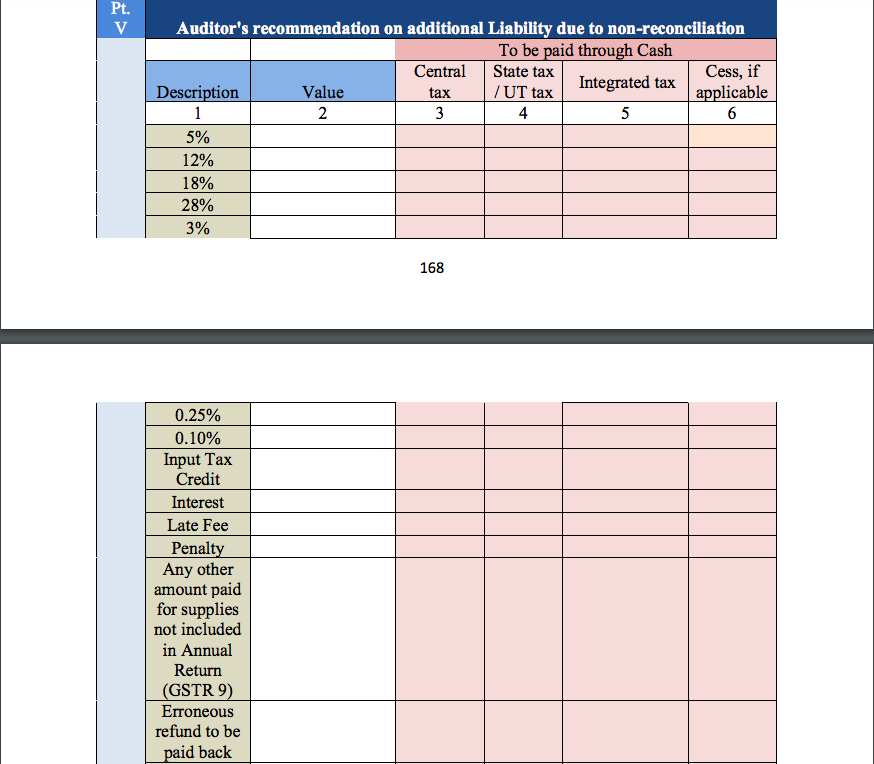

Part V of GST Audit Report FORM GSTR 9C:Auditor’s recommendation on additional Liability due to non-reconciliation

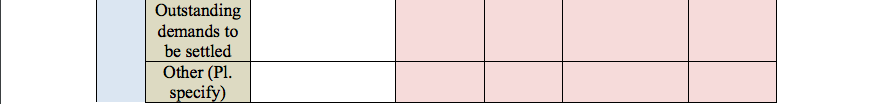

Part V consists of the auditor’s recommendation on the additional liability to be discharged by the taxpayer due to non-reconciliation of turnover or non-reconciliation of input tax credit. The auditor shall also recommend if there is any other amount to be paid for supplies not included in the Annual Return. Any refund which has been erroneously taken and shall be paid back to the Government shall also be declared in this table. Lastly, any other outstanding demands which is recommended to be settled by the auditor shall be declared in this Table.

Auditor’s recommendation on additional Liability due to non-reconciliation

This table contains the details of liability arise due to non reconciliation of return. In this form we have reconciled the data from financials and data given in Annual return FORM GSTR 9 of GST.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.